Construction of sales partnerships in Germany and Europe

Xpert pre-release

Language selection 📢

Published on: May 14, 2025 / update from: May 14, 2025 - Author: Konrad Wolfenstein

Mastering the market entry: The power of strategic sales partnerships (reading time: 64 min / no advertising / no paywall)

Success factor sales partners: How companies grow in Germany and Europe - the power of strategic sales partnerships

Sales partnerships represent a fundamental strategic instrument for companies that go far beyond the pure sales expansion. They act as a lever for sustainable growth, enable deeper market penetration and contribute to risk versification. This applies in particular when entering complex or new markets, such as the German market or the diverse European regions. The decision for or against a sales partnership is therefore a fundamental course that affects the market position, the type of customer relationship and the allocation of internal resources of a company.

The relevance of sales partnerships becomes particularly clear when you look at the specific characteristics of the target markets of Germany and Europe. Germany, one of the strongest economic nations, is attractive, but also characterized by high competition. Local expertise and established networks that are brought in by partners can create decisive competitive advantages here. With its pronounced cultural and regulatory diversity, Europe presents itself as a special challenge. Sales partners can serve as indispensable “bridgeheads” in order to successfully master local market conditions and to meet the specific requirements of the individual country markets.

This report pursues the goal of providing a comprehensive and practice -oriented guide. It is intended to enable companies to make well -founded decisions in the establishment and management of sales partnerships in Germany and Europe. Strategic, operational and cultural aspects are examined in detail in order to ensure a holistic overview.

The progressive globalization and especially digitization have significantly increased both the complexity and the opportunities of sales partnerships. Companies are faced with the task of not only understanding and applying traditional partnership models, but also the growing role of digital platforms and entire ecosystems as a potential partner or sales channels. The mention of online marketplaces such as Amazon as an indirect sales channel or the importance of B2B marketplaces illustrates that the term “partner” must continue to be summarized today. The strategic importance of partnerships is therefore no longer exclusively in bilateral agreements, but increasingly also in intelligent integration into larger digital sales structures. This implies the need for companies to create their partnership strategy wider and to actively consider forms of cooperation.

An inadequate or poorly adapted sales strategy, especially when entering new regions, is a frequently identified main reason for entrepreneurial failures. Successful sales partnerships can significantly reduce this risk. By introducing well -founded local market knowledge and access to already established sales channels, partners can reduce the typical hurdles of a market entry. There is a clear causal relationship: a lack of local adjustment in sales leads to a higher risk of market entry. Conversely, sales partners with specific local expertise can significantly reduce this risk. As a result, investing in the careful selection and professional management of sales partners represents an effective form of risk minimization and increases the likelihood of successful and sustainable market appearance.

Fundamental aspects of sales partnerships

A. Definition and core concepts

A sales partnership in general describes a form of cooperation in which companies work together with external entities - be it individuals or organizations. The primary goal of this cooperation is to drive your own products or services more effectively to end customers and to significantly expand the market range. A characteristic feature is that the partners involved usually preserve their legal and economic independence. This definition forms the basis for understanding the various forms and strategic implications of sales partnerships.

In order to fully grasp the strategic importance of sales partnerships, a clear demarcation to other forms of sales is necessary:

- Direct sales: In this form, the company sells its products or services directly to the end customer without the involvement of intermediate dealers. Examples of this are the sale via their own online shop, through company -owned sales employees in the field or in their own branches. Direct sales offers the advantage of high control over the sales process and the customer relationship as well as potentially higher profit margins, since no intermediaries are involved. However, this is an often limited range and a usually higher initial and ongoing effort for the structure and maintenance of your own sales structures.

- Indirect sales: In contrast, the sale of indirect sales through middlemen or partner is sold. These take on essential parts of the sales process. The indirect distribution enables a greater range and often a faster market entry, especially in new or difficult to access markets, and this with potentially less self -expense for the manufacturing company. However, this often goes hand in hand with less direct control over the sales process and the end customer relationship as well as with lower profit margins, since the partners have to be paid for their services. Sales partnerships are a core design and a central instrument of indirect sales.

The clear delimitation of these forms of sales is of crucial importance for companies. It enables the strategic decision for indirect sales and thus to make it consciously and for the establishment of partnerships and on the basis of a well -founded alternative evaluation.

Overview of the most important types of sales partnerships

The landscape of sales partnerships is diverse, and every model has specific characteristics that make it more or less suitable for certain products, markets and corporate goals. A fundamental understanding of these differences is crucial for the selection of the right partnership model.

- Commercial representatives (agents): Sales representatives act as independent traders and convey business in the name and account of the client company. You will receive a commission for your work. An important feature is that sales representatives usually do not buy the goods themselves and therefore do not bear a warehouse risk. This leads to comparatively low fixed costs for the company. However, the company often has less direct control over sales activities and immediate customer service because the sales representative acts independently.

- Distributors/dealers: In contrast to sales representatives, distributors or dealer buy the manufacturer's products on their own account and sell them in their own name and on their own account. They therefore bear the full distribution and warehouse risk. This form of partnership can enable deeper market penetration, since distributors often have established logistics and sales networks. However, higher investments may be necessary for the partner, and the manufacturing company may give part of the control over marketing activities and the direct relationship with the end customer.

- Franchising: In franchising, a company (franchisor) grants an independent partner (franchisee) the right to use the brand, established business model and operational processes against payment of fees (e.g. admission fee, ongoing license fees). Franchising enables quick growth and benefits from local investments and market knowledge of the franchisee. However, the franchisor requires strict control to ensure quality and brand standards and, for example, pose potential for conflicts, for example with regard to the distribution of profits or compliance with specifications.

- Reseller agreements: These are agreements in which one company grants another right to resell its products or services. The products typically buy resellers from the manufacturer or an upstream provider and then sell them to their own customers. This model is similar to that of the distributor, but can be broader and different levels of obligation and integration encompass.

- Strategic alliances with sales dealers: This form of partnership includes cooperation with companies that have already had established and efficient sales networks with the aim of significantly increasing the reach of one's own products or services. Such alliances can take a variety of forms and include cooperation with wholesale dealers, retailers or other specialized sales partners.

- Joint Ventures: With a joint venture, two or more partner companies found a new, legally independent company. As a rule, this involves common property and control rights. The aim is to bundle resources, specialist knowledge and market knowledge in order to use business opportunities that could not be feasible for a single company. Joint ventures are often used to enter new markets, the development of new products or the implementation of large -scale projects with considerable investment needs and risk division.

- Structural sales (Multi-Level marketing, MLM): This model is based on a network of independent sales partners, the income is based on both the direct sale of products to end customers as well as through the recruitment and the establishment of your own team of new sales partners, in the sales of which you participate. Structure sales offer high flexibility and the potential for scalable income for the partners. However, it also harbors specific risks such as income uncertainty, possible reputation problems of the entire sales system and often high pressure for recruitment. A clear and unequivocal demarcation to illegal pyramid systems, in which the focus is on recruitment of new members and not product sales, is of crucial legal and ethical importance.

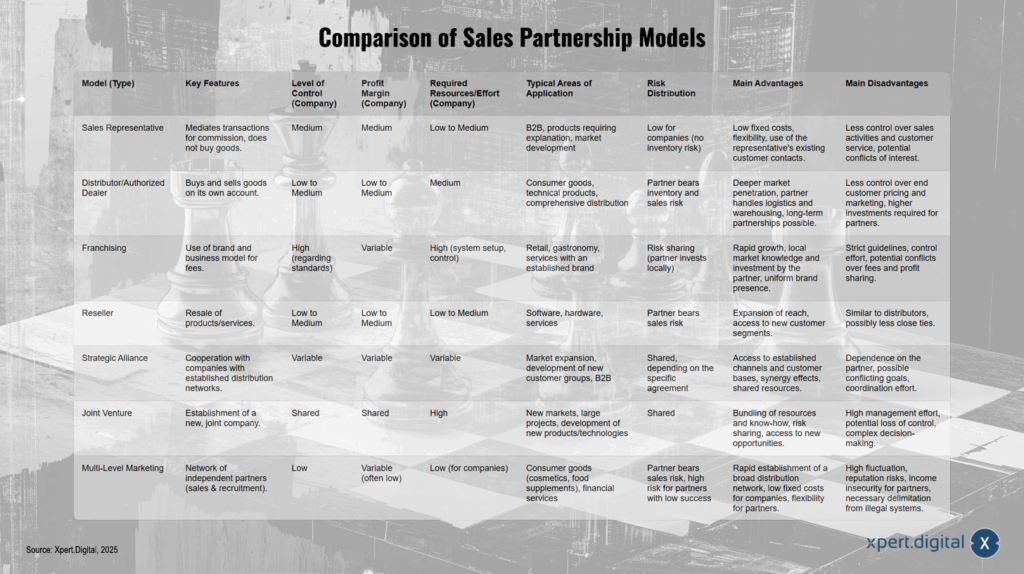

The following table offers a comparative overview of the aforementioned sales partnership models:

Comparison of the sales partnership models

A comparison of the sales partnership models shows different approaches and their main features. The sales representative is a mediation of business against commission without the representative buying goods. The company has a medium control level and profit margins, while the required resource effort is low to medium. Typical areas of application are in the B2B area, in the case of products in need of explanation or market closure. The company bears only a low risk because there is no risk of goods, benefits from low fixed costs and flexibility, but has less control over sales activities, and conflicts of interest can arise.

Buy and sell distributors or dealers on your own account. Here the company has a low to medium control level and profit margins with mediocre resource effort. This method is often used for consumer goods, technical products or for a comprehensive distribution. The partner bears the risk of goods and sales, which means that companies benefit from a deeper market penetration, takeover of logistics and warehousing as well as long-term partnerships. However, there is less control over the end customer price and marketing, and the partners have to make higher investments.

Franchising enables a company to grow rapidly by using an established brand and a business model for fees. The control level in terms of standards is high, the profit margin and the resource effort are variable to high, in particular due to the system structure and control. The areas of application are retail, gastronomy and services with established brands. The risk division is carried out by investing the partners, who also benefit from local market skills and a uniform brand presence. Disadvantages are strict guidelines, high control effort and potential conflicts about fees and distribution of profits.

Buy and sell reseller products or services. The control level and the profit margins are low to medium, the required resource effort is also required. Areas of application are software, hardware and services. The partner bears the risk of sales, which means that companies expand their reach and achieve new customer segments. These partnerships are similar to those with distributors, but resellers can have a less close bond with the company.

Strategic alliances relate to cooperation partnerships with companies that have established sales networks. Both the control level as well as the profit margins and the resource effort are variable. They are often used to expand or open up new customer groups in the B2B area. The risk distribution is divided depending on the agreement. The main advantages are access to established channels, synergy effects and common use of resources. Disadvantages are dependencies on the partner, potential conflicts of goals and increased coordination effort.

A joint venture describes the establishment of a joint company in which resources and risks are shared and high profit margins and management expenses are expected. Typical areas of application are projects in new markets, the development of new products or technologies as well as major projects. The partners benefit from the bundling of resources and know-how, during the high management effort, potential control losses and complex decision-making can be challenging.

Structural sales are based on a network of independent partners who both sell and recruit new partners. The control level is low, the profit margins are variable, but often low, with minimal resource effort on the part of the company. Typical areas of application are consumer goods such as cosmetics or nutritional supplements as well as financial services. The risk is mainly among the partners. The advantages are the quick establishment of a broad sales network, low fixed costs for companies and flexibility for the partners. Challenges are high fluctuation, reputation risks, income uncertainty for partners and the clear demarcation to illegal systems.

The choice of the right partnership model is not an isolated decision, but must be directly related to the overall strategic goals of the company. For example, models such as franchising or the use of distributors often enable rapid growth and rapid market penetration. However, this advantage can be accompanied by a certain loss of control via the brand or direct customer interaction. If the primary strategic goal is the quick conquest of market shares, a higher degree of control may seem acceptable. If, on the other hand, the long -term care of the brand image and the structure of direct, loyal customer relationships of superordinate importance, a model with more entrepreneurial control - possibly by less, but selective selected partners - could be preferred, even if this means more slow growth. This underlines that the sales partnership strategy must always be a derived strategy of the overall company strategy and cannot be considered detached from it.

Weighing up the advantages and disadvantages: When is a sales partnership the right choice?

The decision to build a sales partnership should be based on careful consideration of the potential advantages and the associated disadvantages.

Advantages of sales partnerships:

- Larger reach and faster market entry: An important advantage is the possibility of using the existing networks, customer trunks and the established market presence of partners. This can lead to a significantly faster market penetration than would be possible with your own resources, especially when entering new geographical regions or complex market segments.

- Less (own) effort and cost savings: Since the partners take on a large part of the sales tasks, companies can protect their own resources and focus on core competencies such as product development, production and superordinate marketing. The establishment of your own nationwide sales team or the opening of numerous branches is often associated with considerable investments and running costs, which can be reduced or avoided by partnerships.

- Access to specific market knowledge and expertise: sales partners often have valuable local market knowledge, profound industry experience and many years of established customer relationships. This know-how can be invaluable for companies that are new in a market or want to address specific customer groups.

- Risk division: For certain partnership models, such as joint ventures or collaboration with distributors who buy goods on their own account, the financial and operational risk of market entry and sales are distributed over several shoulders.

- Flexibility and scalability: Compared to the establishment of your own, firmly established sales structures, partnerships can often be designed more flexibly, adjusted faster or resolved if necessary. This enables companies to respond to market changes.

Disadvantages of sales partnerships:

- Lower control: Cooperation with external partners inevitably means submitting some of the control over the sales process, direct customer relationship and the presentation of the brand image. The way the partner acts cannot always be controlled down to the last detail.

- Lower profit margins: The services of the sales partners must be remunerated, be it through commissions, dealer discounts or other forms of profit sharing. As a rule, this leads to lower profit margins for the manufacturing company compared to direct sales.

- Dependence on partners: The success of sales activities depends largely on the performance, motivation and commitment of the selected partners. If a partner does not fulfill the expectations or does he even fail, this can significantly impair the distribution of the company and lead to a loss of sales.

- Potential for conflicts: Different corporate goals, different corporate cultures, unclear expectations or communication problems can lead to friction and conflicts between the partners. Such conflicts can burden the cooperation and, in the worst case, lead to the failure of the partnership.

- Communication effort and management needs: successful sales partnerships require continuous and open communication, careful coordination of the activities and an active management of the relationship. This binds management capacity and causes effort.

- Reputation risks: The behavior and business practices of the sales partner can fall directly to the image and the reputation of the manufacturing company. Malks or unprofessional acting of a partner can therefore harm the reputation of your own brand.

An honest and comprehensive examination of these advantages and disadvantages is essential. It helps companies to develop realistic expectations of a sales partnership and to make the decision for or against such cooperation on a solid, well -informed basis.

It is striking that many of the disadvantages of sales partnerships mentioned - such as loss of control, dependency or the potential for conflict - are not necessarily and unavoidable in the selected partnership model itself. Rather, they are often the result of failures or mistakes in earlier phases of the partnership process. A defective or hasty partner selection, an unclear or incomplete contract design that does not clearly regulate important aspects of cooperation, or inadequate, reactive partner management can significantly increase the likelihood of the occurrence of these disadvantages. The importance of a clear goal definition and division of tasks in the contract, the need for clearly defined common goals, open communication and solid legal framework as well as the importance of governance structures, active relationship management and clearly defined roles indicate that proactive and careful measures can co-mitigate. This implies that companies can significantly reduce the risks by conscientious planning, careful selection of partners and a professional execution and control of the partnership and at the same time maximize the potential advantages. It is therefore less a question of whether a partnership makes sense, but rather how a partnership is designed and managed.

The structural distribution takes on a special position within the sales partnership models. It offers potential advantages such as flexibility for sales partners and the opportunity to generate a passive income. At the same time, however, specific and sometimes serious risks are associated with this model. This includes often high income uncertainty for the partners, a potentially negative image of the sales system in public, high sales and recruitment pressure as well as a often high fluctuation rate among sales partners. The necessary, clear demarcation to illegal snowball systems, in which the sales sale, but primarily the recruitment of new members, is particularly critical and the income is mainly generated from the contributions of these new members. Due to this specific risk structure and the ethical and legal implications, the consideration of the structure sales as a sales option requires a particularly careful and profound examination. A superficial consideration is not sufficient here; Rather, a comprehensive diligence, a precise analysis of the remuneration plan and a robust compliance framework are essential in order to avoid legal pitfalls and reputation damage. This model is therefore not suitable for every company or product and should only be considered after a very critical weighing.

Strategies for identifying and selecting sales partners in Germany

The success of a sales partnership begins significantly with the careful identification and selection of the right partner. Established strategies and resources exist for the German market that can support this process.

Market analysis and definition of the ideal partner profile

Before the active search for sales partners begins, well -founded preparation is essential. This initially includes a profound understanding of the German target market. This includes an analysis of the market size, the current competitive landscape, the relevant customer segments and the specific cultural and economic conditions in Germany.

A crucial first step is to create an ideal customer profile (Ideal Customer Profile, ICP). Companies must clearly define who their end customers are, what needs and problems they have and how their own product or service addresses them. This customer profile forms the basis for the derivation of the ideal partner profile, because the partner you are looking for must be able to effectively achieve and operate these target customers.

The ideal partner profile can be derived from the ICP and your own strategic goals. The following questions are central:

- What specific properties, skills and resources must a potential partner have? This can include industry experience, an existing and suitable customer network, technical skills, proven sales strength, financial stability or a compatible corporate culture.

- Which type of partner (e.g. sales representative, distributor, specialist dealer) fits best with your own sales strategy, the product or service and the defined goals in the German market?

A clearly and detailed partner profile serves as a compass for the search, focuses on the efforts and makes the later evaluation and selection of the candidates considerably easier.

Effective search methods in Germany

A number of effective methods and channels are available for the search for sales partners in Germany:

- Online platforms and directories:

- Specialized platforms for sales representatives: Portals such as Handelsverprache.de offer a qualified search for sales representatives, often filter bar for industries, product groups and target customers. Functions such as an email push service inform registered representatives directly about new offers.

- B2B marketplaces and company directories: platforms such as Amazon Business, Unite (formerly Mercateo), compass or “Who delivers what” (WLW) can not only serve as direct sales channels, but also to identify potential sales or cooperation partners. They often offer detailed company profiles and contact information.

- Industry events and trade fairs:

- Masses are central platforms for the initiation of business contacts and networking with potential partners. They offer the opportunity to get to know each other personally and to present your own offer.

- The Auma (Exhibition and Messe Committee of the German Wirtschafts eV) is an important source of information for trade fair dates and locations in Germany and supports companies in trade fair planning.

- Networking:

- The active participation in events of industry associations can open valuable contacts with potential partners or multipliers.

- Professional online networks such as LinkedIn and Xing are ideal for identifying companies and individuals who are suitable as partners, as well as for the first contact.

- Cold sequence and direct address:

- The targeted research of potential partner companies and the subsequent direct contact by phone, email or postally is a proactive method. Good preparation, a clear understanding of the business of the potential partner and a convincing promise of benefits are crucial for success.

- Content marketing and lead generation:

- The creation and distribution of high -quality, target group -specific content such as white paper, specialist articles or webinars can serve to draw the attention of potential partners to your own company and its offer and to generate qualified inquiries.

- Use of Sales Intelligence Tools:

- Modern software solutions, such as the tools offered by Dealfront, can make the process of identifying, researching and qualifying potential sales partners significantly more efficient by accessing extensive corporate databases and filter functions.

The combination of different search methods usually increases the likelihood of identifying a sufficient number of suitable partner candidates. The German market offers a well -developed infrastructure and a variety of starting points for finding a partner. The partner search in Germany is increasingly developing towards digital and data -controlled approaches. Platforms, B2B marketplaces and sales Intelligence Tools gain in importance and complement traditional methods such as trade fairs. The mention of LinkedIn, specialized online platforms for sales representatives, B2B marketplaces and prospecting tools underlines this development. While trade fairs continue to remain important meeting points, digitization enables a broader, faster and often more targeted approach to the arrival and research of potential partners. Companies should therefore pursue a hybrid search strategy that integrates both digital channels and traditional paths to exploit full potential.

Evaluation and Due diligence test of potential partners

After identifying potential candidates, the critical phase of the evaluation and DUE diligence test follows. A superficial consideration is not sufficient here to justify long -term successful partnerships.

- Development of a catalog of criteria for the evaluation: Based on the ideal partner profile, a detailed criteria catalog should be created. This can include aspects such as proven experience in the relevant industry, specific specialist knowledge, existing resources (e.g. sales team, storage capacities, technical equipment), the commitment shown and motivation for a partnership, technological affinity, the reputation in the market, financial health and stability as well as the compatibility of corporate culture and values.

- Occupation of references and implementation of background checks: It is advisable to obtain references from existing or former business partners of the candidate in order to better assess their reliability and performance. In addition, professional background checks (e.g. credit checking, review of commercial register entries) can provide important information about the seriousness and financial situation of the potential partner. The principle of AHK China to check background information is also transferable to the German market.

- Personal conversations and structure of a first relationship: direct conversations, ideally personally, are essential to gain a deeper insight into the potential partner's company, to get to know his team and to examine the interpersonal “chemistry”. Trust is an essential basis for every successful partnership and often begins to form in these first interactions.

- Check for possible conflicts of interest: It must be carefully checked whether the potential partner already sells products or services from direct competitors or maintains other business relationships that could lead to conflicts of interest.

A thorough and systematic DUE diligence test minimizes the risk of wrong decisions and prevents later problems and disappointments in the partnership. The careful definition of the ideal partner profile based on a clear understanding of your own target customer is a critical success factor that significantly influences the efficiency of the search and quality of the later partnership. The emphasis on the creation of an ideal customer profile as an initial step and the listing of criteria for the partner selection, which are based on the needs of the company and the ability to achieve end customers, illustrate this connection. Without a clear understanding of who the end customer is and what needs it has, it cannot be precisely defined which specific skills and resources a sales partner needs to successfully address these customers. A vague or incomplete partner profile inevitably leads to a more inefficient search and potentially to choose from partners who do not optimally fit the target group or your own strategy. This in turn affects the performance of the partnership from the start. The preparatory work in the form of a precise profile definition is therefore crucial for the end result and the long -term load -bearing capacity of the cooperation.

Use of IHKS, AHKS and GTAI for the partner search in Germany

Institutional actors such as the Chambers of Industry and Commerce (IHKS) and Germany Trade and Invest (GTAI) can offer valuable support in the process of partner search, even if their primary mandates are stored differently.

- Industry and trade chambers (IHKS): The IHKs in Germany are important contact points for companies. They often offer initial advice on general sales strategies, provide market information and provide information about legal framework conditions. Some IHKs have specialized service offers such as business advice or initial consultation on marketing and sales issues, which can indirectly also be helpful in preparing the partner search. You can support companies to define their specific needs for a partnership and, if necessary, indicate relevant networks, events or sources of information. Although the information provided does not name any explicit mediation services for purely domestic sales partners by the IHKs, they are still important institutions for strategic preparation and information procurement.

- Germany Trade and Invest (GTAI): The GTAI is the business development agency of the Federal Republic of Germany. Their main focus is on the recruitment of foreign investments for Germany as well as the support of German companies in their expansion abroad. Their direct role in the mediation of partnerships between two German companies in Germany is therefore rather limited. Nevertheless, the detailed market analyzes, industry reports and information about business trends published by the GTAI can also be useful for domestic partners search by helping to identify market potential and suitable partner segments.

Although IHKS and GTAI represent valuable resources, the main responsibility for the active search, speech and selection of sales partners is ultimately at the company. They are rarely pure mediation agencies, especially when it comes to purely domestic partnerships. The advisory services, information and funding programs provided are important building blocks, but do not replace the entrepreneurial initiative. Companies should therefore proactively use these organizations as part of a broader search and selection strategy and do not only rely on their mediation.

🎯🎯🎯 Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & SEM

AI & XR 3D Rendering Machine: Fivefold expertise from Xpert.Digital in a comprehensive service package, R&D XR, PR & SEM - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here:

Create cultural diversity and regional expertise: the key to successful expansion in Europe

Development of the European market: special features of partner searches

The expansion into European markets on sales partnerships requires a differentiated approach that takes into account the heterogeneity of the continent. A strategy that is successful in Germany cannot be easily transferred to other European countries.

Overview of the European sales landscape

Europe is not a homogeneous internal market, but as a mosaic of over 44 countries, each with their own economic structures, different purchasing power, specific consumption habits and individual legal framework. The EU internal market facilitates cross-border trade through the reduction of customs barriers and the harmonization of certain regulations (e.g. in the area of product liability or partly in competition law). Nevertheless, there are significant national differences, for example in contract law, in tax law, in the approval procedure for certain products and above all in consumer culture and business practices. The recognition of this pronounced heterogeneity is the first and most important step on the way to a successful European expansion strategy. Experience has shown that a “one-size fits-all” strategy that is used undifferentiated to all European markets is rarely successful and carries considerable risks.

Regional differentiations: Western, North, South and Eastern Europe-specific approaches

For an effective partner search, it is helpful to divide Europe into larger regions with tendency -similar characteristics, even if there are still national differences within these regions:

- Western Europe (e.g. France, Benelux countries, Great Britain): These markets are often very ripe, have high purchasing power and demanding consumers. The sales structures are usually well established and the competition is intense. Quality, innovation and excellent service are often decisive differentiation features. Compared to Germany, cultural nuances can exist in business initiation and communication.

- Northern Europe (Scandinavian countries such as Sweden, Norway, Denmark, Finland): This region is also characterized by a high purchasing power. There is a strong focus on high quality, functional design and increasingly sustainability. Business culture is often egalitarian, punctuality and efficiency are highly valued, as are a good work-life balance. Communication tends to be direct, but polite and less formal than in Germany. Finding consensus in the decision -making process plays an important role. On the east -tentative status symbols or exaggerated gifts should be avoided, as this could be perceived as inappropriate.

- Southern Europe (e.g. Italy, Spain, Portugal, Greece): The establishment of personal relationships and mutual trust in these cultures is often of fundamental importance for business success and can take more time than in northern or Central European countries. Dealing with schedules and agendas can be more flexible. Communication may be more indirect and it is important to hospitality and social interaction. The price sensitivity of consumers can be higher in some segments. Small, well -selected gifts can be acceptable and even welcome in certain business contexts.

- Eastern Europe (e.g. Poland, the Czech Republic, Hungary, Baltic States): Many of these markets are dynamically growing economies with considerable consumption and investment needs. On average, per capita income is often even lower than in Western Europe, which can open up a market for cheaper or simpler products, even though demand for quality increases here too. The structure of trust is an important aspect of the business relationship. Communication can be more indirect and context -related than in Germany. Hierarchies and formal manners can play a larger role, and initial reluctance to business contacts is not unusual. The search for injection molding companies in specific regions such as Western and Eastern Europe underlines that there are also different market needs and specializations in the European sub-regions within industries.

Knowledge of these regional tendencies and cultural nuances enables a more targeted address of potential sales partners and a more effective adaptation of your own negotiation strategy and the communication style.

Strategies for Europe -wide partner search

The search for sales partners at European level requires an adapted strategy that takes into account the variety of markets and uses international resources:

- Market research as the basis:

- A thorough analysis of the suitability of your own product or the service for the respective country market is essential. Local cultural conditions, consumption habits, trends and regulatory requirements must be taken into account.

- The assessment of the market size, potential sales channels (e.g. established retail chains, specialized retailers, online platforms), competitive situation and the pricing of the competition provides important basis for decision-making.

- Use of international platforms and networks:

- Enterprise Europe Network (EEN): This network, which is made by the European Commission, offers an extensive, free database to search for business, technology and research partners in Europe and beyond. Companies can search for suitable cooperation offers and set their own profiles with their cooperation applications.

- Online B2B directories with European reach: platforms such as compass, Europages, Tradewheel.com or export portal list companies from numerous European countries and industries and can be used to identify potential partners.

- Partner ecosystem platforms: Certain software solutions for partner relationship management (PRM), such as Kademi, Introw PRM or KIFLO PRM, are primarily management tools, but can also be helpful in identifying new partners in Europe through their network effects and databases.

- Export consultant and specialized agencies:

- Companies such as exporteers or ad Maiora Consulting specialize in support for international market development and offer services to identify and address distributors, commercial agents and other sales channels in specific European countries.

- Such consultants often have established local networks, detailed market knowledge and can provide valuable support in overcoming cultural and linguistic barriers.

- Handels chambers (AHKS):

- The German Handels Chambers (AHKS) are represented in most European countries and offer a wide range of services for German companies. This includes support in the closing of the market, the implementation of address searches, the targeted search for business partners and the organization of first contact talks. They have excellent local networks and deep knowledge of the respective market conditions.

- Germany Trade and Invest (GTAI):

- The GTAI supports German companies in their expansion abroad by providing comprehensive market information, industry analyzes and contacts to relevant actors in the target markets.

- Personal visits and network structure on site:

- Traveling to the European target markets are often essential to develop a feeling for local culture, to check the business landscape directly, to meet potential partners personally and to build a resilient network.

The role of trade fairs and international industry events

International leading fairs, which often take place in Germany, but also in other important European economic centers, serve as central meeting points for industry players from all over Europe and beyond. They offer excellent opportunities to get to know new products and technologies, to observe market trends and, above all, to establish direct contacts with potential sales partners. The AUMA (Exhibition and Messe Committee of the German Wirtschafts EV) offers support and information for companies that want to take part in abroad, for example as part of the federal government's foreign trade fair program.

The cultural and economic distance between Germany and other European countries, especially in South and Eastern Europe, is often underestimated. Inadequate adaptation of the search strategy, the way of communication and the negotiation tactics to these specific differences often leads to lower success rates in partner finding and can make it difficult to set up long -term business relationships. The differences in purchasing power and product requirements between Eastern and Western Europe, the differentiated business labels regarding punctuality, relationship structure and communication style in north, western, southern and Eastern Europe as well as the importance of the respective national language and local customs are evidence of this. For example, if a German company acts in a typical German, very direct and strongly -oriented approach in a southern European market, without taking into account the often more important aspect of personal relationship structure, potential partners could be deterred or at least irritated. This underlines that intercultural competence and the ability to adapt flexible are key variables for the success of partner search and design in a European context.

While large, internationally established companies may have the necessary internal resources for their own, extensive market analyzes and direct speeches in various European countries, small and medium -sized companies (SMEs) are often more dependent on inexpensive or state -funded support offers. This includes in particular the Enterprise Europe Network (een), the services of the foreign trade chambers (AHKS) or the expertise of specialized export consultants. The complexity and the costs associated with the development of over 44 European markets can be a significant hurdle for SMEs. Offers such as the een (often free of charge) or advice from AHKs are also explicitly tailored to the needs of SMEs, as support programs for SMEs. Export consultants collect fees for their services, but they can be significantly lower compared to the establishment of their own international sales structures or at the costs of failed market entries. This suggests that the choice of search strategy also depends largely on the size and financial and personnel resources of the searching company and that SMEs should specifically search for supporting networks and funding instruments in order to realize their international ambitions.

Another aspect that influences partner search in Europe is the increasing strategic trend towards shortening and diversify supply chains. This increases the attractiveness of sales partners in geographically closer European regions, especially in Central and Eastern Europe, as an alternative to distant procurement and sales markets. The statement that Central and Eastern Europe is becoming increasingly important for the German economy, also to shorten supply chains, indicates a strategic realignment that goes beyond pure sales interests. Companies in these regions could not only search for the distribution of their products, but also as an integral part of a more resilient and reactionable European value chain. For the search for a partner, this means that criteria such as geographical proximity, logistical skills of the partners and, if necessary, their production capacities (if relevant for a combined sales and procurement partnership) could become more important.

Contract design for successful sales partnerships

A carefully elaborated and legally sound sales contract is the foundation of every successful and long -term partnership. It creates clarity about rights and obligations, minimizes risks and serves as a guide for cooperation.

Important legal framework in Germany and the EU

In the design of sales contracts, especially with partners in Germany and within the European Union, various legal framework conditions must be observed:

- German Commercial Code (HGB): Sections 84-92c HGB is of central importance for commercial representatives based in Germany. Among other things, these provisions regulate the obligations of the sales representative and the entrepreneur, the claim for commission, termination periods and in particular the claim for compensation of the commercial agency when the contract is terminated.

- EU Trading Directive (86/653/EEC): This guideline harmonizes the right of independent sales representatives within the EU and forms the basis for the National Commercial Representative Act of the Member States, including the relevant provisions in German HGB. It aims to ensure a minimum protection level for sales representatives throughout the EU.

- EU cartel law: Article 101 of the contract for the way of working of the European Union (TFEU) is of particular relevance, which prohibits agreements between companies that limit the competition. The vertical group exemption regulation (vertical GVO) No. 2022/720 determines the conditions under which certain vertical agreements (ie agreements between companies at different production or sales levels, such as sales contracts) are released from the cartel ban of Art. 101 Para. 1 TFEU. This affects regulations on exclusivity, regional restrictions or to certain forms of pricing. It should be noted that direct or indirect fixed or minimum price bonds for resale by the partner are generally considered serious restrictions on competition. Non -binding price recommendations, on the other hand, are usually harmless as long as no pressure on the partner is exerted to actually apply it.

- GeoBlocking Ordinance (EU) 2018/302: This regulation prohibits the unjustified discrimination against customers due to their nationality, their place of residence or their branch in online access and services within the EU. This has implications for online sales strategies and the design of sales areas.

- General Data Protection Regulation (GDPR/GDPR): As soon as personal data from customers or the contact persons are processed at the sales partner, the strict requirements of the GDPR must be observed. This applies to the collection, storage, use and distribution of such data and often requires specific agreements on order processing if the partner processes data on behalf of the company.

The exact knowledge of this legal framework is essential in order to make legal and enforceable contracts. The non -observance can lead to sensitive punishments, the nullity of individual contractual clauses or even the entire contract and result in considerable economic disadvantages.

Essential contractual clauses

A well -structured sales contract should contain a number of essential clauses to clearly define the rights and obligations of both parties and to prevent potential disputes:

- Contracting parties: exact and complete name of the companies involved (company, legal form, address, registration number).

- The aim of the partnership: A clear definition of the common goals and the purpose of the cooperation helps to compensate for expectations.

- Contract object/products/services: a precise and detailed description of the products or services that are the subject of the sales contract. This should include specifications, quality standards and, if necessary, brands.

- Sales area (territory): A clear spatial delimitation of the area for which the sales partner is responsible. This can be designed exclusively or non-exclusive.

- Exclusivity/non-exclusivity: Clear regulation as to whether the sales partner receives sole sales law in the defined area (sole sales right) or whether the manufacturing company itself or other partners may also work in this area.

- Obligations from the supplier/manufacturer: Definition of the company's obligations, such as the timely delivery of the contract products in agreed quality, the provision of product information, marketing materials, technical support and training.

- Obligations of the sales partner: Detailed description of the tasks of the partner, such as active sales promotion and efforts to penetrate market penetration, achievement of agreed minimum turnover goals or acceptance quantities (possibly with clear consequences in the event of no sufficient, such as loss of exclusivity or right of termination), regular reporting on sales activities and market developments, maintaining the interests of the supplier and compliance Quality and brand standards.

- Remuneration/commission/prices: a transparent and comprehensible regulation of the partner's remuneration. For sales representatives, this is typically commission rates (if necessary staggered) and their basis for calculation. In the case of distributors/contractual dealers, the purchase prices, possible discount structures and terms of payment are to be determined.

- Competition bans:

- During the contract term: a ban on competition that prohibits the partner to drive competing products is often legally (e.g. for sales representatives) or contractually intended and permitted.

- Post -contractual competition ban: A ban on competition that goes beyond the termination of the contract is only effective under strict conditions. As a rule, it must be appropriate with regard to duration (usually a maximum of two years), spatial scope and factual scope (only for the displaced products and the contract area). For sales representatives, such a ban is often linked to the payment of adequate childcare compensation.

- Property rights (intellectual property): regulations for the use of brands, logos, patents, copyrights and other intellectual property of the manufacturer by the sales partner. This often includes the granting of a (possibly limited) license for the duration of the contract.

- Confidentiality (NDA - confidentiality agreement): A commitment of both parties to maintain confidential information and business secrets that become known as part of the cooperation. This clause should continue for a certain time after the end of the contract.

- Liability and warranty: Clear regulations on the liability for product safety, material and legal deficiencies in the displaced products as well as for damage that arises in connection with sales. This can also include compensation or exemption clauses that determine which party the other holds harmless in the event of claims by third parties.

- Contract duration and termination: Determining whether the contract is concluded for certain or indefinite times. Definition of ordinary notice periods and conditions as well as important reasons that justify an extraordinary (without notice).

- Minimum acceptance quantities: Minimum acceptance quantities can be agreed, especially in the case of distributor contracts. The non-fulfillment of these quantities can result in contractual consequences, such as the loss of exclusivity, conversion into a non-exclusive contract or a right of termination for the supplier.

The inclusion of these clauses in a detailed and clearly understandable form minimizes the risk of misunderstandings and potential for conflict and contributes significantly to secure the interests of both contracting parties.

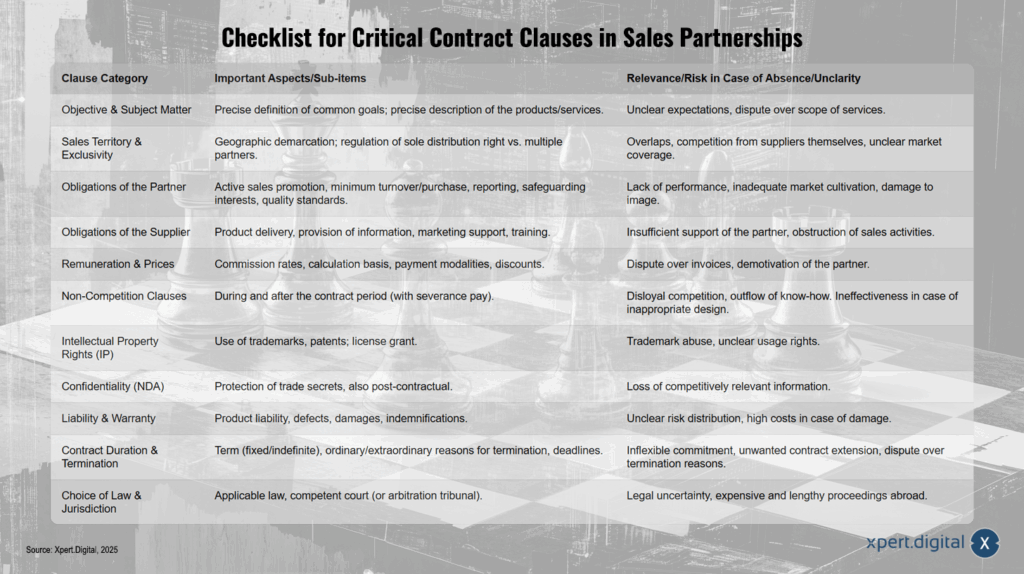

Checklist for critical contractual clauses in sales partnerships

The checklist for critical contractual clauses in sales partnerships includes various categories that should take essential aspects into account in order to minimize risks and conflicts. First of all, it is important to clearly define the goal and subject of the contract by precisely determining common goals and precisely describing the products or services in order to avoid unclear expectations and disputes. In the area of sales area and exclusivity, spatial delimitation as well as regulations on sole sales rights and several partners should be made to prevent overlaps, competition by the supplier himself and ambiguities about the market coverage.

The duties of the partner include aspects such as active sales promotion, minimum sales requirements, reporting, preserving interests and compliance with quality standards, since lack of performance or inadequate market processing can lead to problems. On the other hand, the duties of the supplier should also be regulated, including product delivery, provision of information, marketing support and training, since inadequate support could hinder sales activities.

The remuneration and pricing are also essential, with commission rates, calculation bases, payment modalities and discounts to be defined in order to avoid disputes about billing and a possible demotivation of the partner. Competition bans should be clearly regulated both during and after the period of contract, possibly with a cartoon compensation to counteract illoyal competition and the drainage of know-how. However, the design must be appropriate so that competition bans do not become ineffective.

With regard to property rights such as brands, patents and licenses, the use should be clearly regulated in order to avoid brand abuse and unclear usage rights. Confidentiality agreements (NDA) ensure that business secrets remain protected, even beyond the contract term to prevent the loss of competitive information. Liability and warranty must also be described precisely, in particular in terms of product liability, defects, damage and exemptions in order to avoid unclear risk distributions and high costs in the event of damage.

In addition, clear regulations on the duration of the contract and termination are necessary. This includes stipulations at the term of the contract (determined or indefinite), ordinary and extraordinary reasons for termination as well as corresponding deadlines in order to avoid inflexible bonds, unwanted contract extensions or disputes about termination reasons. Finally, the choice of law and the place of jurisdiction should also be clearly regulated. By determining the applicable law and the responsible court - or, if necessary, an arbitration - legal uncertainties as well as expensive and lengthy procedures abroad can be avoided.

Unclear or unfair contractual clauses represent one of the main causes for later conflicts and the potential failure of sales partnerships. A proactive, detailed and balanced contract design is therefore not only a legal necessity, but rather a decisive investment in longevity and success of the cooperation. The emphasis on the importance of clearly defining goals and tasks, the warning of vague terms and the need to clearly determine responsibilities in order to reduce disputes, as well as the realistic expectations and unclear role distributions often lead to conflicts. The contract is therefore not just a legal formality, but a fundamental control instrument of the partnership. Deficiencies in contract design almost inevitably lead to operational problems, misunderstandings and a loss of mutual trust, which can endanger the entire partnership.

Special features of international contracts (especially EU context)

In sales partnerships that go beyond national borders, especially in the European context or with partners in third countries, additional contractual aspects obtain importance and require special attention:

- Legal choice: It must be clearly determined which national law should apply to the contract. Despite the efforts of the harmization within the EU, the national contract law of the Member States continues to have differences. A clear legal selection clause creates legal certainty here. If no choice of law is made, the law of the state is often used in which the sales partner is based or performs its characteristic performance. However, it is important to note that mandatory regulations, such as antitrust law, are usually based on the law of the state in which the distribution actually takes place and has an impact and cannot be avoided by a legal election clause.

- Jurisdiction: It should be agreed which court is responsible in the event of disputes between the contracting parties. A jurisdiction agreement is common in international contracts and is often very useful in order to avoid costly and lengthy disputes about responsibility.

- Arbitration: As an alternative to state jurisdiction, the agreement of an arbitration clause can be considered. Arbitration procedures can offer advantages in international disputes, such as greater neutrality of the decision -makers, specific subject expertise of the referees, greater confidentiality of the procedure and often a better international enforceability of arbitration sayings.

- Language of the contract: It is important to determine the binding contractual language. If contracts are translated into several languages, it should be clarified which language version is decisive in the case of interpretation differences. The greatest value must be attached to the accuracy and quality of the translations.

- Improvement/export regulations, tariffs, taxes: In the case of cross-border goods traffic, country-specific import and export regulations, tariffs, consumption taxes and sales tax regulations can significantly influence pricing, delivery obligations and the entire profitability of the partnership. These aspects must be taken into account in the contract and responsibilities are clearly assigned.

These additional aspects increase the complexity of international sales contracts and require a careful examination and, if necessary, the involvement of legal advisors with expertise in international contract law.

The EU cartel law, in particular the vertical GVO, sets clear limits for competitive agreements in sales contracts, but at the same time also offers a so-called “safe haven” for many typical sales designs. Companies should therefore not only regard these regulations as a potential restriction of their contractual freedom, but also as a framework that enables permissible and competitive cooperations and designs them legally. For example, the vertical GVO allows certain exclusive contracts or selective sales systems under defined conditions and market share thresholds. This means that not every form of restriction of the partner is prohibited per se. Companies that adhere to the requirements and market share thresholds of the vertical GVO can design their sales agreements with a high level of legal certainty. A well -founded examination of these European regulations thus enables companies to implement their sales strategy more effective and at the same time legally compliant, instead of avoiding potentially advantageous but complex contractual designs from exaggerated caution or ignorance.

An often underestimated, but potentially significant cost factor in the termination of sales partnerships is the compensation claim of the sales representative according to § 89b HGB, which is based on the EU Trade Representative Directive. This claim is intended to compensate the representative for the advantages he created and remaining after the end of the contract from the built -up customer base. This claim for compensation is compelling nature and can hardly be effectively excluded. Under certain conditions developed by the case law, such a compensation claim can also be entitled to the contract if they are integrated into the manufacturer's sales organization, similar to a sales representative, and perform comparable tasks. This represents a hidden complexity that must be taken into account in the financial planning and risk assessment of sales partnerships. Companies that work with sales representatives or certain types of closely integrated contract dealers should therefore include the possibility of this claim in their calculations and, if necessary, form provisions in order not to be surprised by considerable financial claims at the end of the contract. As mentioned, a contractual exclusion of this claim is usually only very limited or not at all possible and should therefore not be regarded as a reliable protection.

Management and further development of sales partnerships

The successful establishment of a sales partnership is only the first step. Proactive management and the continuous development of the relationship are essential for long -term success.

Building a strong partner relationship

The foundation of every successful and permanent sales partnership is a strong, trusting relationship between the companies involved. The following aspects are of central importance:

- Open and regular communication: Transparent, honest and continuous communication is the basic prerequisite for building trust and smooth cooperation. This not only includes communication for problems that occur, but also a planned and regular exchange about goals, progress, challenges and market observations.

- Building: Trust develops over time and is based on reliability, honesty, transparency in actions and compliance with commitments. The result is consistently positive experiences in cooperation.

- Common objective and coordination of the strategy: It must be ensured that both partners pursue the same overarching goals and that their respective strategies and measures are coordinated in order to use synergies and avoid conflicts in. The definition of smart goals (specifically, measurable, attractive, realistic, scheduled) for the partnership can be helpful, analogous to the objective in the CRM area.

- Clear roles and responsibilities: A clear definition and delimitation of the roles, tasks and responsibilities of each partner avoids misunderstandings, duplication and potential conflicts from the start.

- Promises for the partner: The sales partner must recognize a clear and convincing benefit in working with the company. This benefit often goes beyond purely monetary aspects such as commissions and, for example, can include access to innovative products, a strong brand, excellent support or new technologies. A clearly communicated value proposition motivates the partner and strengthens the bond.

A good, resilient relationship is not only pleasant, but also forms the foundation for the long -term success and the sustainable motivation of the sales partner.

Effective onboarding, training and support for partners

To ensure that sales partners can effectively market and sell the company's products or services, structured onboarding as well as continuous training and support measures are essential:

- Structured onboarding: New sales partners should be systematically introduced into the products or services, the relevant company processes, the systems to be used (e.g. CRM, PRM portal) and the basic corporate culture. A well-planned onboarding process accelerates the familiarization and laid the foundation for successful cooperation.

- Regular training: Continuous further training is crucial to keep the partner's knowledge up to date. This includes product training (especially for innovations or updates), sales training to improve the final techniques, training courses on marketing campaigns and the imparting of knowledge about IT systems and sales tools used. Suitable formats for this are webinars, e-learning courses, presence workshops or mentoring programs in which experienced partners support new or less experienced colleagues.

- Provision of resources: Sales partners need access to current and high-quality sales and marketing materials. These include product brochures, presentations, price lists, technical data sheets, case studies and templates for offers or communication measures.

- Continuous support: There should be clear contacts and support channels for the sales partners that you can contact with questions, problems or suggestions. Fast and competent support in the event of a need is an important factor for the satisfaction and performance of the partners.

Well -informed and professionally supported sales partners are not only more powerful and successful on sale, but usually also loyal and more tied to the company. Investments in onboarding, training and continuous support for partners pay themselves directly in a higher partnership and a stronger partner loyalty. Neglecting these aspects, on the other hand, often leads to demotivated, poorly informed and ultimately less successful partners. If partners do not feel sufficiently informed and supported, their ability and motivation to effectively sell the company's products or services. This results in poorer sales results, which in turn affects the relationship between companies and partners. This makes it clear that partner management is a continuous process of qualification and support and not only represents a pure control function.

Definition of clear performance indicators (KPIS) and performance management

A systematic performance management is crucial to ensure that the sales partnership delivers the desired results and to be able to react early to possible problems or deviations:

- Common determination of KPIs (important performance indicators): Together with the sales partner, clear, measurable, accessible, relevant and time -related (smart) goals and performance indicators should be defined. Typical KPIs in sales partner management include sales goals, market share development, number of generated leads, conversion rates, customer satisfaction values or the speed of market penetration.

- Regular monitoring and reporting: The performance of the partner should continuously be followed and documented based on the agreed KPIs. This requires transparent reporting structures and processes.

- Feedback talks: Regular and open exchange about the achievement achieved, current challenges, successes and potential for improvement is essential. These conversations should be constructive and give both sides the opportunity to give and maintain feedback.

- Incention systems and commission models: Attractive and fair remuneration models that reward the performance of the partner and create incentives for above -average results are an important motivation factor. This can be staggered commissions, bonuses for target achievement or other performance -related incentives.

A systematic performance management creates transparency, promotes responsibility and enables the partnership to be actively controlled and continuously optimized.

Use of partner relationship management (PRM) systems

With increasing number of sales partners or increasing complexity of the partner program, the use of specialized software solutions for partner relationship management (PRM) can become very advantageous or even essential:

- Definition and purpose: PRM systems are software applications that support companies in efficiently manage, controlling and optimizing cooperation with their sales partners.

- Core functions: Typical functions of a PRM system include a central partner portal for access to information and resources, tools for lead management and deal registration (to avoid channel conflicts), communication tools, a library for marketing and sales materials, functions for performance tracking and the analysis of partner data, modules for administration Commission accounts as well as integrated platforms for training and certifications.

- Advantages: The use of a PRM system can lead to significant efficiency increases in partner management, improve transparency for both sides, simplify communication and support the scalability of the entire partner program.

- Selection criteria for a PRM system: When selecting a PRM solution, companies should pay attention to criteria such as the desired degree of automation, flexibility and scalability of the platform, user-friendliness (both for your own team and the partners), the ability to integrate with existing systems (in particular CRM systems) and the quality of the offered support.

PRM systems are an important tool to professionally manage partner programs and exploit the full potential of sales partnerships. With the increasing complexity of partner networks and the increasing need for data-controlled decisions, the use of PRM systems develops from an optional “nice but not absolutely necessary” into a strategic need for efficient partner management, especially in the international context. The manual administration of numerous aspects such as onboarding, marketing support, lead distribution and performance measurement across a large number of partners, possibly in different countries, time zones and with different agreements, is extremely prone to error, time-consuming and inefficient. PRM systems offer the necessary structure here, enable the automation of routine tasks and create the necessary transparency for everyone involved. Companies that successfully scale and professionalize their partner programs should therefore invest in appropriate technologies at an early stage in order to reduce the administrative effort and to focus on the strategic development of the partnerships.

Conflict management and solution strategies

Conflicts are not unusual in business partnerships and can result from different expectations, goals, communication problems or external market changes. A proactive and structured approach to conflict resolution is crucial in order not to permanently damage the relationship and to continue cooperation:

- Early detection of conflict signals: It is important to pay attention to initial signs of discrepancies or problems. This can be changes in the partner's communication behavior, a reduction in performance, repeated symptoms or a generally tense atmosphere. An early perception enables timely intervention (analogous to the principles in dealing with customer conflicts).

- Establishment of clear processes on conflict resolution: Ideally, clear processes and escalation levels for dealing with disagreements and conflicts should be defined in advance or in the partnership agreement. This includes naming contact persons on both sides who are responsible for the conflict resolution.

- Open communication and joint problem solving: problems arising should be addressed directly, openly and respectfully. The aim should be to analyze the causes of the conflict together and to look for solutions that are acceptable for both sides (Win-Win approach).

- Mediation or arbitration: In the case of stuck conflicts in which the parties cannot find an independent solution, the use of a neutral third party in the form of mediation or an arbitration process can be useful. This can help to restore communication and avoid an escalation towards legal disputes.

- Contractual regulations on the dispute settlement: As already mentioned in the section on the contract design, contracts for the choice of law and the place of jurisdiction or arbitration should contain clauses that apply in the event of an insoluble conflict.

A constructive handling of conflicts can even strengthen a partnership by showing that both sides are interested in long -term cooperation and are willing to master challenges together.

The “benefit promise”, ie the promise of benefits, is not only of crucial importance for the extraction of end customers, but also plays a critical role in the acquisition and long -term binding of sales partners. Partners must understand clearly and convincingly why collaboration with this specific company is particularly advantageous for them. This advantage often goes beyond the pure commission and can include aspects such as access to highly innovative and requested products, a strong and well -known brand name that facilitates sales, excellent technical and sales support, the opportunity to open up new customer segments or access to advanced technologies and training programs. Partners make a selection with which companies they cooperate with, as they often work with several providers, including competitors. A company that offers its sales partners a clear, differentiated and convincing added value is preferred when choosing a partner and can expect a higher level of commitment and loyalty. For companies, this means that they actively market their partnership offers as a kind of “product” for potential partners and have to differentiate themselves in the competition for the best partners.

Successful partner management requires a careful balance between standardized, efficient processes and an individualized care tailored to the specific needs of the respective partner. On the one hand, the advantages of systematization by PRM systems and the need to make clear, measurable KPIs emphasize the meaning of structured processes. On the other hand, aspects such as “offering tailor -made support” and the importance of “personal service for your partners” emphasize the need for individual approaches. A purely system -driven approach in partner management can quickly be impersonal and demotivating, while only an individual approach is not scalable and inefficient with a larger number of partners. The best partner management strategies therefore use technology and standardized processes to simplify administrative tasks and create freedom. These freedom can then be used for high -quality, personal interactions, flexible adaptation to the needs of individual partners and the structure of strong, trusting relationships.

Our recommendation: 🌍 Limitless reach 🔗 Networked 🌐 Multilingual 💪 Strong sales: 💡 Authentic with strategy 🚀 Innovation meets 🧠 Intuition

At a time when a company's digital presence determines its success, the challenge is how to make this presence authentic, individual and far-reaching. Xpert.Digital offers an innovative solution that positions itself as an intersection between an industry hub, a blog and a brand ambassador. It combines the advantages of communication and sales channels in a single platform and enables publication in 18 different languages. The cooperation with partner portals and the possibility of publishing articles on Google News and a press distribution list with around 8,000 journalists and readers maximize the reach and visibility of the content. This represents an essential factor in external sales & marketing (SMarketing).

More about it here:

Success factor sales partnership: cultural intelligence, clear rules and sustainable cooperation

Cultural intelligence in European sales

The successful establishment and management of sales partnerships in the heterogeneous European market requires a high degree of cultural intelligence. Cultural differences in business communication, relationship structure and in general business practices can significantly influence success.

Understanding cultural differences in business communication and in relationship structure in Europe

Although generalizations are always to be treated with caution, typical cultural tendencies in business life can be observed for various European regions that can differ from German business culture:

- Germany: German business culture is often characterized by a strong factual orientation, direct and explicit way of communication as well as a high importance of punctuality, detailed planning and compliance with rules. The formal salutation (“you”) is widespread and hierarchies are usually respected. The structure of deep personal relationships often plays a lower role in a purely business context than the professional competence and quality of the offer.

- Northern Europe (Scandinavia): Here is often an egalitarian attitude. Punctuality and efficiency are also important, as are a pronounced work-life balance. Communication tends to be direct, but polite and often less formal than in Germany. Decisions are often made in consensus. Ostentative gestures or expensive gifts are avoided more because they could be interpreted as inappropriate or as an attempt to bribble.

- Southern Europe (Italy, Spain, Portugal, Greece): The establishment of a personal relationship and mutual trust in these cultures is often a fundamental prerequisite for successful business deals and can take significantly more time. Dealing with schedules and agendas can be handled more flexibly. Communication may be indirect and context -related. Hierarchies can play a role, and hospitality and social interactions are often important components of business relationships.

- Eastern Europe (e.g. Poland, the Czech Republic, Hungary): Here, too, building trust is an important aspect. Similar to southern Europe, communication can be indirect and more context -related. Respect for hierarchies and formal manners can be more pronounced. An initial reluctance to new business contacts is not unusual, but can be overcome by building a personal relationship.

- Western Europe (e.g. France, Benelux): In countries like France, it is often important for professionalism, structure and formal communication. The importance of the national language alongside English can be higher here, similar to Russia, than in other regions of Europe.

In general, some Europe -wide tendencies can be determined: The handshake is a common form of welcome, formal clothing is appropriate in most business situations, and respectful communication is expected. However, the importance of academic or professional titles can vary from country to country. Cultural misunderstandings, which result from non -observance of such differences, can significantly burden business relationships or, in the worst case, even cause failure.

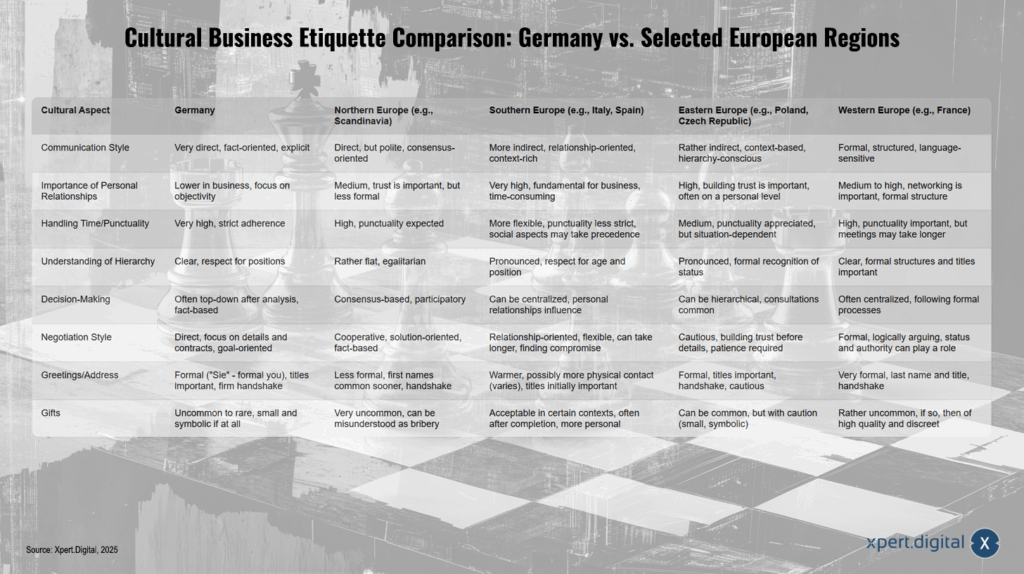

Cultural business labels in comparison: Germany vs. selected European regions