Material handling (material handling, material transport) plays an important role in manufacturing and logistics. Almost every subject of physical trade is transported on a conveyor belt, a forklift or a different type of material transport device in production facilities, warehouses and retail stores. While material transport is usually necessary in intralogistics as part of the work of every production worker, over 650,000 people work as a committed “material transport operator” in the United States and have a medium annual wage of $ 31,530 (May 2012). These operators use material transport devices to transport different goods in a variety of industrial environments, including the transport of building materials on construction sites or transport of goods to ships.

Suitable for:

Material handling involves movement over short distances within a building or between a building and a transport vehicle. A wide range of manual, semi-automatic and automated equipment is used and includes consideration of the protection, storage and control of materials during their manufacture, storage (e.g. buffer storage ), distribution, consumption and disposal. Material handling can be used to create temporal and spatial utility through the handling, storage, and control of waste, in contrast to manufacturing, which creates form utility by changing the form, shape, and nature of the material.

Global leaders in material handling automation systems in 2019-2020, based on revenue (in million US dollars)

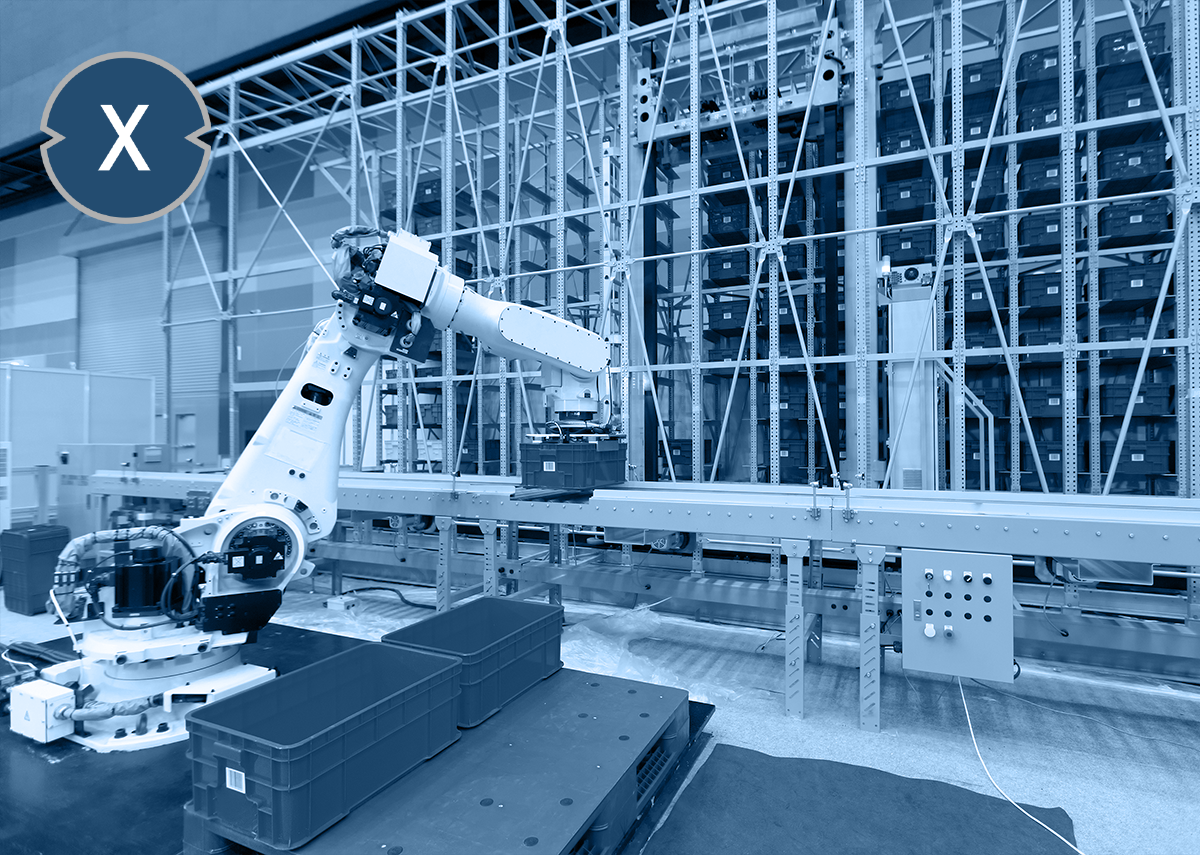

Material flow systems (Material Handling Automation) – leading global providers – Image: Xpert.Digital

This statistic shows the world's leading providers of material handling systems (Material Handling Automation) from 2019-2020. Germany's Schaefer Holding International GmbH (SSI Schaefer) ranked third with sales of over $3.1 billion in 2020.

Material flow systems (Material Handling Automation) – leading global providers 2020

- Daifuku Co., Ltd. – 4,540 million US dollars

- Dematic – 3,226 million US dollars

- Schäfer Group – 3,120 million US dollars

- Vanderlande – 2,100 million US dollars

- Honeywell Intelligrated – $2,018 million

- Murata Machinery Ltd. - 1,490 million US dollars

- Knapp AG – 1,450 million US dollars

- Beumer Group GmbH – 1,400 million US dollars

- MHS/Material Handling Systems – $1,050 million

- TGW Logistics Group GmbH – 1,000 million US dollars

- Siemens Logistics – 1,000 million US dollars

- WITRON Integrated Logistics – 855 million US dollars

- Swisslog AG – 646 million US dollars

- Kardex AG – 466 million US dollars

- Bastian Solutions – $405 million

- Elettric 80 – 354 million US dollars

- System Logistics SpA – $262 million

- DMW&H – $214 million

- viastore Systems – $192 million

- SAVOYE – $185 million

Material flow systems (Material Handling Automation) – development/change from 2020 to 2019

- Daifuku Co., Ltd.: +13%

- Dematic: +21.2%

- Schäfer Group: -3%

- Vanderlande: +23.5%

- Honeywell Intelligrated: +12.1%

- Murata Machinery, Ltd.: -17.2%

- Knapp AG: +5.8%

- Beumer Group GmbH: +27.3%

- MHS: +5%

- TGW Logistics Group GmbH: +17.6%

- Siemens Logistics: N/A

- WITRON Integrated Logistics: +27%

- Swisslog AG: -4%

- Kardex AG: -12.4%

- Bastian Solutions: +14.7%

- Elettric 80: +30.1%

- System Logistics SpA: +0.4%

- DMW&H: 0%

- viastore Systems: +22.3%

- SAVOYE: N/A

Also interesting for you?

- Contract logistics – service providers for logistics – 80% of all larger companies use them!

- High-bay warehouse consulting & planning: Automatic high-bay warehouse – optimize pallet warehouse fully automatically – warehouse optimization

Daifuku remains No. 1 for the 7th consecutive year and reports 2020 revenue of more than $4.5 billion, up 13% year-over-year.

Stuart Oliphant from Daifuku's corporate communication: “During the clean room and semiconductor sector, sales with intralogistics systems for manufacturers and retailers remain robust due to an increase in projects from e-commerce and food logistics industry, which we partly attribute to the increase in home work as a result of the COVID-19 pandemic. In addition, a large project for automotive production line systems in North America, which was our largest so far, contributed significantly to this. ”

Due to the global corona pandemic, the material flow systems affected by delivery interruptions and temporary closures. However, the food and beverage industry experienced growth where automation was pushed forward. It is also a fact that e-commerce played a significant role in this.

Industry experts saw an unprecedented amount of project activity in 2020, especially in the area of warehouse and material flow automation. The focus continues to be on e-commerce growth and the increasing demands for quick and efficient delivery fulfillment with the same or less workload. This is where goods-to-person automation comes into focus.

Suitable for:

- Networked distribution centers – intralogistics 4.0

- Last mile logistics

- Intralogistics Glossary

- Intralogistics & Logistics Library (PDF)

Construction of material handling systems

Material handling is an essential part of most production systems because the efficient flow of materials between the activities of a production system depends heavily on the arrangement (or layout) of the activities. When two activities are next to each other, material can be easily passed from one activity to the other. When the activities are arranged one after the other, a conveyor can transport the material at low cost. When activities are separate, more expensive industrial trucks or overhead conveyors are required for transportation. The high cost of using an industrial truck to transport materials arises from both the operator's labor costs and the negative impact on the performance of a production system (e.g. increased work in process) when multiple units of material are combined into a single transport batch , to reduce the number of trips required for transportation.

Automated handling

Whenever technically and economically feasible, devices can be used to reduce and optimally replace the need for manual material handling. Most existing material handling equipment is only semi-automatic, requiring a human operator for tasks such as loading, unloading and driving that were previously difficult and/or too costly to fully automate. However, with continued advances in sensor technology, machine intelligence and robotics, it is possible to fully automate an increasing number of handling tasks. A rough guide to determining how much can be spent on automated equipment that would replace a materials handler is to consider that the average moving machine operator costs a company approximately €38,000 per year, with additional benefits. Assuming a real interest rate of 1.7% and a useful life of 5 years for the equipment with no residual value, a company should be willing to purchase automated equipment that replaces a worker ( Intralogistics 4.0 ).

Suitable for:

- Germany is a leader in robotics

- Robotics & automation in the warehouse

- Learn from Amazon Logistics

- Amazon is expanding its share of robots

That's why Xpert.Plus for warehouse and material flow automation such as automated warehouse optimization (material handling automation) in intralogistics

Xpert.Plus is a project from Xpert.Digital. We have many years of experience in supporting and advising on storage solutions and in logistics optimization, which we bundle in a large network Xpert.Plus

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus