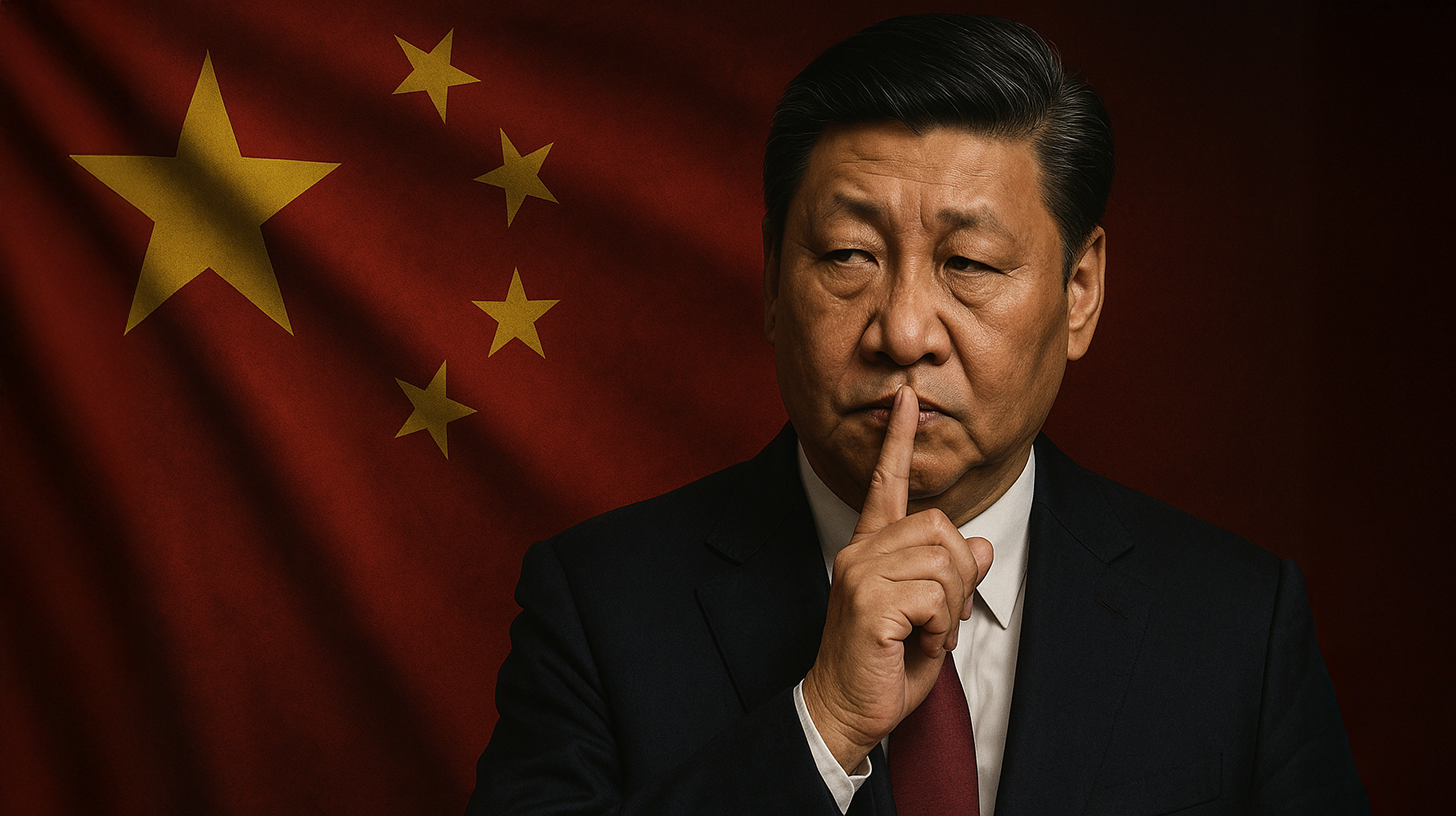

Beijing's strategic silence: The rhetoric of power in times of crisis – Creative image: Xpert.Digital

The silent implosion: Why China is silent about its biggest economic crisis

### 20 Million Shattered Dreams: The True Drama Behind the Evergrande Collapse ### China's Ticking Time Bomb: More Than Just Evergrande – The True Extent of the Crisis ### Beijing Detonated the Bomb Itself: How a Political Decision Brought Evergrande Down ### Evergrande's End: Why Beijing's Silence Is Louder Than Any Stock Market Crash ###

What the Evergrande case teaches us about China's true strategy: Silence is power

The demise of Evergrande, sealed by its delisting from the Hong Kong Stock Exchange, is far more than the collapse of a real estate giant. It is a harbinger of a systemic crisis that is shaking China's economy to its core—a crisis whose true extent is being obscured by a strategic maneuver from Beijing: deafening silence. While successes in future-oriented sectors like artificial intelligence and electric mobility are celebrated with great fanfare, the Communist Party is shrouding the decline of its once most important economic engine in a veil of secrecy. But behind this deliberately orchestrated silence lies a drama of historic proportions: debts exceeding $300 billion at Evergrande alone, more than 50 bankrupt developers, and an estimated 20 million apartments that were sold but never completed. This analysis reveals why Beijing's silence is not a sign of helplessness but a calculated power strategy, how this tactic contrasts sharply with the loud propaganda surrounding success stories, and why this asymmetric communication undermines trust in China's economic model in the long run.

What does Evergrande's delisting from the stock exchange tell us about China's communication strategy?

The delisting of Evergrande from the Hong Kong Stock Exchange on Monday not only marks the end of a company, but also reveals a fundamental pattern in China's political communication. Beijing's silence on this dramatic case is anything but accidental – it is a deliberately chosen strategy, typical of how the Chinese leadership deals with uncomfortable truths. While success stories are celebrated with great fanfare, crises are shrouded in a vacuum of silence.

This strategy of selective silence is deeply ingrained in the political DNA of the Chinese Communist Party. It follows the principle that information is only communicated publicly if it serves the party's narrative. Evergrande's collapse does not fit this narrative of continuous rise and economic superiority, which is why it is suppressed from public discussion.

How dramatic is the Evergrande case really?

Evergrande's decline is unprecedented in its scale. Just a few years ago, the company was considered a prime example of China's economic miracle. With a market capitalization of over $50 billion at its peak, Evergrande was once China's second-largest real estate developer. The group managed approximately 1,300 projects in over 280 cities and even owned the country's most successful football club, Guangzhou FC.

Today, only rubble remains of this empire. With debts of at least $300 billion, Evergrande is considered the most indebted real estate developer in the world. Its shares have lost over 99 percent of their value, and millions of Chinese families are still waiting for their prepaid but never delivered apartments. Liquidation by a Hong Kong court in January 2024 finally sealed the fate of the once-powerful corporation.

What role did China's "Three Red Lines" policy play in this collapse?

Evergrande's demise was not accidental, but the direct result of a political decision. In 2020, Beijing introduced the so-called "Three Red Lines" policy, which aimed to limit the excessive debt of real estate developers. This regulation restricted borrowing based on three criteria: the debt-to-cash ratio, the debt-to-equity ratio, and the debt-to-assets ratio.

Evergrande crossed all three red lines simultaneously, leading to an immediate liquidity crisis. The irony is that the government itself laid the groundwork for the collapse, which it now so vehemently tries to conceal. The “Three Red Lines” policy was a clear signal that Beijing was prepared to let even large corporations fail in order to achieve its economic policy objectives.

How widespread is the crisis in the Chinese real estate sector?

Evergrande is by no means an isolated case, but merely the tip of the iceberg. Since 2021, over 50 real estate developers have defaulted on payments. Country Garden, once another industry giant, reported losses of $27.5 billion for 2023—the second-largest loss ever recorded by a Chinese company. Other prominent developers such as Kaisa Group, Fantasia Holdings, Sunac, and Sinic Holdings are also on the verge of collapse.

The scale of the crisis is evident in the sheer number of affected projects. It is estimated that 20 million housing units have been sold but not yet built. These unfinished projects have become symbols of shattered dreams and represent a tremendous blow to consumer confidence.

Why is the Chinese government silent about this crisis?

Beijing's silence on the real estate crisis is strategically motivated and follows established patterns of crisis communication. The Chinese government systematically employs a policy of concealment, inaction, and distraction when it comes to uncomfortable truths. This strategy is based on several considerations.

First, the housing crisis doesn't fit the desired narrative of continuous economic success. While successes in future-oriented sectors like artificial intelligence, electric vehicles, or renewable energies are widely publicized, structural problems are deliberately kept out of public discourse. Second, the leadership fears that an open discussion about the extent of the crisis could further erode public confidence and lead to social unrest.

How does China's propaganda machine work with success stories?

While China remains silent during crises, its propaganda machine unleashes its full power when it celebrates success stories. The Central Propaganda Department of the Communist Party systematically coordinates positive messages across various media channels, skillfully employing modern digital technologies to reach younger audiences.

One example of this strategy is the use of artificial intelligence to create propaganda content. Companies like GoLaxy develop sophisticated systems for the Chinese government that are capable of creating tailored messages and distributing them to specific target groups. This technology makes it possible to amplify positive narratives about China's progress in areas such as technology, infrastructure, and economic development.

What are the economic effects of the real estate crisis?

The real estate crisis has had a devastating impact on the entire Chinese economy. The real estate sector accounts for roughly a quarter to a third of China's economic output and was one of its most important drivers of growth for decades. Its collapse has triggered a chain reaction that extends far beyond the industry itself.

House prices continue to fall – in June 2025, prices in 70 major cities dropped by 3.2 percent year-on-year. Sales are plummeting, projects are stalling, and local governments are losing their main source of revenue from land sales. Since most Chinese families have invested their wealth in real estate, the price decline is leading to a drop in consumer confidence and spending.

How is the government trying to manage the crisis?

Despite its public silence, the Chinese government is working behind the scenes to limit the worst effects of the crisis. These measures include a variety of instruments, from easing lending to direct state intervention.

In January 2024, China introduced a "whitelist" system designed to facilitate access to financing for selected real estate projects. By October 2024, banks had placed over 5,000 projects on this list and approved loans totaling $196 billion. Additionally, a 300 billion yuan program was launched to help state-owned enterprises acquire unsold apartments.

Why have these rescue efforts been insufficient so far?

The rescue measures implemented so far are a drop in the ocean because they don't address the underlying problem. Paradoxically, the "whitelist" system favors precisely those projects and companies that need the least help. Projects with unresolved legal disputes or financially troubled developers are systematically excluded.

Many private developers try to circumvent these barriers by transferring their projects to local financing vehicles. However, these quasi-governmental entities are themselves heavily indebted and often use the funds received to cover their own liabilities rather than to complete projects. This has further diluted the intended effect of the policy.

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here:

Evergrande debacle: How a real estate giant is shaking the foundations of the Chinese economy

How long will the sector's recovery take?

Forecasts for a recovery in the Chinese real estate sector are bleak. Optimistic estimates suggest that prices could stabilize by the end of 2025 or the beginning of 2026. More realistic assessments indicate that a full recovery of the sector could take three to ten years.

Goldman Sachs estimates that without further government intervention, housing prices could fall by another 20 to 25 percent, bringing them to about half their peak. Bank of America forecasts a decline in new-build sales of 8 to 10 percent and a decrease in new-build projects of 15 to 20 percent for 2025.

What structural problems underlie the crisis?

The real estate crisis is not merely cyclical, but reflects fundamental structural problems in the Chinese economy. Demographic changes play a central role in this. With an aging population and declining birth rates, the natural demand for housing is decreasing.

At the same time, China's rapid urbanization has led to a glut of real estate. Experts estimate that around 90 million permanent structures stand empty on the mainland – that's one building for every two inhabitants. This massive oversupply cannot be met by domestic demand in the foreseeable future.

How does the crisis affect China's political stability?

The housing crisis poses a serious challenge to the political legitimacy of the Communist Party. For decades, the party's legitimacy rested on two pillars: economic performance and nationalism. With slowing economic growth, the nationalist card is becoming increasingly important for maintaining popular support.

But the housing crisis is simultaneously undermining both sources of legitimacy. Economic performance is faltering, and the government's inability to stabilize one of its most important sectors calls its competence into question. At the same time, the loss of wealth for many families is leading to growing discontent, which is difficult to mask even with nationalist appeals.

Why does concealing the crisis work?

The systematic cover-up of the real estate crisis works in China for several reasons. First, the Communist Party, through its Central Propaganda Department, controls all major media channels. Journalists and media organizations are compelled by a system of surveillance, censorship, and self-censorship to avoid critical reporting.

Secondly, over decades the Chinese population has become accustomed to certain topics not being discussed publicly. The strategy of “non-comment” and “strategic ambiguity” is deeply ingrained in Chinese political culture. People have learned to read between the lines and adapt to what is officially communicated.

What role does the international dimension of the crisis play?

The international dimension of the Evergrande crisis highlights the limitations of China's strategy of silence. While domestic reporting can be controlled, this is not possible with international media and markets. The delisting of Evergrande in Hong Kong—an international financial center—could not be concealed.

International creditors who have invested billions of dollars in Chinese real estate developers cannot simply be silenced. Their losses and their criticism of the lack of transparency are damaging China's reputation as a reliable partner for foreign investors. This highlights the limitations of a strategy of silence when it comes to globally interconnected economic sectors.

How does silence during crises contrast with communication about successes?

The contrast between China's communication about crises and successes could hardly be greater. While the real estate crisis is met with a wall of silence, achievements in promising technologies are loudly celebrated. Advances in artificial intelligence, electric vehicles, and space exploration are communicated through all available channels.

This selective communication strategy follows the principle that only news that aligns with the desired narrative is disseminated. Success stories are often exaggerated, while problems are systematically ignored. This asymmetry in information policy is characteristic of authoritarian systems that maintain their legitimacy by controlling public perception.

What impact does this strategy have on trust?

The strategy of concealing crises while simultaneously boasting about successes paradoxically undermines public trust. While the government hopes to avoid panic by suppressing negative news, the silence often leads to even greater uncertainty. People develop a sense for when information is being withheld, which fuels speculation and rumors.

In the case of the housing crisis, the extent of the problems is obvious to the affected families and investors, despite the censorship. The government's silence is therefore interpreted not as reassurance, but as a sign of helplessness or a lack of transparency. This damages confidence in the government's ability to handle crises.

How will demographic trends influence the future of the real estate sector?

Demographic trends in China are significantly exacerbating the structural problems of the real estate sector. With an urbanization rate already reaching 70 percent, urban growth is slowing. At the same time, the one-child policy of the past and cultural changes are leading to declining birth rates and an aging population.

These demographic changes mean that long-term demand for new housing will structurally decline. Experts predict it could take 30 to 40 years to reduce the current oversupply of real estate. This makes the housing crisis a long-term problem that cannot be solved by short-term economic stimulus measures.

What alternatives to the strategy of silence are there?

Theoretically, the Chinese government could have chosen a more transparent communication strategy. An open discussion about the challenges in the real estate sector could have strengthened trust and created realistic expectations. Many Western governments pursue a strategy of controlled openness in times of crisis, acknowledging problems while simultaneously outlining solutions.

However, such a strategy contradicts the political DNA of the Communist Party. The system is designed to project infallibility and suppress any form of criticism. Open discussion of systemic problems could be interpreted as weakness and challenge the party's authority. Therefore, despite its obvious drawbacks, the strategy of silence remains the preferred option.

How is the crisis affecting other sectors of the economy?

The real estate crisis has repercussions far beyond the sector itself. The construction industry, traditionally a key driver of China's growth, has been shrinking for years. Demand for building materials, household appliances, and even vehicles has plummeted. Local governments, heavily reliant on land sales, are under immense financial pressure and have been forced to cut spending.

The crisis is also impacting the banking system, as many loans to real estate developers could become non-performing. Although Chinese banks have remained resilient so far, the risk of systemic problems increases with the duration and depth of the crisis. This partly explains why, despite its policy of silence, the government is actively working on solutions behind the scenes.

How are the financial markets reacting to the silence?

Financial markets are reacting with increasing skepticism to China's strategy of silence. The delisting of Evergrande is just one symbol of the growing uncertainty surrounding the true state of the Chinese economy. International investors are complaining about the lack of transparency and are, in some cases, withdrawing from the Chinese market.

The market reaction reveals the limitations of the strategy of silence. While domestic media can be controlled, international investors are not so easily deceived. They evaluate investments based on available information, and a lack of transparency is factored in as a risk. This leads to higher capital costs for Chinese companies and complicates crisis management.

What are the long-term consequences of the strategy of silence?

The long-term consequences of China's strategy of silence extend beyond the current real estate crisis. Systematically concealing problems while simultaneously boasting about successes creates a distorted picture of economic reality. This can lead to misallocation of resources, as political decisions are based on incomplete or distorted information.

At the international level, China's strategy of silence undermines its credibility as a responsible global actor. When crises are systematically concealed, doubts arise about the reliability of Chinese information in general. This could harm China's ambitions to play a greater role in global governance.

Why silence cannot be sustained in the long term

Beijing's strategy of remaining silent during crises and boasting about successes may work in the short term, but it is not sustainable in the long run. The housing crisis demonstrates the limitations of this communication strategy. While domestic reporting can be controlled, the effects of a systemic crisis cannot be censored.

The delisting of Evergrande therefore marks not only the end of a corporation, but also a turning point in the perception of China's economic model. The crisis persists, no matter how deafening the silence. The tragedy lies not only in the economic damage, but also in the missed opportunity to build trust through transparency and open communication. Yet in a system based on the control of information, this opportunity remains untapped. Evergrande may have disappeared from the stock exchange, but the structural problems that led to its downfall remain and will not vanish through silence.

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus