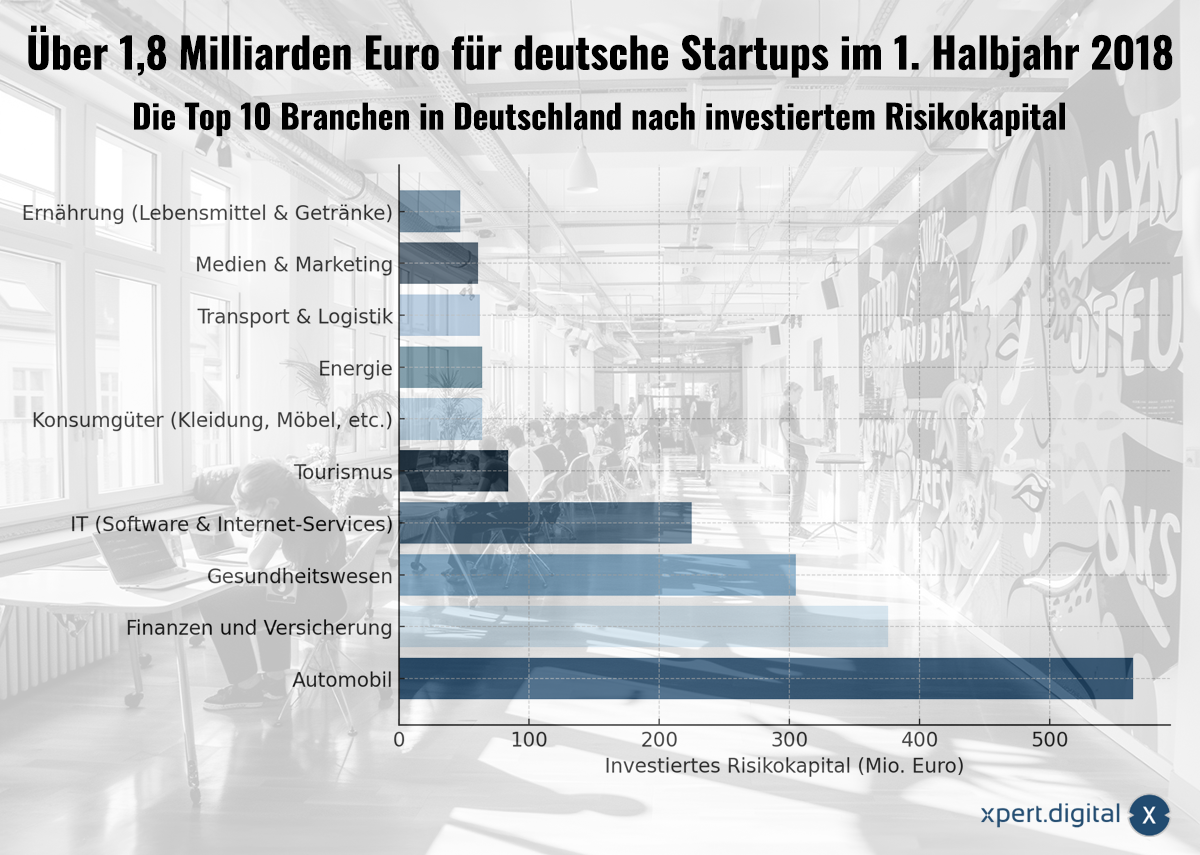

Over 1.8 billion euros for German startups - Top 10 sectors in Germany for risk investments 2018 - Image: Xpert.Digital

📈 Investor trust: 1.8 billion euros for German young companies

💶🌟 From founders to winners: The growth of German startups

German startups have been recording impressive growth for years, largely driven by the growing number of venture capital investments. In the first half of 2018 alone, over 1.8 billion euros were invested in German start-ups. This trend is not only evidence of the innovative strength of German founders, but also a clear sign of the trust that investors place in the local ecosystem.

🚀 Berlin as the center of the start-up scene

In recent years, Berlin has established itself as the undisputed center of the German startup scene. The city attracts around two thirds of all investments and offers the perfect breeding ground for innovative ideas and disruptive business models. The advantages that Berlin offers for startups are manifold: an international and open atmosphere, a large network of founders, experienced entrepreneurs and investors, as well as comparatively low costs of living compared to other metropolises such as London or Paris.

The city is also a magnet for talent from all over the world. This is not only due to the cultural diversity and attractiveness of the city, but also to the opportunity to work in a fast-growing and dynamic environment. Large incubators and accelerator programs such as the “Berlin Startup Academy” or “Factory Berlin” support young companies and offer valuable support in the early phase.

📊 Key industries and growth areas

The automotive industry leads the list of the best-financed sectors with 564 million euros of invested risk capital. This is hardly surprising considering the traditional and strong presence of the German automotive industry. But while large companies such as Volkswagen, BMW and Mercedes Benz are known worldwide, a new generation of companies is also emerging that want to shape the future of mobility with innovative technologies. Startups in the fields of electromobility, autonomous driving and mobility services are increasingly receiving capital as they are considered the driving forces of the coming industrial revolution.

In second place is the finance and insurance sector, which attracted a total of 376 million euros in investments in 2018. The digitalization of banking and insurance, also known as FinTech and InsurTech, has developed rapidly in recent years. New business models based on blockchain technology, artificial intelligence and data-driven solutions are particularly in demand in this industry. FinTech startups in Germany in particular offer innovative solutions for traditional banking, payment services and asset management that are shaking up the market.

Healthcare is in third place with €305 million and represents another exciting growth industry. Digital health startups have emerged as a response to the increasing pressure on healthcare systems worldwide. From telemedicine platforms to wearables that track health data in real-time to AI-powered diagnostic tools, the health technology space is attracting more and more capital. The corona pandemic has once again highlighted the importance of digital health solutions, which should further strengthen this sector in the coming years.

💼 The role of venture capital in startup growth

Venture capital is typically the most important source of external capital for startups. Unlike traditional forms of financing such as bank loans, which involve fixed interest payments, venture capitalists benefit from company development in the form of investments. This investment often gives founders not only financial flexibility, but also access to a broad network of industry experts, mentors and potential partners.

The risks that investors take are high - especially since the majority of startups fail in the first five years. Nevertheless, investors take this risk because the potential returns can also be enormous. The chances of above-average returns are greater, particularly in areas with high innovation potential such as IT, biotechnology or FinTech.

🚀 Challenges and opportunities for German startups

Despite their considerable successes, German startups also face challenges. Although access to capital has become easier in recent years, there is still a lack of large venture capital funds that are able to invest larger sums in later phases. Many startups that have successfully completed the proof of concept and are entering the scaling phase often have to turn to international investors to secure further funding.

Another problem is the high level of regulation, especially in the areas of finance and health. Innovative business models in these sectors often have to overcome complex regulatory hurdles, which delays market entry and presents startups with major challenges. This can lead to a competitive disadvantage, particularly in highly regulated markets such as Germany.

At the same time, however, there are also many opportunities. Germany has established itself as an innovation hub, not only due to its highly developed industry, but also thanks to its strong research landscape. Universities and research institutes work closely with startups to develop new technologies and bring them to market. This is evident, for example, in the growing number of deep tech startups specializing in artificial intelligence, robotics and the Internet of Things.

📊 The international comparison: Where does Germany stand?

In international comparison, Germany is an important player in the European startup scene, but it lags behind countries such as the USA, China and the United Kingdom. In particular, access to large sums of venture capital and the internationalization of startups are more advanced in these countries. Silicon Valley is still considered the Mecca for founders worldwide, while Berlin has developed a position as a leading location in Europe.

Nevertheless, there are clear differences in mindset and willingness to take risks between the USA and Germany. While failure is often viewed as a valuable experience in the USA, German founders are more risk-averse and increasingly focus on sustainable and stable business models. This is also reflected in the type of sectors invested: While the USA has a high concentration of software and Internet startups, more traditional sectors such as automobiles and industry are more strongly supported in Germany.

💼 Where is the journey going?

The development of the German startup scene is promising, and it can be assumed that further record amounts of venture capital will flow in the coming years. Technological change and advancing digitalization offer enormous opportunities, especially for startups, to open up new markets and revolutionize existing industries.

However, in order to remain competitive in the long term, it is crucial that Germany continues to invest in building a comprehensive venture capital landscape and removes regulatory hurdles so as not to hinder innovation. In addition, international collaborations should be promoted to facilitate the transfer of knowledge between different startup hubs and to give founders access to new markets.

The German startup scene is at a turning point, and with the right decisions, it could develop into one of the leading innovation centers worldwide in the coming years. It will be exciting to see how investments develop and which new technologies and business models will come to the fore.

📊💶 Venture capital investments in German startups: Detailed analysis for the first half of 2018

🎨📊 A total of over 1.8 billion euros were invested, with investments spread across various sectors. The top 10 industries account for 95 percent of all venture capital. Let’s take a closer look at the numbers and analyze what they mean for the respective industries and the German startup ecosystem.

🚗 1. Automobile: 564 million euros

The automotive industry received by far the most venture capital investments in the first half of 2018 - a total of 564 million euros. This reflects the enormous importance of the automotive industry in Germany. Germany is known for its leading automobile manufacturers such as Volkswagen, BMW and Daimler. But alongside these established players, new startups are increasingly emerging that focus on electromobility, autonomous driving and new mobility solutions. These startups are important players in the transformation of the automotive industry towards more environmentally friendly and efficient transport concepts.

The areas of e-mobility and connected cars in particular have aroused interest from investors. Startups that specialize in the development of battery technologies, charging infrastructure or software for autonomous driving benefit from these financing rounds. The high amount of investment indicates that change in the automotive industry is in full swing and that many disruptive innovations can still be expected.

📈💵 2. Finance and insurance: 376 million euros

The finance and insurance industry was able to book 376 million euros in risk capital in the same period. This number shows how much interest in FinTech and InsurTech startups has grown. In recent years, digital financial service providers and insurance technologies have experienced a real boom. Many of these companies offer innovative solutions that challenge traditional banking and insurance, whether through simplified online banking services, peer-to-peer lending platforms or insurance platforms powered by machine learning.

In Germany, FinTech startups such as N26 and Raisin are among the pioneers of this movement. The high investments in this area show that Germany is one of the leading locations for FinTech in Europe. At the same time, the sum of 376 million euros signals that further disruptive developments can be expected in the future, which could fundamentally change both the banking sector and the insurance market.

🏥💊 3. Healthcare: 305 million euros

At 305 million euros, healthcare is one of the sectors that attracted a particularly large amount of venture capital in 2018. This shows that investors see great potential in the digital healthcare sector. Startups that deal with topics such as telemedicine, digital health platforms, wearables and personalized medicine are particularly in demand.

The German healthcare industry is increasingly being transformed by technological innovations. Startups are becoming particularly important in the areas of preventative healthcare, AI-supported diagnostics and remote patient monitoring. These developments are of great importance not only for the healthcare industry but also for society as they can contribute to improving overall healthcare.

💻🌐 4. IT (Software & Internet Services): 276 million euros

The IT industry, including software and internet services startups, attracted €276 million in venture capital. These investments illustrate the role that digitalization plays in almost all areas of life. Startups in this sector develop solutions ranging from cloud-based services to cybersecurity and data-based applications.

What's particularly interesting is that many of these startups are developing platform-based business models that allow them to offer scalable solutions for different industries. The level of investment suggests that Germany is an attractive location for software and internet service companies that offer digital solutions for both B2C and B2B sectors.

🏖️✈️ 5. Tourism: 265 million euros

With 265 million euros in venture capital, tourism is another high-growth segment. Digital platforms that are revolutionizing the travel market are increasingly attracting investments. Startups offering innovative concepts for travel bookings, mobility and accommodation have challenged traditional market players.

The growing importance of TravelTech startups like GetYourGuide, which enable users to book travel experiences easily and digitally, shows that tourism is also an important growth industry in Germany. The large amount invested in this area signals that the change in the travel industry is far from complete.

👗🛋️ 6. Consumer goods (clothing, furniture, etc.): 228 million euros

The consumer goods sector, particularly clothing and furniture, has received 228 million euros in investments. This shows that the e-commerce sector continues to be a strong growth market. Startups that specialize in selling consumer goods online have developed enormously in recent years. In addition to fashion startups like Zalando or About You, there are increasingly companies that also offer furniture and household goods online.

These startups are benefiting from changing consumer behavior, with more and more people doing their shopping online. The digitalization of retail and the development of innovative business models such as subscription services or sustainable production have made this industry an attractive target for investment.

🔋🌍 7. Energy: 222 million euros

222 million euros in risk capital were invested in the energy sector. The energy transition and the trend towards sustainable energy production and use have made this sector a popular investment area. Startups focused on renewable energy, energy storage solutions and energy efficiency have benefited greatly from the investments.

In Germany there are numerous initiatives to promote cleantech companies that develop technologies that reduce the carbon footprint and make energy production more efficient. These startups make a significant contribution to the implementation of climate goals and at the same time offer investors attractive growth opportunities.

🚛📦 8. Transport & Logistics: 193 million euros

With 193 million euros, the transport and logistics industry is in the middle range of investments. Startups in this area develop innovative solutions for freight transport, logistics optimization and delivery. Logistics startups are becoming increasingly important, especially in the context of the growing e-commerce market.

The development of autonomous delivery vehicles, drones for package delivery and platforms for optimizing supply chains are just a few examples of the innovative concepts being advanced in this industry. Investors are recognizing the potential of these technologies to transform the transportation sector.

📺📈 9. Media & Marketing: 153 million euros

The media and marketing industry has received 153 million euros in investments. Startups that offer data-driven marketing solutions or new media formats are particularly interesting for investors. Digital advertising platforms, influencer marketing and personalized content strategies are just some of the areas where startups are growing.

The development of AI-supported tools for the automation of marketing processes and the data-based analysis of consumer behavior is particularly attracting investors. These solutions offer companies the opportunity to optimize their marketing strategies and respond more effectively to the needs of their target groups.

🍽️🥤 10. Nutrition (food & drinks): 139 million euros

The food industry was able to raise 139 million euros in venture capital. Startups that deal with sustainable food, plant-based alternatives or innovative delivery models such as meal kits are particularly in demand. The trend towards healthier and more sustainable consumer behavior has caused this area to grow significantly.

In Germany there are numerous foodtech startups that try to revolutionize the nutrition system. From the production of alternative proteins to delivery services for fresh food to innovative packaging solutions - the nutrition industry offers a variety of options for investing. ”

📊📈 Digitalization is shaping the business of German start-ups

🌐✨ Digitalization plays a crucial role in today's business world and has a profound impact on almost all industries. Start-ups in particular, which are often seen as pioneers of new technologies, have used digitalization not only as a tool to optimize internal processes, but also to develop completely new business models. In this article we look at how digitalization is shaping the business of German start-ups, which markets it influences and what strategic opportunities arise from this development.

📊📱 Importance of digitalization for business models

Start-ups are often characterized by their ability to react flexibly to market changes. This is particularly evident in the way they integrate digitalization into their business models. Digitalization not only influences the efficiency of processes, but also enables completely new business areas and services that would not have been possible before.

Strong impact on business models

A significant part of the German start-ups indicates (source: KPMG) that digitization has a “very large” or “big” influence on their business model. This illustrates that digitization is not only seen as a technological development, but as a central basis for the entire understanding of business. These companies use digital technologies to develop new markets, automate business processes and develop innovative products or services.

🚀💡 Opportunities through digitalization

The opportunities presented by digitalization are diverse. Some key areas deserve particular mention here:

1. Automation and increased efficiency

With the help of digital technologies, companies can automate their internal processes and not only reduce costs but also increase efficiency. Tasks that were once manual and time-consuming can now be automated through software solutions, giving employees freedom for more creative and strategic tasks.

2. Expansion of target markets

Digital technologies enable start-ups to offer their services and products across geographical boundaries. Companies can operate worldwide and reach new customer groups via online platforms and digital marketing strategies. This is particularly important for young companies that want to scale quickly and expand their market presence.

3. Innovative business models

Digitalization creates new, innovative business models. Companies can use data analysis and artificial intelligence (AI) to develop products that create personalized experiences for customers. For example, a digital start-up in the fashion industry can offer a platform that uses AI-based recommendations to suggest individually tailored clothing items.

💻⚠️ Challenges of digitalization

In addition to the opportunities, digitalization also brings with it challenges. Start-ups have to overcome these in order to survive in an increasingly competitive environment.

1. Data and IT security

With increasing digitalization, the risks of cyber attacks are also increasing. Start-ups, which often work with limited financial and human resources, must ensure that their IT infrastructure is adequately protected. Data leaks or security vulnerabilities can have serious consequences, both for customer trust and the company's reputation.

2. Rapid technological change

Technologies are evolving rapidly, and startups need to be able to quickly adapt to these changes. Anyone who reacts too slowly to new trends runs the risk of falling behind the competition. Flexibility and a strong culture of innovation are crucial here.

3. Shortage of skilled workers

There is a noticeable shortage of skilled workers, particularly in the IT and technology sectors. Start-ups have to compete for the best talent not only with other companies, but also with large corporations. In order to survive in this competition, many young companies rely on creative solutions, such as flexible working models and attractive corporate values, in order to attract the best minds.

🌍📶 International markets and their importance

Globalization and digitalization go hand in hand, especially for start-ups that benefit from the possibilities of global networking. Digital technologies enable young companies to expand their reach beyond the national market and serve international markets.

Germany as the main market

Despite the international orientation of many start-ups, Germany remains the most important market for many young companies. There are several reasons for this: On the one hand, Germany offers a strong infrastructure and a business-friendly environment for start-ups. On the other hand, the needs and preferences of German consumers are well known, which reduces business risk.

EU and non-EU countries

Many start-ups are also expanding into neighboring EU countries because they are more accessible due to common regulatory frameworks. Non-EU countries in Europe also play a role, but to a lesser extent. North America is also an attractive market for German start-ups, especially for technology companies that want to benefit from the innovative strength of the USA.

📈🌐 Digital business strategies

It is crucial for start-ups to develop a clear digital strategy. This should not only concern the technological infrastructure, but also the way in which digital channels are used to contact customers and optimize business processes.

1. Omnichannel strategy

An omnichannel strategy allows companies to interact with their customers across various digital and physical channels. For example, e-commerce companies can offer their products not only via their website, but also via social media and online marketplaces.

2. Personalization through data analysis

Thanks to modern analysis tools, start-ups can use customer data to create personalized offers and experiences. This individualization leads to higher customer loyalty and increases customer satisfaction.

3. Cloud-based solutions

The use of cloud solutions enables start-ups to flexibly design their IT infrastructure. Cloud services provide a scalable platform for running digital applications and can be expanded or reduced as needed. This gives young companies the flexibility they need to react quickly to market changes.

💼🔍 The role of investors

Investors play a crucial role in promoting digitalization in start-ups. They not only offer financial support, but also valuable strategic advice, especially with regard to scaling and expanding business models.

Venture capital for technological innovations

Many venture capitalists are particularly interested in startups that drive technological innovation. They see great potential in digital business models, as they are often quickly scalable and promise high profitability. Start-ups that use innovative technologies such as artificial intelligence, blockchain or the Internet of Things (IoT) often have a good chance of successful financing.

🔮📊 The future of digitalization in start-ups

Digitalization offers start-ups enormous opportunities, but also presents challenges. Companies that are able to react flexibly to technological changes and integrate digital innovations into their business model will be successful in the long term. In particular, the ability to open up international markets and use digital technologies effectively will determine which start-ups succeed in the market and which do not.

The coming years will show what role new technological trends, such as the metaverse or the further development of artificial intelligence, will play. What is certain, however, is that digitalization remains an indispensable tool for start-ups to survive in a globalized and technological world.

💼 Sales distribution of start-ups by market in 2018

1. 🇩🇪 Germany – 78.7% share of sales

By far the largest share of sales for German start-ups comes from the domestic market. Almost 80% of total sales are generated in Germany. This suggests that German start-ups think globally, but are strongly focused on the national market. This can have several reasons:

Known market environment

Start-ups know the preferences and behavior of their domestic customers. Due to its size and economic power, the German market offers a solid foundation for young companies.

Regulatory benefits

In Germany, the legal framework for start-ups is familiar, which makes it easier to bring new products and services to market.

However, this focus on the domestic market could also reflect a certain reluctance to internationalize. This could be due to the challenges that come with expanding into foreign markets, such as cultural differences or regulatory hurdles.

2. 🔗 EU countries – 11.0% share of sales

Another important market for German start-ups are the EU countries, which account for 11% of sales. The European Union offers numerous advantages, including:

Common internal market

The European internal market allows companies to operate within the EU without major trade barriers. This means less bureaucracy and easier trading conditions.

Common currency (Euro)

For many EU countries there is the advantage of a common currency, which makes doing business and pricing easier.

Despite these advantages, the share of sales in the EU is comparatively low compared to the German market. This could indicate that German start-ups are aiming to expand into Europe, but this tends to occur in the early phases of internationalization.

3. 🌍 Europe (not EU) – 2.3% share of sales

Countries in Europe that do not belong to the EU only contribute 2.3% to total sales. This shows that these markets currently play a smaller role for German start-ups. Reasons for this could be:

Regulatory differences

Countries outside the EU are subject to different regulations and legal frameworks, which can make market entry more difficult.

Economic differences

Markets outside the EU may appear economically less stable or less attractive, discouraging German start-ups from expanding there.

However, there could be opportunities for start-ups in the future, as some non-EU countries in Europe, such as Switzerland or Norway, represent economically strong and technologically advanced markets.

4. 📈 North America – 4.4% revenue share

The North American market (specifically the USA and Canada) accounts for 4.4% of sales. This is a remarkably small share considering that North America is one of the world's largest and most important technology markets. Possible reasons for this relatively low proportion could be:

Highly competitive market

The US market is particularly competitive because many leading tech companies are based there. It can be difficult for start-ups to gain a foothold in this environment.

Cultural and regulatory differences

The US and Canada have different legal requirements and cultural expectations that could make expansion difficult.

High market entry costs

Entering the North American market involves high costs, especially in the areas of marketing and customer acquisition.

Nevertheless, North America offers enormous potential for German start-ups, especially in the tech sector. The market is large, technologically advanced and offers access to key investors and networks.

5. 📊 Other countries – 3.6% share of sales

Markets outside Europe and North America contribute 3.6% to total sales. These markets are very diverse and include regions such as Asia, Africa, Latin America and Australia. The small proportion suggests that German start-ups have so far only focused on global markets outside of the well-known economic blocs. However, there may be growth opportunities here in the future:

Emerging markets

Countries like China, India and Brazil offer great growth opportunities, especially for tech start-ups. These markets have a growing middle class and increasing demand for digital services.

New technologies and infrastructure

In some emerging markets, massive investments are being made in digital infrastructure, which offers new opportunities for start-ups in the technology and services sectors.

🌐 Impact of digitalization on business models

The influence of digitalization on the business models of German start-ups provides detailed insights into how strongly it is perceived.

1. 🚀 Very high influence – 61.1%

Over 60% of the start-ups surveyed say that digitalization has a very big impact on their business model. This means that the majority of German start-ups see digitalization not just as a tool, but as the central basis of their business strategy. This very large influence indicates companies that rely on digital products and services or have completely digitalized their internal processes.

2. 💡 A lot of influence – 18.2%

18.2 % of the start-ups state that digitization has a “big” influence. Here, too, it can be seen that digital technologies play an important role, but possibly not to shape the business model to the same extent as with the start-ups with “very large” influence. For example, these companies could digitally optimize existing analogous business models without completely switching on digitization.

3. ⚖️ Medium Impact – 10.3%

Around 10% of start-ups report a medium impact of digitalization. In these cases, digitalization is probably used to improve or supplement existing processes, but is not seen as a primary driver of business development.

4. 🔍 Little influence – 6.5%

6.5% of start-ups say that digitalization has only a minor impact on their business model. These startups are likely to operate in areas that are less technology dependent or rely on traditional business models that do not benefit greatly from digital technologies.

5. 🚫 No Impact – 3.9%

A small minority of 3.9% say that digitalization has no impact on their business model. These could be start-ups in very specific niche markets that have so far hardly been touched by digitalization, or companies that consciously rely on analogue models.

📊 Opportunities and challenges for German start-ups

The numbers make it clear that digitalization plays a key role for German start-ups, both in terms of developing their business models and expanding into new markets. While the German market remains the most important source of sales, there are enormous opportunities in further internationalization, especially in Europe and North America. However, in order to exploit the full potential of digitalization, start-ups must overcome the challenges that come with digitalization, such as IT security, a shortage of skilled workers and rapid technological change. The companies that successfully address these challenges will be able to assert themselves in a globalized and digitalized world in the long term.

We are there for you - advice - planning - implementation - project management

☑️ Start-up and industry expert, here with its own Xpert.Digital industry hub with over 2,500 specialist articles

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus