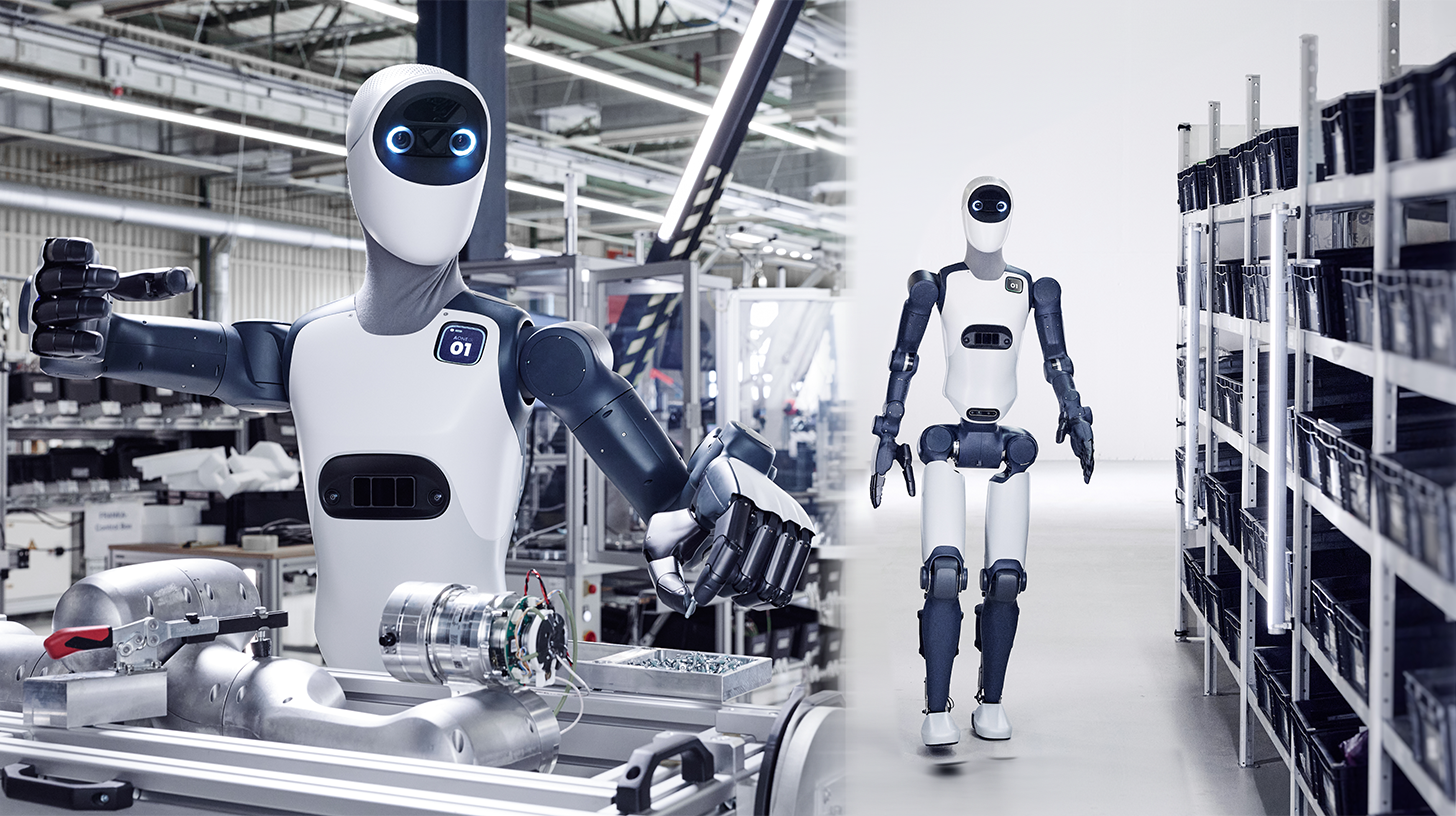

Production in Bavaria instead of China: Agile Robots will produce the industrial humanoid robot Agile ONE in Germany starting in 2026 – Image: Agile Robots

Hidden Giant: How a German robotics unicorn is challenging the world market leaders

The German robotics revolution: When Agile Robots transform industry

At a time when the traditional automotive industry is faltering and global competition for technological supremacy is raging between the USA and China, the Munich-based unicorn Agile Robots is making a bold statement. With the announced series production of the humanoid robot "Agile ONE," the company, which emerged from the German Aerospace Center (DLR), is challenging giants like Tesla and XPeng – and doing so with a product "Made in Bavaria."

But this is about far more than just mechanics. It's about the fusion of cognitive intelligence with physical precision. Supported by the newly formed Industrial AI Cloud from Telekom and NVIDIA, this could lay the foundation for the technological sovereignty that Europe urgently needs. Can German engineering hold its own against the aggressive scaling from overseas? Will "Physical AI" solve the skills shortage or radically disrupt the labor market?

The following analysis sheds light on the strategic background of this daring initiative, assesses the opportunities in the multi-billion-dollar humanoid market, and shows why the year 2026 could decide the future of Germany as an industrial location.

Suitable for:

The turning point is imminent – and Bavaria could become the global center of gravity for Physical AI.

Germany's industrial landscape is at a crossroads. While established corporations are still debating investment strategies, Agile Robots is preparing to begin mass production of its humanoid robot, Agile ONE, in early 2026. But this announcement is far more than a product launch. It signals the arrival of a new era of industrial automation, in which artificial intelligence is no longer confined to data centers, but directly shapes and transforms the physical world.

The significance of this moment is often underestimated. Agile Robots is not in isolation. A growing number of competitors – from Tesla to XPeng, from Apptronik to established players like Boston Dynamics – are simultaneously entering this market. At the same time, Bavaria, and the Munich region in particular, provides a unique infrastructural and technological foundation that opens up unprecedented opportunities for this transformation process. The research and production capacities, combined with the newly announced Industrial AI Cloud from Telekom and NVIDIA, form an ecosystem that could enable Germany to take a leading position – or not, if the momentum is not optimally leveraged.

This analysis examines the economic, strategic and structural implications of Agile Robots' production launch and places it within the global context of the Physical AI revolution.

The rise of Physical AI as an industrial principle

From programmed mechanics to autonomous intelligence

Traditional industrial robotics is based on a fundamental principle: precision through programming. A robot arm is configured for a specific task, performs it with high repeatability, but requires a specialist with programming knowledge for every process change. This is both its strength and its weakness. Flexibility is limited; new tasks require new investments in knowledge and time.

Physical AI overcomes this dilemma by integrating sensory perception, cognitive models, and continuous machine learning directly into physical systems. A robot thus becomes no longer a tool that reacts to rigid instructions, but an autonomous agent that perceives its environment, draws conclusions, and acts contextually. This shift is fundamental because it decouples flexibility and precision.

In the context of Agile Robots, this is implemented through the concept of a multi-layered AI architecture. Each layer specializes in a specific level of cognition and control: strategic thinking and task planning at the top level, rapid responsiveness at the middle level, and precise fine motor control at the bottom level. This layered approach enables Agile ONE not only to handle complex tasks in real-world work environments, but also to do so with an adaptability previously reserved for humans.

The practical implications are significant. Agile ONE was specifically designed to take over tasks that dominate industrial environments: material handling, pick-and-place operations, machine operation, tool use, and precise manipulation tasks. Unlike previous generations of robots, these functions do not need to be individually programmed. Instead, the system is trained with real-world industrial data and can then make autonomous decisions in dynamic environments. This is the key difference compared to traditional cobots or industrial robots.

Agile Robots: Building and Positioning a Hidden Champion

From research idea to a 200 million euro company

Agile Robots was founded in 2018, making it one of the youngest, yet most advanced robotics companies on the German market. Its founding is particularly noteworthy: it was initiated by Zhaopeng Chen and other experts from the German Aerospace Center (DLR), an institutional environment with deep expertise in precision robotics and automation. This is no small detail. Being embedded in the DLR research landscape meant that Agile Robots didn't have to start with basic technical knowledge, but rather with advanced expertise in force-torque sensing, human-robot collaboration, and complex manipulation problems.

The company's financial performance underscores the appeal of its approach. In 2020, it raised over $130 million – an exceptional sum for a German robotics startup. A year later, in October 2021, it secured $220 million in Series C funding, led by SoftBank Vision Fund 2. This made Agile Robots the highest-valued unicorn in the field of intelligent robotics worldwide. Investors in this round included not only financial investors such as Abu Dhabi Royal Group and Sequoia China, but also strategic investors like Xiaomi Group and Foxconn, two of the world's leading manufacturers in electronics and manufacturing.

This financing structure is strategically remarkable. It signals not only confidence in the technology but also the company's global positioning. With offices in Munich and Beijing, Agile Robots established itself early on as a bridge between European engineering expertise and Asian manufacturing volume. By 2024, the company had continuously doubled its revenue, reaching approximately €200 million. This suggests that profitability has likely not yet been achieved – typical for scale-up companies at this stage – but at the same time, the revenue growth is unusually rapid for a hardware company in the German market.

Agile Robots' portfolio extends far beyond Agile ONE. The force-sensitive FR3 robot arm is already established in the market and used in numerous research institutions and industrial plants. The Agile Hand, often described as the world's most precise robotic hand, embodies a core competency of the company: the ability to perform complex grasping and manipulations with tactile feedback. The Thor series of robots, various autonomous mobile robots, and driverless transport systems complete the portfolio. Crucially, however, all these systems do not operate in isolation but are integrated via the AgileCore platform – AI-driven software that enables seamless integration across all systems.

This is the core of the Agile Robots approach and the central reason why the mass production of Agile ONE is strategically important. The true added value lies not in the isolated humanoid robot, but in a fully networked and intelligent production system where every device is connected to every other and learns from each other.

The production site: Bavaria as a manufacturing location for future-oriented technology

Why setting up operations in Germany is strategically smart

The announcement that Agile ONE will be fully manufactured at its own plant in Bavaria warrants closer examination. The decision not to relocate production to Asia or other low-wage countries is unusual for hardware manufacturers in this volume and cost environment. There are several reasons for this.

First: Control and quality

For a robot whose core value proposition lies in precision and reliability, in-house manufacturing is of strategic importance. Every Agile ONE undergoes the most stringent quality checks possible, and the entire production chain is under the company's direct control. This is particularly critical for the high-precision hands with fingertip sensors and force-torque sensors in each joint, which require tight tolerances and calibrated assemblies.

Second: Technology transfer and security

The technology behind Agile ONE is valuable and, in many aspects, a trade secret. Manufacturing in Bavaria under German control reduces the risk of technology outflow, which, given the current geopolitical climate—particularly with tensions with China—is a real and serious risk. The US and the EU have both implemented restrictions on technology transfer, and robotics technology falls under many regulatory jurisdictions.

Third: Market positioning

German production is a mark of quality and a marketing advantage. European buyers, and especially German OEMs and suppliers, prefer partners whose production is transparent, compliant with regulations, and reliably high-quality. "Made in Germany" continues to hold a prominent position in robotics and industrial goods.

However, there is also the other side of the coin.

Manufacturing costs in Bavaria are significantly higher than in Asia. Assuming that Agile ONE is to be positioned in a competitive price segment – comparable to the estimated price of the Tesla Optimus of around €20,000 to €30,000 – manufacturing costs are crucial. Production in Bavaria means higher labor costs, higher energy costs, and higher logistics costs. This can only be profitable if the volume is very high or the product margin is substantial.

The announcement that production will utilize a new facility in Bavaria, rather than the existing plant in Kaufbeuren, suggests that Agile Robots anticipates significant production volumes. However, the CEO and co-founder has deliberately remained vague regarding production figures, indicating that these are either not yet finalized or are being kept under control for the time being. This is typical for companies that want to avoid unsettling the market, but also those still working through regulatory or financial uncertainties.

The competitive landscape: A market in transition

Tesla, XPeng, Apptronik and the battle for market share

The market for humanoid robots in 2026 will not be a two-horse race. Several global players and startups are preparing for mass production in parallel. Tesla, with its Optimus robot, is arguably the most visible and financially strongest competitor. Elon Musk has announced specific production targets: a few thousand units in 2025, up to 100,000 units in 2026, and potentially 500,000 units in 2027. These figures are ambitious, and there are reasons to view them with skepticism—Tesla has a long history of optimistic production forecasts that have not materialized. At the same time, the company has also demonstrated a rare ability to rapidly scale production lines when political and financial support is available.

Tesla's Optimus is expected to have a base price of around $20,000 to $30,000 and will primarily be produced in Tesla factories in the US, with a possible later expansion to other locations. The strategy is clear: first, production for Tesla's own operations, then expansion to external customers. The volume potential is enormous if Tesla's plans are realized.

XPeng, the Chinese electric vehicle manufacturer, plans to begin mass production of its IRON robot by 2026. The company announced investments of between 7 and 14 billion US dollars to scale up robot production, signaling serious intentions. XPeng has the advantage of already having an established manufacturing network in China and direct access to component suppliers and labor. The cost advantage over Bavaria is considerable.

Apptronik has announced a partnership with global manufacturer Jabil to produce its Apollo humanoid robot and launch it in 2026. This is a strategically smart move, as Jabil possesses enormous manufacturing expertise and global capacity. Apptronik will not have to face the complex task of setting up production and can instead focus on technology and customer acquisition.

Other competitors, such as Agility Robotics with its Digit, Boston Dynamics, and a host of smaller players like 1X Technologies, Neura Robotics, and Figure AI, complete the field. Neura Robotics, a German company, already presented its humanoid 4NE-1 at Automatica 2023 and announced updates for 2025. While Boston Dynamics has long-term ambitions, it is unlikely to begin mass production of humanoid robots before 2026.

What does this mean for Agile Robots? The company isn't competing with Tesla or XPeng on cost. These two have financial resources and existing manufacturing structures that Agile Robots lacks. Instead, Agile Robots must focus on its core strengths: precision, tactility, software integration, and European quality. This means the company will likely concentrate on niche segments and specialized applications, not the mass market.

Automatica 2025 in Munich attracted over 49,000 visitors, a record for this leading trade fair. More than 1,100 robots were exhibited. This underscores that the market is real and diverse. There is sufficient demand and interest for several players with different market positions.

Our EU and Germany expertise in business development, sales and marketing

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Deutsche Telekom and NVIDIA launch Europe's largest Industrial AI Cloud: How Agile Robots aims to revolutionize robotics in Europe

The AI model and training: The Industrial AI Cloud as an infrastructure wildcard

The Telekom-NVIDIA partnership and its significance for Agile Robots

A critical, yet often overlooked, aspect of the Agile ONE strategy is the role of AI infrastructure. Agile Robots utilizes an AI model based on one of Europe's largest industrial datasets, enriched with simulated and human-collected data. This model requires continuous training and updates to learn new skills and enhance existing ones.

This requires significant computing power. This is precisely where the newly announced Industrial AI Cloud from Deutsche Telekom and NVIDIA comes into play. In November 2025, it was announced that the two companies were launching a €1 billion partnership to create the first large-scale Industrial AI Cloud in Europe. This cloud will be hosted in Munich, with up to 10,000 NVIDIA Blackwell GPUs, providing a computing power of 0.5 exaFLOPS. This represents an additional 50 percent of Germany's current AI computing capacity.

For Agile Robots, this is a strategic win. The Industrial AI Cloud will go live in the first half of 2026 – coinciding with the production launch of Agile ONE. This means the company can access computing power to train its AI model in Germany without any data leaving the country. This is not only a data privacy advantage under GDPR, but also a competitive edge in the current geopolitical climate.

NVIDIA CEO Jensen Huang emphasized during the announcement that modern AI infrastructures are like new factories. The Industrial AI Cloud is therefore not just a data center, but a strategic manufacturing tool for digital intelligence. Agile Robots can significantly benefit from this. The company will not have to compete with OpenAI, Meta, or other global AI players for computing resources. Instead, it has access to high-performance infrastructure precisely tailored to European and German industrial use cases.

The training was specifically conducted using real-world industrial data. This is technically demanding and requires not only computing power but also expertise in data preparation, feature engineering, and model validation. The fact that Agile Robots works with the largest industrial datasets in Europe suggests that the company has partnerships or data acquisitions that set it apart from many competitors.

The German and European market for humanoid robots

Market size, growth and opportunities

The market for humanoid robots in Germany is at a turning point. Deep Market Insights forecasts that the German market for humanoid robots will grow from USD 109.97 million in 2024 to USD 1,161.81 million by 2033. That's an annual growth rate of over 30 percent. Another research firm sees the industrial robot market in Germany growing to USD 9.5 billion by 2032, with humanoid robots representing an increasing share.

The global market is even more dramatic. Fortune Business Insights forecasts growth from $3.28 billion in 2024 to $66 billion by 2032. This represents an annual growth rate of approximately 45.5 percent. Nexery Research predicts that by 2030, there could be around 20 million humanoid robots in use worldwide.

For comparison: There are currently around 4.3 million industrial robots and cobots in use worldwide. The projection of 20 million humanoid robots within five years would signal an unprecedented paradigm shift.

Germany is currently a leader in robotics installations. The World Robotics 2025 Report shows that 40 percent of all factory robots in the EU are installed in Germany. In 2024, 27,000 new industrial robots were installed in Germany. This represents a slight decrease of 5 percent compared to the previous year, but the annual growth since 2019 is still 4 percent.

Interestingly, there are significant differences between industries. The metalworking industry is the growth driver, with an increase of 23 percent to 6,000 installed robots. The chemical and plastics industry shows an increase of 71 percent, with 3,100 units installed. This indicates a diversification trend – it's no longer just the automotive industry, but various sectors recognizing the value of automation.

The automotive industry, historically the driving force behind robotics investments in Germany, is showing a decline of 25 percent. This is the weakest result in 15 years and raises questions about future competitiveness. There are several explanations: 1) Economic uncertainty and declining sales at OEMs such as Volkswagen and others; 2) The slow adaptation to the shift to electric mobility; 3) A reassessment of strategy – some OEMs expect humanoid robots and physical AI to make traditional production lines more transparent in the future, which is why they are hesitant to invest in older generations.

This is a critical observation. The decline of the automotive industry as the primary robotics investor in Germany could be a signal that the sector has realized that the next wave of automation will not come via traditional cobots and rigid robots, but rather via humanoid systems like Agile ONE and Tesla Optimus.

Economic and structural effects of mass production

Value creation, labor market and transformation potential

Agile Robots' announcement of the start of production has several economic and structural implications that extend beyond the company itself.

First: Value creation in the Bavaria region

A modern robotics production facility in Bavaria will create jobs – not only in manufacturing, but also in engineering, quality assurance, supply chain management, and logistics. The fact that production takes place in Bavaria and not elsewhere means that the direct and indirect economic benefits will be concentrated in this region. This strengthens Bavaria as a technology and manufacturing hub.

Second: Supply chain effects

The production of Agile ONE requires a network of suppliers for specialized components – high-precision sensors, specialized drives, and software components. Many of these suppliers are likely German or European companies accustomed to a stable and large-volume customer base. Demand from Agile Robots could be a new growth driver for these suppliers, especially if production volumes reach the planned 100,000+ units per year.

Thirdly: The labor market

This is more complex and controversial. A study by the Bonn Business Academy shows that 77 percent of the surveyed executives and union representatives expect humanoid robots to replace up to half of all jobs. 58 percent assume that about a third of all jobs will be lost due to these technologies. These figures are remarkable and signal considerable unease.

However, there is also another side

54 percent of respondents see the potential for robotics and AI to alleviate the skilled worker shortage. 64 percent expect employers to be the primary beneficiaries of the AI robotics revolution. For small and medium-sized enterprises (SMEs), a key benefit is that humanoid robots could become affordable for the first time – many predict acquisition costs comparable to a small car, which could be achieved through hire purchase or leasing for smaller businesses.

The societal dimension is therefore not trivial. On the one hand, there are risks of mass unemployment and strain on social security and pension systems. On the other hand, there are opportunities for economic growth, support for small and medium-sized enterprises (SMEs), and addressing skills shortages. These dynamics require proactive policymaking, but that is outside the focus of this economic analysis.

Positioning and strategic opportunities for Agile Robots

Niche specialization vs. mass market

Agile Robots' likely positioning will not be direct competition with Tesla in terms of volume. Instead, the company will probably pursue a niche specialization strategy. Its core strengths are: 1) Precision and tactility; 2) European quality standards and regulatory compliance; 3) Software integration and the AgileCore platform; 4) Access to European industry data and expertise.

These strengths are particularly valuable in industries with high precision requirements: precision assembly, electronics manufacturing, medical device production, and pharmaceuticals. They are also valuable in segments where regulatory compliance and data protection are critical – with European customers willing to pay a premium for German or European production and data sovereignty.

An estimated price point would be in the range of €50,000 to €150,000 per Agile ONE. This is considerably higher than the estimated €20,000 to €30,000 for the Tesla Optimus, but it is also entirely appropriate for a differentiated positioning. The customer is paying for precision, European quality, and data security – not for the lowest price.

Volume ambitions are likely moderate compared to Tesla or XPeng. A realistic estimate for 2026 could be 1,000 to 5,000 units, escalating to 10,000 to 20,000 units per year by 2028. This is small compared to global automotive volumes, but appropriate for a high-end niche product.

Geopolitical and technopolitical dimensions

Technological sovereignty and the German-European path

Agile Robots' announcement must also be understood in the context of technological sovereignty and geopolitical competition. The US and China have both recognized that physical AI and robotics are strategically critical technologies. Several American and Chinese companies are receiving massive investments. NVIDIA, the core of the AI infrastructure, is subject to export controls and strict regulations.

Europe and Germany have realized that they cannot simply be followers in this field. The Industrial AI Cloud is a direct attempt to create European technological independence. Agile Robots, a German company with European technological roots, is positioning itself as a European player in a global market.

This also has a defensive character. The European Union is working on a Digital Sovereignty Framework that prioritizes data protection, technology control, and technological independence. Agile robots, with production in Bavaria and data training on the German sovereignty infrastructure, fit perfectly into this picture.

At the same time, tensions exist. Agile Robots has strategic investors that are not European – SoftBank (Japan), Xiaomi, and Foxconn (China). This is normal for an innovative company, but it raises questions about long-term control and strategic autonomy. Should the geopolitical situation escalate, such ownership structures could become problematic.

Scenarios and outlook: What could happen in the next 24 months?

From announcement to reality

The period between now and the end of 2027 will be crucial. Several possible scenarios are emerging:

Scenario A – Production starts as planned

Agile ONE will launch in 2026 with initially limited volume but high quality. The units will find buyers in Europe, particularly OEMs and suppliers with high precision requirements. Production will scale moderately to 5,000-10,000 units per year until 2027. The company will remain profitable assuming moderate prices and continuously decreasing manufacturing costs. Agile Robots will establish itself as a premium supplier with a strong European focus.

Scenario B – Delays and Adjustments

Production starts later than planned or with reduced volumes due to supply chain issues, software integration problems, or market acceptance barriers. The company remains in venture capital funding or is considering a capital increase. Agile Robots retains its position as a technology leader, but market penetration is slower than hoped. Strategic partnerships or acquisitions may be on the horizon.

Scenario C – Acquisition or strategic consolidation

A larger industrial company – for example, an automotive OEM, a mechanical engineering group, or a technology giant – recognizes the value of Agile Robots' technology and market position and acquires the company. This would pave the way for greater volume and market penetration, but potentially reduce the independence of technology development.

Scenario D – Intense competition leads to consolidation or marginalization

Tesla's Optimus and XPeng's Iron are scaling faster than expected and capturing large volumes with aggressive pricing. Agile Robots is finding it difficult to compete in this volume-driven environment and is either scaling back its ambitions or being acquired by a competitor. This is a plausible scenario if Agile Robots doesn't scale quickly enough or if the market consolidates faster than anticipated.

The most likely scenario is a combination of A and B: Production starts, but with initial delays or reduced volumes. The company maintains its technological and European positioning, but expands more slowly than originally planned. In parallel, management is likely to seek strategic partnerships to acquire volume and capital.

Physical AI: Germany's chance in the global technology race

Agile Robots' announcement that it will begin mass production of Agile ONE in 2026 marks a turning point for the German robotics industry and for Europe's role in the physical AI revolution. The company has the right technology at the right time. The infrastructure – industrial AI cloud, research institutions, and skilled workers – is in place. Market conditions are favorable, with growing demand for automation and a shortage of skilled workers.

At the same time, there are considerable uncertainties. Global competition is intense, and competitors like Tesla have greater financial resources. The market is not yet fully validated – it is unclear whether customers are truly willing to pay for humanoid robots and whether the technological promises will be fulfilled. The labor market implications are substantial and could generate political resistance.

Agile Robots is thus in a key position. It could become Europe's champion in the physical AI revolution, or a warning sign that Europe cannot scale quickly enough in this critical technology field. The next 24 months will clarify this.

For investors, customers, and policymakers, it's an exciting but also risky time. The opportunities for value creation and economic growth are real, but so are the risks and the potential for global players to dominate the market. What happens this year with Agile Robots and the German-European robotics industry will be a key indicator of Europe's competitiveness in the 21st century.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: