Published on: January 3, 2025 / update from: January 5, 2025 - Author: Konrad Wolfenstein

Robot density as an indicator: How automation is transforming the global manufacturing landscape

The Future of Industry: Robot Density and its Impact on Global Progress

Robot density in the manufacturing industry shows a clear picture of advancing automation worldwide. The number of robots installed per 10,000 employees is an indicator not only of a country's technological progress, but also of its ability to harness innovation to increase efficiency and competitiveness in manufacturing.

Leading countries in robot density

At the top is the Republic of Korea, which has by far the highest robot density in the world. This is hardly surprising since South Korea has one of the world's largest electronics and automotive industries. Companies like Samsung and Hyundai are relying heavily on robot technologies to optimize their production processes. The robot density in South Korea clearly shows that there is a strong integration of automation technologies and traditional industry here.

Singapore and China follow closely behind South Korea. Singapore, although small in area, has made enormous progress in recent years, particularly in electronics manufacturing. The country is strategically investing in cutting-edge automation, which has led to a significant increase in robot density.

China, which is known as the “workbench of the world”, has significantly increased its robot density in recent years. This is a result of the “Made in China 2025” strategy, which aims to bring the country to the top of the world technologically. China's focus is on robotics and automation in order to meet the growing requirements of global markets.

Europe's leading countries

Germany is at the top in Europe. With its strong automotive industry, led by companies like Volkswagen, BMW and Daimler, the high density of robots in German manufacturing is no surprise. Germany is known for its innovative strength and its ability to quickly adapt new technologies to make production more efficient.

Japan, Sweden and Denmark are also leaders in robot density. Japan has a long tradition in robotics and is a world leader in the production of industrial robots. Companies like Fanuc and Yaskawa Electric play a crucial role here. Sweden and Denmark are characterized by their focus on precision technologies and sustainable manufacturing, which is supported by high robot density.

Countries in the middle

The USA, Taiwan, the Netherlands and Austria are in the middle. The United States is increasingly relying on robotics in the automotive industry, while Taiwan, as Asia's technology hub, is heavily automated, particularly in semiconductor production. The Netherlands and Austria also show a strong integration of robotics into their manufacturing industries, particularly in mechanical engineering and food processing.

Countries with lower robot densities

Countries such as Slovakia, France, Spain and Finland have lower robot density compared to leading nations. This could be due to different economic structures, less industrialization or lower investments in automation technologies.

Global trends and perspectives

The global average robot density is 162 robots per 10,000 employees. What's interesting is that many countries traditionally considered technologically advanced are above this average. This illustrates the increasing importance of robotics in the manufacturing industry. Countries that are below average could invest more in these technologies in the coming years in order to remain competitive.

Another notable trend is the use of robotics in new industries. While robots have traditionally been used in automotive and electronics manufacturing, they are increasingly being used in food processing, pharmaceuticals and even agriculture. This change shows that robotics has long since grown beyond its original areas of application and is now also contributing to increasing efficiency in other areas.

Suitable for:

Challenges of automation

Despite the many advantages, increasing automation also presents challenges. One of these is the potential loss of jobs, particularly in jobs that can easily be replaced by robots. At the same time, however, new jobs are being created in areas such as robotics engineering, maintenance and programming.

Another aspect is the high investment amount required for the use of robots. Small and medium-sized enterprises (SMEs) in particular may have difficulty keeping up with this development. Government support programs and incentives could play an important role here in supporting these companies.

Future developments

Robot density will continue to increase in the coming years as technologies such as artificial intelligence (AI), machine learning and the Internet of Things (IoT) continue to develop. These technologies enable robots to become more intelligent and adaptable, allowing them to take on even more diverse tasks.

Suitable for:

The development will be particularly interesting in emerging countries that are increasingly investing in automation. Countries like India and Brazil could see significantly higher robot densities in the next few years as they look to modernize their production processes and remain globally competitive.

Robot density in the manufacturing industry is a key indicator of a country's technological progress and competitiveness. While leading nations such as South Korea, Germany and Singapore are already fully embracing the possibilities of robotics, there is still significant potential for growth in other countries. Automation will continue to play a critical role in the global economy and profoundly change the way products are made.

Leading countries and their numbers

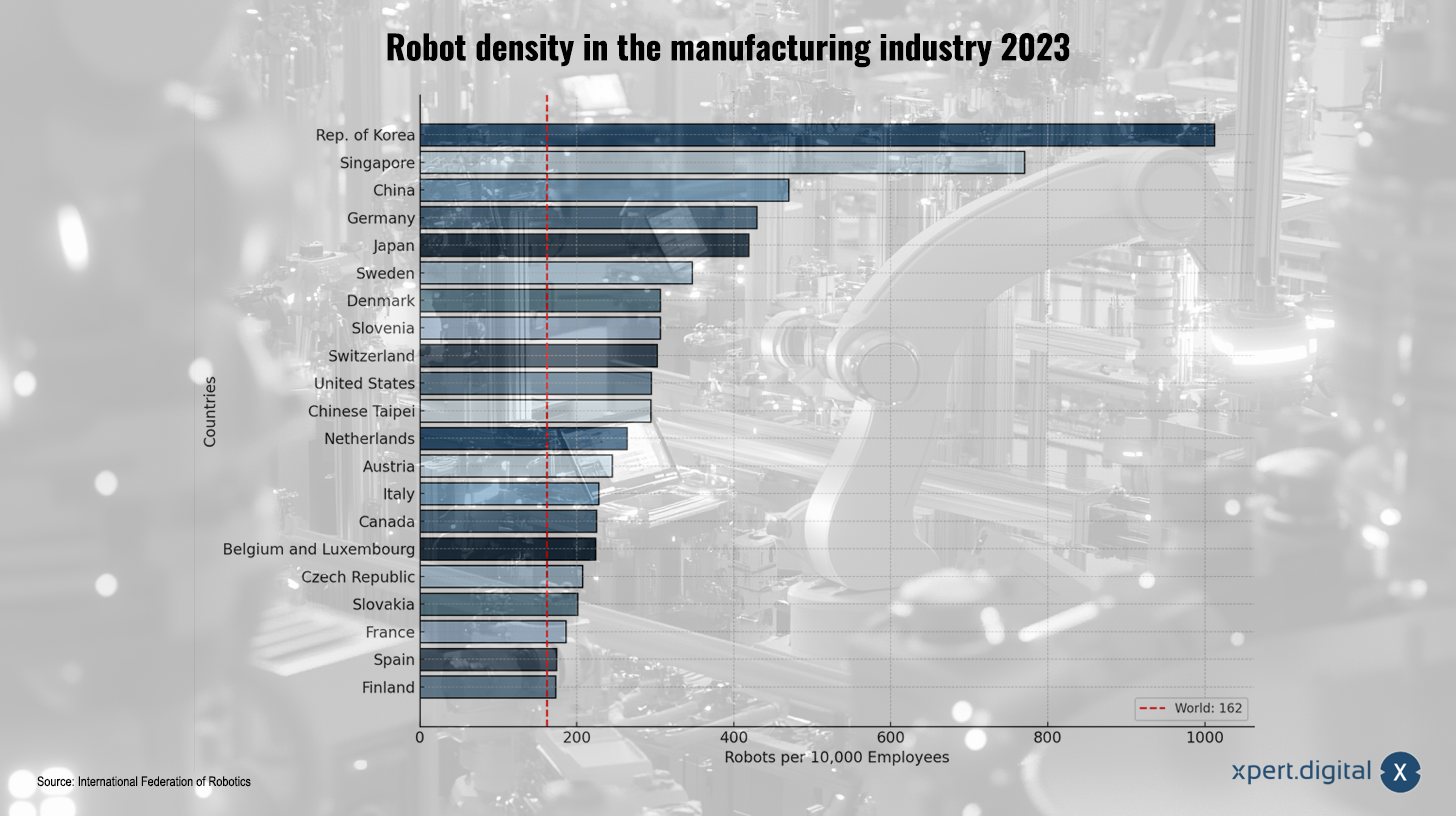

The graphic shows the robot density in the manufacturing industry in 2023, measured in the number of industrial robots per 10,000 employees. The differences between countries are significant and reflect the level of technological development and the strategic importance of automation.

Republic of Korea (South Korea)

South Korea tops the list with around 1,000 robots per 10,000 employees. That's more than six times the global average of 162 robots per 10,000 employees. South Korea benefits from its dominant electronics and automotive industries, which are highly automated. Particularly noteworthy is the advanced integration of robotics in almost all manufacturing sectors.

Singapore

With a robot density of around 670, it is also well above the global average. Singapore's success is based on its high-tech industries, particularly electronics manufacturing and semiconductor production. The country also uses robots in logistics and healthcare, adding to the impressive numbers.

China

The robot density in China is stated to be around 400-450 robots, which shows a significant increase in recent years. This growth is part of the “Made in China 2025” strategy, which massively promotes automation and high-tech manufacturing. China is now also the world's largest market for the purchase of new industrial robots.

Germany

With around 400 robots per 10,000 employees, Germany is the leader in Europe. The high number is a result of the highly automated automotive industry and the leading position in mechanical engineering. Robots are used here not only for assembly work, but also for complex production steps such as welding and painting.

Countries with medium robot density

Japan

The robot density is around 390 robots. Japan has a long tradition in robotics and is both a leading manufacturer and user of industrial robots. The focus is particularly on automobile and electronics production.

Sweden and Denmark

Both countries are in the upper midfield with around 250-300 robots. In Sweden, robots are used particularly in the automotive and metal industries, while Denmark is known for its innovation in collaborative robots.

United States

The US reaches a robot density of approximately 250 robots, which is slightly above the global average. The automotive industry in particular is driving automation. Recently, the country has also been investing in robotics for the logistics and e-commerce industries.

Netherlands, Austria and Taiwan

These countries are also above the global average, with 200-250 robots. The Netherlands is characterized by high automation in agriculture and food processing, while Taiwan specializes in electronics production.

countries below average

France and Spain

With a robot density of around 150-200 robots, these two countries are just below the global average. France is showing slow progress in automation, while Spain is increasingly modernizing its manufacturing, particularly in the automotive industry.

Slovakia, Czech Republic and Belgium/Luxembourg

With figures between 120 and 180 robots per 10,000 employees, these countries have solid but not outstanding figures. Here, SMEs dominate manufacturing, which may explain lower investment in automation.

Finland

With around 100-120 robots per 10,000 employees, Finland brings up the rear among the countries listed. This could be due to lower industrialization and focus on other sectors such as services.

Global perspective

The average robot density worldwide is 162 robots. The red lines in the graphic mark this value and show how far many countries are above or below this average. Countries such as South Korea, Singapore and Germany are many times higher, while others such as Finland and Spain have comparatively low values.

The average robot density in the EU is 219, in North America 197 and Asia 182 robots.

Comparison of the top and bottom performers

The difference between the leader South Korea (approx. 1,000 robots) and the bottom performer Finland (approx. 100 robots) is significant. South Korea has a robot density ten times higher than Finland, reflecting the stark difference in automation intensity. While high-scoring countries like South Korea and Singapore are investing heavily in automation, countries at the bottom of the list show slower adaptation to technological trends.

The numbers illustrate the uneven distribution of robot density worldwide. They reflect both economic priorities and technological development levels. Countries with a high density of robots are increasingly focusing on increasing efficiency and global competitiveness, while countries with a lower density still have potential for further development.

Suitable for: