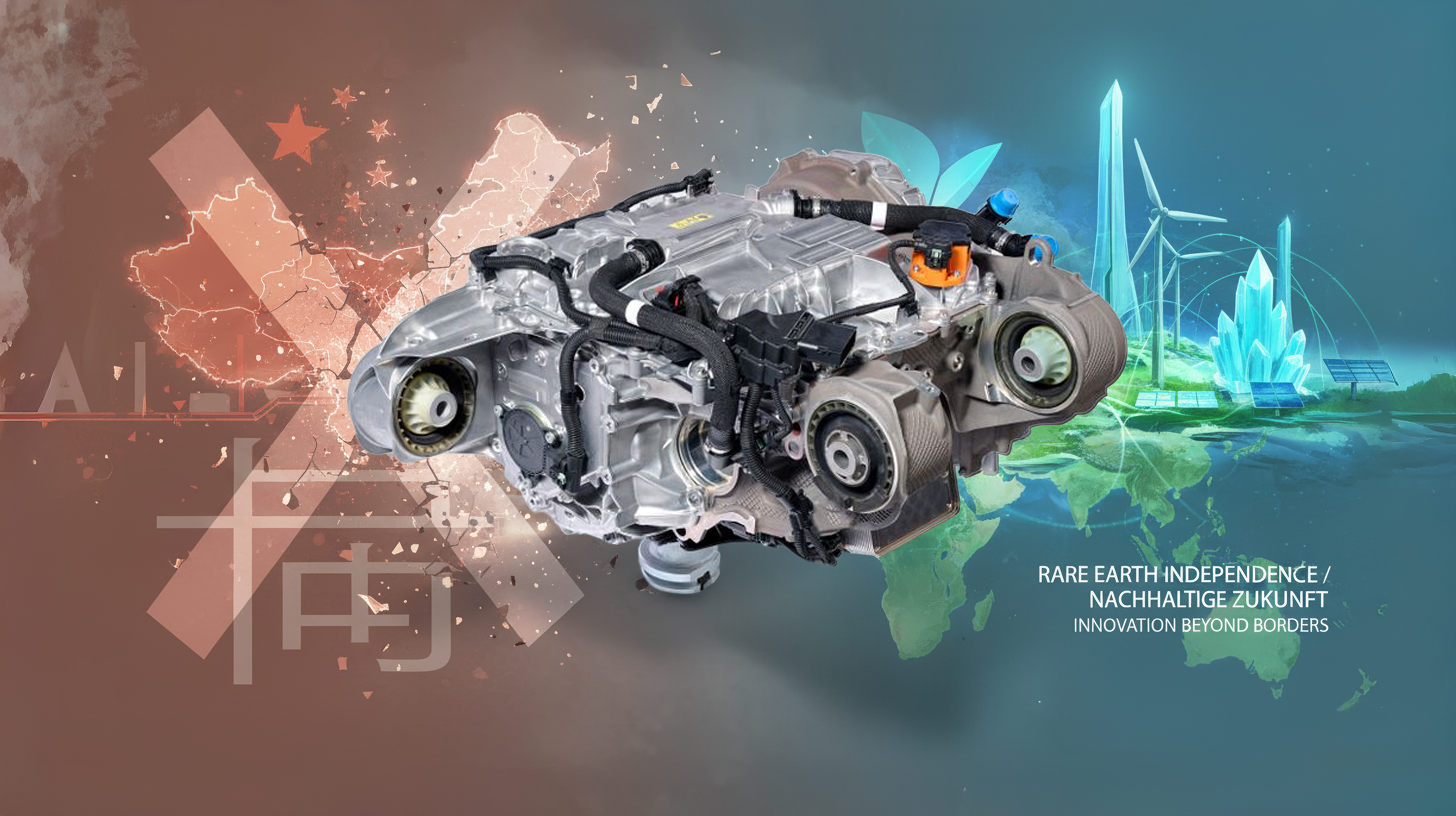

Electric motors without rare earth elements: This German technology finally makes us independent of China – Original image: BMW / Creative image: Xpert.Digital

No more rare earths: How the automotive industry is overcoming its greatest raw material dependency

BMW is already doing it in series production: The ingenious engine trick that is saving the electric car industry

The automotive industry is currently undergoing one of the most significant transformations in its history, but this change reveals a critical vulnerability: the dependence on rare earth elements for electric motors has become a geopolitical risk factor, threatening the entire electrification strategy of Western automakers. What was long considered a technical necessity is increasingly proving to be a surmountable hurdle. BMW is already in series production, Mahle and ZF are approaching market readiness, and even in India, companies are working intensively on developing electric motors that function entirely without these critical raw materials. The question is no longer whether, but when these technologies will achieve a breakthrough.

Chinese dominance as a systemic risk

Global dependence on China for rare earth elements has reached dimensions far exceeding normal market concentrations. China controls approximately 60 percent of global production and 90 percent of the refining of these strategically important raw materials. This dominance is no accident, but rather the result of decades of state-directed investment in mining capacity and processing technologies. While Western countries neglected rare earth mining due to high environmental costs and complex processing methods, Beijing recognized early on the strategic importance of these raw materials for the technologies of the 21st century.

Recent developments clearly demonstrate the fragility of this one-sided dependency. On April 4, 2025, China introduced export controls for seven rare earth elements for the first time, including dysprosium and terbium, which are essential for high-performance magnets in electric motors. On October 9, these controls were massively expanded to include five more elements, as well as technologies for mining, processing, and recycling. As of December 1, 2025, foreign companies even require permits if they wish to export products containing Chinese rare earth elements to third countries.

These measures reveal a new level of economic warfare. China is using its raw material controls not only as leverage against the US, but also as an instrument for controlling entire value chains. The combination of export restrictions on raw materials and technology transfer controls creates a dual dependency that puts European and American automakers in a strategically untenable position. Dysprosium and terbium, the so-called heavy rare earth elements that make magnets more heat-resistant and efficient, are almost entirely produced in China. Deliveries from Myanmar are particularly problematic, as its political instability poses additional supply risks.

The economic impact of these controls manifests itself in dramatic price fluctuations. A kilogram of neodymium, which cost around $65 in 2020, rose to as much as $223 in 2022 before falling back to around $123. An average permanent magnet motor contains approximately 600 grams of neodymium, meaning that the raw material costs for the magnets alone can fluctuate considerably. This volatility makes calculations uncertain and forces manufacturers to add risk premiums, ultimately impairing their competitiveness.

Suitable for:

- Rare earths: China's raw material dominance-with recycling, research and new mines out of raw material dependency?

The technological countermovement is gaining momentum.

The automotive industry's response to this dependence is a technological offensive that is bringing various rare-earth-free motor concepts to series production. BMW is at the forefront with its fifth generation of electric drives, which have been used in the iX3 since 2021 and are now in series production. The decision to use externally excited synchronous motors was made after intensive preliminary development in which all alternatives were examined. The BMW plant in Steyr started series production of the sixth generation for the New Class vehicles in July 2025, with investments of over one billion euros by 2030.

The separately excited synchronous motor generates its magnetic field not through permanent magnets, but through electric current, which is fed into the rotor via maintenance-free slip rings. This technical innovation completely eliminates the dependence on neodymium and dysprosium without any significant loss of performance. With this technology, BMW achieves efficiencies of over 95 percent in the most common driving conditions. The motors are available in various power classes, from 140 to 360 kilowatts, based on two stator diameter variants.

The decisive advantage lies not only in the elimination of critical raw materials, but also in their operational characteristics. Externally excited synchronous motors can be switched off, thus eliminating drag losses during coasting. During long highway journeys at high speeds, they exhibit better efficiency than permanent magnet motors, as no energy is lost through constant magnetic fields. Furthermore, the precise control of the rotor current allows for optimal adaptation to varying load conditions, further increasing efficiency.

Mahle is pursuing an even more radical approach with its magnet-free SCT motor, which operates through inductive and therefore contactless power transmission via a rotating transformer. This technology completely eliminates mechanical wear and achieves outstanding efficiency, especially at high speeds. The motor is equipped with an innovative integrated oil cooling system that dissipates heat precisely where it is generated. Continuous power output exceeds ninety percent of peak power, which is crucial for demanding applications such as electric trucks driving in mountainous terrain or repeated sprints. Mahle plans to bring this technology to series production around 2024.

At the end of 2024, ZF Friedrichshafen received the CLEPA Innovation Award for its in-rotor inductively excited synchronous motor. In this system, the energy for the magnetic field is transferred via an inductive exciter within the rotor shaft, resulting in an exceptionally compact motor with maximum power and torque density. Compared to conventional externally excited systems, the inductive exciter reduces energy transfer losses to the rotor by fifteen percent. The elimination of brush elements or slip rings makes additional seals unnecessary, and the motor requires up to ninety millimeters less axial installation space. The CO2 footprint of manufacturing is reduced by up to fifty percent compared to permanent magnet motors.

Renault, in collaboration with Valeo, is developing a third-generation, 200-kilowatt motor, scheduled for production in 2027. This E7A motor requires no rare earth elements and, with the same power output, is approximately 30 percent more compact than current units. Its rotor technology utilizes wound coils instead of permanent magnets, reducing the CO2 footprint of production by 30 percent. Additionally, the motor is designed for 800-volt systems, significantly shortening battery charging times. The current Renault Megane E-Tech and the new Renault 5 already employ this magnet-free technology.

India's catch-up as a geopolitical factor

Particularly noteworthy is the speed at which Indian companies are developing alternative motor technologies. Sterling Gtake E-Mobility, in its 3,500 square foot laboratory in Faridabad, is working on reluctance motors using technology licensed from Advanced Electric Machines that require no rare earth elements. Seven leading Indian automakers are already testing these motors, and if successfully validated, commercial production could begin within a year, well ahead of the originally planned year of 2029.

The acceleration of this development is a direct reaction to China's export restrictions of April 2025. India, which has ambitious expansion targets for electromobility, considers itself particularly vulnerable, as it has hardly any of its own rare earth processing capacity. Despite having the world's fifth-largest reserves, the country lacks the necessary processing infrastructure. The government is now examining incentives for mining and processing, as well as partnerships with Japanese and South Korean companies.

Simple Energy became the first Indian manufacturer to commercially produce heavy-duty rare-earth-free motors in September 2025. The patented motor architecture, developed entirely by in-house research and development teams, replaces heavy rare-earth magnets with optimized connections and proprietary algorithms for real-time heat and torque control. Production takes place in a 200,000-square-foot facility in Hosur, Tamil Nadu, with a 95 percent localization rate across the entire supply chain.

Chara Technologies, based in Bengaluru, secured $6 million in Series A funding in October 2025 to scale up production of rare-earth-free electric motors from 20,000 to 100,000 units annually. The startup develops switched reluctance and flux motor designs that utilize advanced electromagnetic technology instead of permanent magnets. This success could establish India as a third hub in the global electric vehicle supply chain, beyond China and the West.

British company Advanced Electric Machines (AEM) has secured a seven-figure development partnership with one of the world's largest automotive suppliers, whose annual revenue is in the tens of billions. AEM claims its electric motors will use safe, recyclable, and readily available materials such as steel and aluminum, and will outperform permanent magnet motors in terms of performance. Series production is planned for the end of the decade.

Economic evaluation of the technology alternatives

The economic analysis of the various motor concepts reveals a complex picture of compromises and optimization potential. Permanent magnet synchronous motors achieve the highest power density and efficiency in the mid-speed range, with efficiencies well over ninety percent in most driving conditions. Their compact design enables greater ranges with the same battery capacity, making them the preferred concept for approximately eighty-two percent of all electric vehicles in 2022.

The cost structure of electric motors, averaged across the three main types, is roughly divided into seventy percent material costs, including semi-finished products such as winding wire or permanent magnets, and thirty percent production costs. The six hundred grams of neodymium in an average motor cost between seventy-five and one hundred and fifty dollars, depending on market conditions. Additional costs include dysprosium, which stabilizes the magnets at high temperatures. The value of rare-earth permanent magnets for traction motors is estimated at approximately one thousand two hundred to one thousand six hundred yuan per vehicle.

Externally excited synchronous motors eliminate these raw material costs but require additional power electronics to supply power to the rotor. However, the overall cost calculation is more favorable, as the savings on magnet costs more than compensate for the more complex electronics. Furthermore, the risks associated with price volatility and supply bottlenecks are eliminated. The production processes are largely similar for the various motor types, so no fundamentally new manufacturing infrastructure is required.

Asynchronous motors represent the most cost-effective alternative, as they require neither permanent magnets nor complex rotor power supplies. Their simple design, featuring a squirrel-cage or slip-ring rotor, makes them robust and low-maintenance. Tesla used this technology in early models and continues to use it for all-wheel drive systems in combination with permanent magnet motors. The main disadvantage lies in their lower efficiency, which is particularly noticeable under partial load. For the same power output, asynchronous motors are approximately thirty percent larger than permanent magnet motors, resulting in additional weight and installation space.

The differences in efficiency have a direct impact on range. A permanent magnet motor can achieve efficiencies of 97 percent, while an asynchronous motor achieves 93 percent. This four percentage point difference translates to approximately five percent less range at an energy consumption of 15 kilowatt-hours per 100 kilometers. With a 70-kilowatt-hour battery, this corresponds to roughly 25 kilometers, which is acceptable for many applications.

Externally excited synchronous motors achieve efficiencies exceeding 95 percent, placing them only marginally below permanent magnet motors. In certain operating conditions, particularly during extended highway driving at high speeds, they can even be more efficient, as they do not suffer drag losses due to permanent magnets. The flexible control of the rotor current allows for precise adjustment of the magnetic field to different load conditions, optimizing efficiency across a wide operating range.

Economies of scale and market dynamics up to 2030

The market for electric motors is experiencing dramatic growth. Global sales of electric drive systems are projected to more than double, rising from €272 billion in 2025 to €634 billion in 2030. Of this, €60 percent (€389 billion) will be attributable to battery cells and packaging, while €30 percent (€186 billion) will be attributable to electric drives.

These economies of scale will significantly reduce production costs for all motor types. While manufacturing costs for permanent magnet motors benefit from automation and standardization, raw material costs remain volatile. Externally excited synchronous and asynchronous motors, on the other hand, can fully realize economies of scale because their main cost components are copper, iron, and electronics, whose prices are more stable and supply chains are more diversified.

The regional distribution of battery cell production remains problematic. By 2030, China is expected to control 70 percent of global capacity, South Korea 15 percent, and Europe only 5 percent. This dependency, exacerbated by the raw material shortage, underscores the fact that Europe is losing added value to Asia. Between 500 and 800 euros in battery manufacturing costs per vehicle flow to Asia, which, given the millions of vehicles produced, has significant economic repercussions.

The market share of different motor types will shift. While the share of rare-earth electric motors was still at 82 percent in 2022, it is expected to fall to around 70 percent by 2030. This does not mean the end of permanent magnet motors, but a significant diversification of drive concepts. Alternative technologies will gain market share, particularly in segments where cost efficiency is more important than maximum power density.

Forecasts predict that the global market share of battery-electric vehicles will rise from 15 percent in 2022 to almost 60 percent in 2035. This massive ramp-up will mean an exponential increase in motor demand, further increasing the pressure on alternative technologies. Every percentage point of market share gained by magnet-free motors equates to 600,000 units, based on the approximately 60 million vehicles produced worldwide each year.

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here:

Magnet-free motors: Europe's answer to raw material dependency

Strategic resilience in the supply chain

The automotive industry is increasingly recognizing that supply chain resilience is not just a matter of risk management, but of strategic survival. Twenty raw materials are considered critical for the transformation of the automotive industry, possessing high strategic relevance and a strong dependence on non-European imports. Besides rare earth elements, these include lithium, cobalt, nickel, graphite, and various other metals.

Experts recommend a multi-layered approach to strengthening resilience. First, transparency regarding the supply, demand, prices, and criticality of raw materials is needed through enhanced monitoring. Second, suppliers must be diversified and strategic partnerships established. Third, the circular economy should be intensified through recycling, even if this has a limited short-term impact due to market ramp-up. Fourth, technologies should be developed that substitute or minimize critical raw materials.

The new EU regulation on critical raw materials, adopted in May 2022, sets ambitious targets: by 2030, ten percent of the demand for strategic raw materials should come from European mining. The Per Gejer rare earth deposit in northern Sweden could play a key role in this, with estimated reserves of over one million tons of metal oxides. However, it will take ten to fifteen years for these resources to reach the market, as exploration, permitting, and infrastructure development take time.

Recycling will make a significant contribution to security of supply in the long term. For base metals such as aluminum, nickel, and copper, secondary raw materials already constitute a significant share of production input. However, for twelve of the twenty critical raw materials, the recycling rate is still well below five percent. The new EU Battery Regulation mandates increasing recycling quotas, and hydrometallurgical processes already enable the recovery of lithium, nickel, and cobalt from lithium-ion batteries. The EU project SUSMAGPRO aims to recover magnetic materials from decommissioned electric vehicles and wind turbines.

The development of magnet-free motors is the most elegant solution in this context, as it tackles the problem at its root. Instead of diversifying dependent supply chains or engaging in costly recycling, this technology eliminates dependency entirely. The economic savings are considerable, considering that millions of vehicles are produced annually, each of which would require 600 grams of neodymium as well as other rare earth elements.

Suitable for:

- A commodity trader's warning: How control over rare earths is bringing Europe's industry to its knees

Industrial policy implications for Europe

Europe finds itself in a precarious position between technological transformation and increasing dependence. China's dominance extends across the entire electromobility value chain, from raw materials and battery production to vehicle manufacturing. Without decisive action, a massive loss of industrial value creation and jobs is imminent.

The development of magnet-free motors offers Europe an opportunity for strategic repositioning. Companies like BMW, ZF, Mahle, and Renault possess leading expertise in this technology and can set standards before Asian competitors catch up. Technological leadership in this area could prove to be a decisive competitive advantage, much like German engineering set benchmarks for combustion engines for decades.

Investments in alternative engine technologies are moderate compared to the overall scale of the transformation. BMW is investing over one billion euros in Steyr by 2030, which is manageable given the strategic importance of the plant. ZF and Mahle are investing similar amounts. These investments not only create technological independence but also secure highly skilled jobs in Europe.

The political framework must support this development. Promoting research and development, accelerating approval processes for production facilities, and potentially offering temporary incentives for the use of magnet-free motors could accelerate market ramp-up. The US has already demonstrated with the Defense Production Act how raw material extraction can be integrated with security policy. Europe must develop similar instruments instead of relying solely on regulation.

Standardization and interoperability of different engine types is another important aspect. If vehicle platforms can flexibly switch between different drive concepts, this increases manufacturers' resilience. BMW is already demonstrating this with its technological openness, producing both combustion engines and various electric drives in parallel. This flexibility makes it possible to react quickly to market changes and supply bottlenecks.

Global competitive dynamics are intensifying.

The battle for technological leadership in electromobility is intensifying. China is attempting to cement its dominance through vertical integration across the entire value chain. Export controls on rare earth elements and related technologies are part of this strategy. At the same time, China is investing heavily in its own electric vehicle production, with Chinese manufacturers such as BYD, SAIC, and Geely rapidly gaining market share in Europe as well.

The US is responding with a combination of investment incentives, import restrictions, and strategic partnerships. The Inflation Reduction Act is providing hundreds of billions of dollars for green technologies, while simultaneously making Chinese products more expensive through tariffs. Donald Trump threatened tariffs of up to 200 percent if China did not reliably supply magnets made from rare earths. While this aggressive policy creates short-term pressure, it does not solve the structural problem of dependency.

Recent developments indicate a temporary easing of tensions: Following the meeting between President Xi Jinping and Donald Trump in Busan in October 2025, China announced it would suspend its tightened export controls for one year. In return, the US lifted some sanctions against Chinese companies. However, this tactical respite does not change the fundamental vulnerability of Western supply chains.

India is increasingly positioning itself as a third force in this competition. With its ambitious climate goals, aiming for carbon neutrality by 2070, and a rapidly growing automotive market, the country offers enormous potential. Focusing on magnet-free motors could give India a competitive advantage, as it avoids the mistakes of earlier dependencies. The Make in India initiative supports this strategy through localization requirements and investment incentives.

Japan and South Korea also play important roles, particularly in battery production. Companies like LG Energy Solutions, Samsung SDI, and Panasonic control significant portions of global battery cell production. Their expertise in power electronics and materials science makes them valuable partners for European automakers seeking to diversify their supply chains.

Technological limits and innovation potential

The development of magnet-free motors is not at the end, but at the beginning of its optimization cycle. While permanent magnet motors have been continuously improved for decades, alternative concepts are still in relatively early stages of development. This means significant potential for improvement in efficiency, power density, and cost.

A promising approach involves ferrite magnets, which are based on iron instead of rare earth elements. Although their magnetic field strength is about fifty to seventy percent lower than that of neodymium magnets of the same size, clever motor designs can compensate for much of this difference. The Japanese company Proterial developed a drive that achieves the same power density with only twenty percent more magnetic material. Combined with high-speed concepts, such as those implemented by Tesla in its Plaid motor with speeds of up to twenty thousand revolutions per minute, ferrite motors could become competitive.

The digitalization of development processes significantly accelerates innovation. Mahle uses evolutionary algorithms to simulate various motor designs, enabling the identification of optimal configurations much faster than with conventional methods. These automated processes can not only modify the geometric parameters of electrical steel sheets but also optimize winding patterns and materials. The time savings compared to traditional development methods range from several months to years.

The integration of motor, transmission, and power electronics into highly integrated e-axles offers further optimization potential. BMW demonstrates this with its modular system, which, through minimized flange surfaces, integrated media routing, and simplified assembly, reduces both potential sources of error and lowers costs. The combination of 800-volt technology with silicon carbide power electronics further increases efficiency and shortens charging times.

Advances in materials science for winding wires, electrical steel sheets, and insulation systems are continuously improving performance. BorgWarner's patented hairpin winding technology, for example, enables higher copper density in the stator, which increases power and efficiency. Similar innovations in other components add up to significant overall improvements.

Economic assessment of transformation costs

The economic costs of dependence on rare earths are difficult to quantify, but considerable. In addition to the direct raw material costs and their volatility, strategic opportunity costs arise when companies have to postpone investment decisions due to uncertain supply chains or factor in risk premiums. The production losses caused by Chinese export restrictions in mid-2025 illustrate this vulnerability.

Investments in alternative technologies, on the other hand, are comparatively moderate and pay for themselves quickly. One billion euros for BMW's Steyr plant seems high, but is put into perspective by its strategic importance and production volume. With an annual capacity of several hundred thousand engines and cost savings of one to two hundred euros per unit due to the elimination of magnets, the payback period is just a few years.

The macroeconomic effects of a successful technology substitution would be considerable. If all electric vehicles produced in Europe were equipped with magnet-free motors, raw material imports worth several hundred million euros would be eliminated annually. Even more important would be the strategic autonomy and independence from geopolitical upheavals. Securing industrial value creation and highly skilled jobs justifies public funding for these technologies.

The employment effects are mixed. On the one hand, jobs are being lost in combustion engine manufacturing, while on the other hand, new ones are being created in electric motor production. BMW plans to employ around 1,000 people in electric motor assembly at its Steyr plant in the future. Depending on global demand trends, half of the entire workforce could be working in e-mobility by 2030. The company's technological openness, allowing it to produce different drive concepts in parallel, secures long-term employment.

Sustainability aspects beyond raw material dependency

The environmental impact of magnet-free motors extends beyond simply avoiding problematic raw materials. The mining of rare earth elements causes significant environmental damage through the use of large quantities of chemicals that pollute soils and waterways. Processing these materials is energy-intensive and generates toxic waste. Even if technological improvements can reduce the environmental impact, the ecological footprint remains significant.

Externally excited synchronous motors and asynchronous motors consist primarily of copper, iron, aluminum, and electronic components. While these materials are not without their problems, their extraction is well-established, less environmentally damaging, and better regulated. Above all, they are significantly easier to recycle. Whereas permanent magnets require complex separation processes, copper and iron can be recovered through conventional scrap recycling methods.

The CO2 footprint in manufacturing decreases by up to fifty percent for magnet-free motors, as ZF demonstrates for its I2SM motor. Renault quantifies the reduction for its E7A motor at thirty percent. These savings result not only from the elimination of magnets but also from simplified supply chains, since less complex components need to be transported over long distances.

The overall environmental impact of an electric vehicle depends significantly on battery production and the source of the electricity. The drive system accounts for only one part of the environmental impact. Nevertheless, every contribution to improvement is relevant, especially if it can be achieved without compromising performance. The longer lifespan and better recyclability of magnet-free motors further support this technology.

Magnet-free electric motors: Europe's chance for technological leadership

The development of magnet-free electric motors is at a turning point. The technology is mature enough for mass production, as BMW has demonstrated, while at the same time considerable optimization potential still exists. The geopolitical turmoil surrounding rare earth elements creates a strong incentive for manufacturers to switch to alternative concepts. Economic arguments increasingly favor magnet-free solutions, as economies of scale amplify the cost advantages.

For the European automotive industry, the message is clear: technological leadership in magnet-free motors is a strategic necessity, not an option. Investments are manageable, but the risks are immense if dependence continues. Governments should support this development through research funding, accelerated approvals, and potentially temporary market incentives.

Diversifying motor portfolios is crucial. Not every application requires maximum power density; often, asynchronous or separately excited synchronous motors are perfectly adequate. Intelligent segmentation based on requirement profiles optimizes the overall package of costs, performance, and strategic resilience.

The standardization of interfaces and platforms facilitates the flexible use of different motor types. This gives manufacturers greater flexibility and allows them to react quickly to market changes. The modularity of modern e-axles already supports this approach, but should be further developed consistently.

Internationally, cooperation with reliable partners is essential. Japan, South Korea, and India offer potential for technology partnerships and supply chain integration beyond Chinese dominance. Establishing a multipolar world order for critical technologies increases stability and reduces vulnerability to blackmail.

The circular economy must be promoted in parallel. Even if magnet-free motors reduce dependence, other critical raw materials such as lithium and cobalt remain relevant. Recycling technologies and urban mining concepts can contribute significantly to security of supply in the medium term. The regulatory framework provided by the EU Battery Directive already points in the right direction.

The automotive industry is facing perhaps its greatest transformation since the invention of the automobile. Electrification is inevitable, but the way this transformation is shaped remains malleable. Magnetless electric motors are more than just a technical alternative. They represent an opportunity to regain strategic autonomy and secure industrial value creation in Europe. The breakthrough is closer than many think. BMW is already producing them, and others will soon follow. The question is no longer whether, but how quickly this technology will become the new norm. China may control rare earth elements today, but Europe can set the standards for mobility without them tomorrow.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

Our global industry and economic expertise in business development, sales and marketing

Our global industry and business expertise in business development, sales and marketing - Image: Xpert.Digital

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations