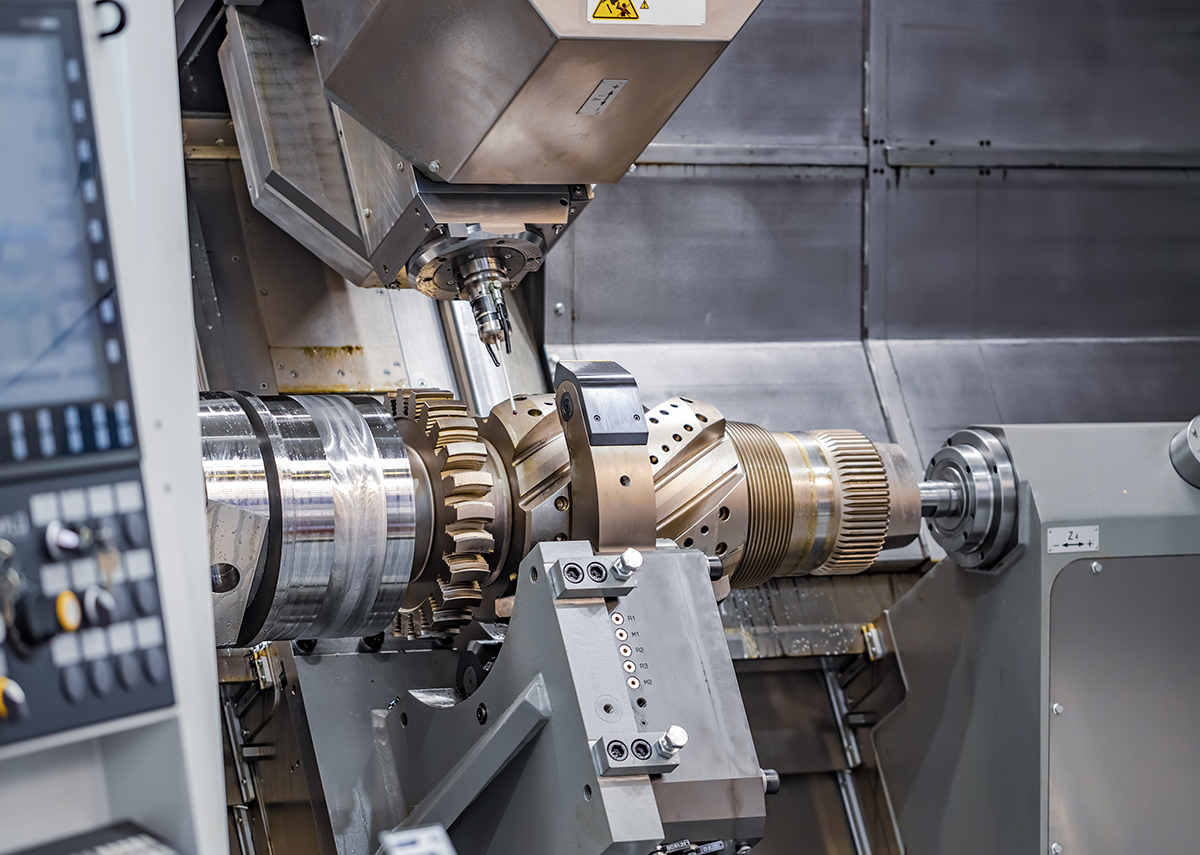

Mechanical engineering, the economic engine, is sputtering alarmingly! – Image: Andrey Armyagov|Shutterstock.com

Mechanical engineering, the economic engine, is sputtering alarmingly!

The German market for mechanical and plant engineering has developed very positively in recent years. According to some experts, this growth can be expected to continue in the coming year. However, there has been a slump in incoming orders in recent months. However, experts believe that this decline is only temporary and that the market will stabilize again in the coming months.

For others, however, the slump in incoming orders among German mechanical and plant manufacturers is worrying. The order books are more empty than they have been since the financial crisis. The Ifo business climate index for the manufacturing sector fell in August to a record low of 84.3 points this year. For comparison: the index value of 75.5 points in April 2020 was the lowest value ever measured.

German mechanical engineering companies expect production to shrink in the coming year. This year, production growth of one percent is still possible, according to the industry association VDMA.

According to a forecast by VDMA chief economist Ralph Wiechers, the global economy will shrink by two percent in 2023. "The wind blows the global economy and thus the mechanical and plant engineering in the face."

Due to less strong growth prospects in China and the ongoing war in Ukraine, the investment industry expects a more cautious attitude from investors. In addition, high inflation and interest rate increases with which central banks are trying to slow down growth are contributing to depressing investment sentiment.

Just try out our universally applicable (B2B/Business/Industrial) Metaverse configurator for all CAD / 3D demo options:

Development of real order intake in mechanical and plant engineering 2021-2022

Development of real order intake in mechanical and plant engineering in Germany from July 2021 to July 2022 - Image: Xpert.Digital

The statistics show the development of real incoming orders in mechanical and plant engineering in Germany from July 2021 to July 2022. In July 2022, incoming orders in German mechanical and plant engineering were 14 percentage points lower in real terms than in the same month of the previous year.

The values were compiled from the association's regular press releases on incoming orders in German mechanical and plant engineering.

Development of the ifo business climate index 2021-2022

Development of the ifo business climate index from September 2021 to September 2022 - Image: Xpert.Digital

The ifo business climate index was 84.3 points in September 2022. Compared to the previous month, the business climate fell by 4.3 points. According to the Ifo Institute, the mood within the German economy has deteriorated significantly. According to the Ifo Institute, the reason for the decline in recent months was the war in Ukraine and the growing uncertainty in the energy sector due to high energy prices and the threat of a gas shortage.

The index value of 75.5 points in April 2020 was the lowest value ever measured. This was due to the outbreak of the corona pandemic.

What is the ifo business climate?

The IFO business climate is an indicator of the economic development in Germany. This is based on approximately 9,000 monthly reports from companies in the processing trade, the main building industry, wholesale and retail and the service sector. The companies are asked to assess their current business situation and to inform their expectations for the next six months. You can mark your location with “good”, “satisfactory” or “bad” and your business expectations for the next six months as “cheaper”, “constant” or “unfavorable”. The balance of the current business situation is the difference of the percentages of the answers “good” and “bad”, the balance value of the expectations is the difference of percentages of the answers “cheaper” and “unfavorable”. The business climate is a transformed mean from the balances of the business situation and expectations. To calculate the index values, the transformed balances are standardized to the average of 2015.

Other economic indicators

Economic indicators measure the economic development of a country or an economic region. They are usually collected at short intervals, usually monthly or quarterly. Their results receive a lot of attention in the media and on the stock markets. The indicators can be differentiated into leading indicators that predict the future situation (e.g. business climate indices), presence indicators that reflect the current situation (e.g. changes in industrial production) and lagging indicators that track economic developments with a delay (e.g. unemployment figures). In addition, a distinction can be made between real economic indicators such as gross domestic product and results from surveys of companies, consumers or economic experts. These are usually weighted and indexed according to different criteria in order to be able to make comparisons between different points in time.

Balances of the ifo business climate for the construction industry 2021-2022

Balances of the ifo business climate for the main construction industry from August 2021 to August 2022 - Image: Xpert.Digital

The statistics show the monthly values of the ifo business climate for the construction industry in Germany from August 2021 to August 2022. In August 2022 the balance value was -14.5 points.

Mechanical and plant engineering in Germany

On the international market, Germany is one of the most important mechanical engineering countries. Only China and the USA recently generated higher sales in the industry. After a decline during the financial crisis of 2008/2009, sales in German mechanical engineering have steadily increased again - most recently around 229 billion euros were generated.

Within mechanical engineering, the machine tools, drive technology and conveyor sectors are the most important in terms of annual sales.

With regard to developments in international trade, the mechanical engineering industry is strongly export-oriented. The export quota in Germany has ranged between 74 and 80 percent in recent years. The most important countries for German machine exports include the USA, China and France

Mechanical and plant engineering in Germany is one of the highest-turnover and most innovative sectors. The industry's sales have consistently exceeded 200 billion euros since 2011. Over a million people are employed in German mechanical engineering. The export value of German mechanical engineering products is far higher than the import value. Germany's most important export countries include the USA, China, France and Italy.

Mechanical engineering is changing. Digital transformation, IoT, Industry 4.0 and AI towards smart factories are changing our image of gear-driven and oil-smeared mechanical engineering.

More about it here:

That's why Xpert.Plus for advice on Industry 4.0 and IoT in the area of funding - mechanical engineering/plant engineering

Xpert.Plus is a project from Xpert.Digital. We have many years of experience in supporting and advising on storage solutions and in logistics optimization, which we bundle in a large network Xpert.Plus

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital – Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital – www.xpert.solar – www.xpert.plus