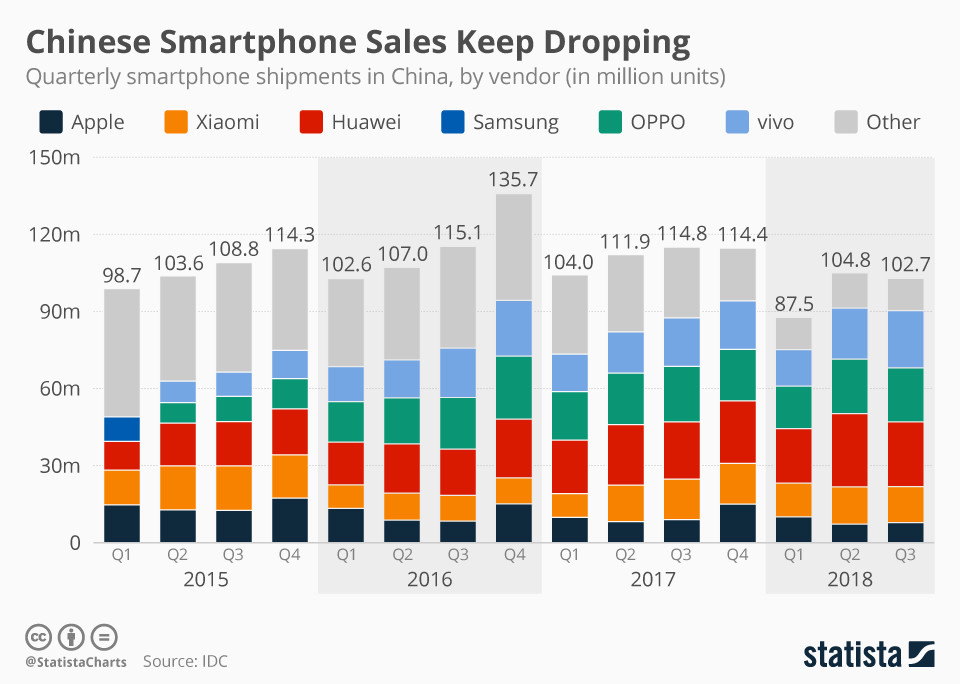

The Chinese smartphone market, once a goldmine for investors and technology companies, has recently lost its appeal. The market has experienced five consecutive quarters of year-on-year decline in volume and is expected to lose further ground in the final quarter of 2018, for which figures are not yet available.

Apple, the maker of the iPhone, is feeling the effects of the sluggish Chinese market, as are domestic companies. Among the major players, only smartphone manufacturer Vivo was able to increase its sales figures in 2018.

Longer replacement cycles and weak consumer spending are reasons why smartphone manufacturers are unable to sell more phones to Chinese consumers, according to the analytics firm Strategy Analytics. The trade war with the United States also did not help Chinese technology companies.

Analysts at IDC expect the Chinese and global smartphone markets to flatten out during 2019 and then pick up again by 2022. They cite the launch of several high-end devices, which they expect will prompt consumers to upgrade from existing phones. Foldable phones and 5G networks are also expected to encourage Chinese consumers to once again pay for smartphones.

The Chinese smartphone market, once an El Dorado for investors and tech companies, has lost some of its appeal recently. The market has been decreasing in volume for five consecutive quarters (year-on-year) and is expected to lose more ground in the final quarter of 2018, for which numbers have yet to be released.

Maker of the iPhone, Apple, has been feeling the effects of the sluggish Chinese market, but so have domestic companies. Among the major players, only smartphone maker Vivo has been able to increase on its track record in 2018.

Longer replacement cycles and weak consumer spending are reasons why smartphone makers can't sell more phones to Chinese consumers, according to analytics firm Strategy Analytics. The trade war with the United States didn't help Chinese tech companies either.

Analyst IDC is expecting the Chinese and global smartphone markets to flatten out during 2019 and pick back up by 2022. They cite the launches of several high-end devices that are expected to have consumers willing to upgrade from existing phones. Foldables and 5G networks are also expected to make Chinese consumers willing to spend on smartphones again.