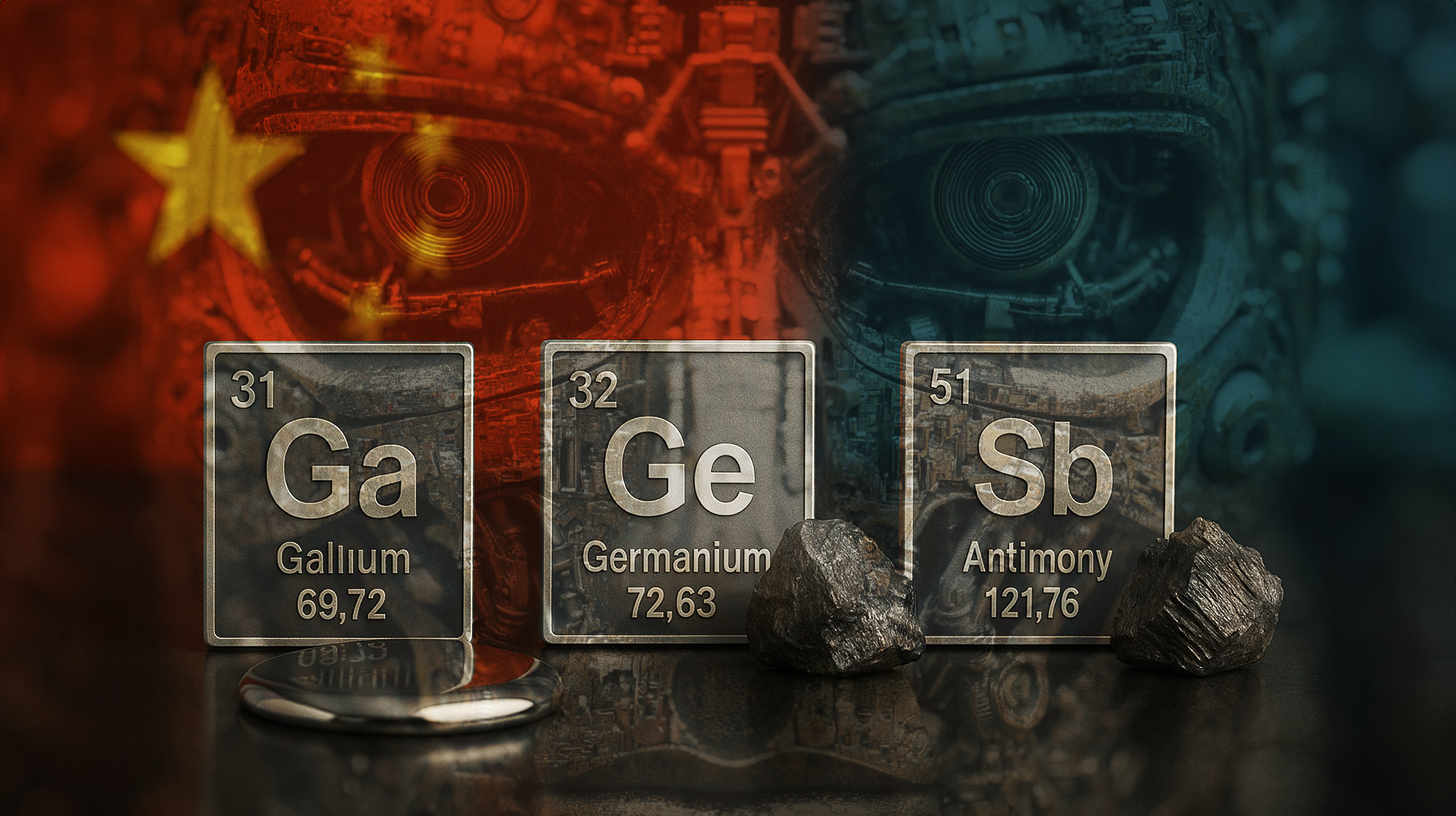

Gallium, Germanium & Antimony: Why China's surprising release of critical metals is a relief to the tech world – Image: Xpert.Digital

After the Trump-Xi summit: The end of the raw materials blockade is here, but only temporarily.

More than just a trade dispute: How China controls the global tech industry with three metals

Which raw materials has China released and why is this significant?

China has temporarily lifted export restrictions on three strategically essential metals: gallium, antimony, and germanium. This decision is significant because these raw materials are indispensable for modern semiconductor production. Without these metals, Western technology companies cannot manufacture their chips and electronic components. The measure primarily affects the US, as China's move demonstrates its willingness to deviate, at least temporarily, from its aggressive raw materials policy. This represents a crucial turning point in a trade war that has been escalating for years.

Suitable for:

- China's germanium embargo and the consequences for Germany's industry: Price explosion by 165% – This metal is becoming a nightmare

What are the exact functions of these three metals in the semiconductor and technology industries?

Gallium is a critical element used in high-frequency chips and light-emitting diodes, or LEDs. These applications are fundamental to telecommunications, defense technology, and the modern lighting industry. Gallium arsenide semiconductors enable high-frequency applications that are not possible with silicon alone. They are found in cell phone towers, radar systems, and satellite components.

Germanium plays a different role: it is used in fiber optic cables and infrared sensors. Germanium diodes and germanium infrared sensors are essential for telecommunications networks and for military thermal imaging and night vision technologies. Without germanium, advanced infrared sensor applications cannot be realized, which would have significant consequences for the defense industry.

Antimony is used in batteries and flame retardants. In the battery and energy storage industry, antimony plays a crucial role in improving the performance characteristics and safety of energy storage devices. In flame retardants, antimony contributes to the fire safety of electronic devices, from smartphones to electric vehicles.

These three metals form the backbone of modern electronics and cannot simply be replaced by other materials. A blockade of these raw materials would indeed bring Western technology production to a standstill.

Critical metals are raw materials indispensable in industry and high-tech sectors, and their supply is considered risky because they are mostly sourced from a few countries, cannot be easily replaced, and demand is rising sharply. The EU currently classifies around 30 metals as critical, including gallium, germanium, and antimony. Rare earth elements, on the other hand, are a clearly defined group of 17 elements upon which modern technologies such as electric motors and wind turbines depend. While they are common in the Earth's crust, they are rarely found in sufficiently high concentrations, and 90% of them are processed in China. While "critical" is a strategic assessment, science defines the rare earth group precisely according to the periodic table.

What is the time period during which the lifting of export restrictions is valid?

The agreement whereby China lifts export restrictions is temporary, valid until the end of November 2026. This means the lifting of restrictions has a duration of approximately 13 months. This deliberately limited timeframe was chosen strategically. It provides Western companies, particularly American chip manufacturers, with a degree of planning certainty without China permanently relinquishing its control over these raw materials.

The time limit sends two messages simultaneously: On the one hand, China demonstrates its willingness to de-escalate; on the other hand, the country reserves the right to reactivate the restrictions at any time should the political situation worsen. This is a classic tactical maneuver in trade disputes.

What role did the meeting between Trump and Xi Jinping in October 2025 play?

The summit between US President Donald Trump and Chinese President Xi Jinping in South Korea at the end of October 2025 was the immediate trigger for this change of course. At this meeting, the two leaders agreed to cap reciprocal tariffs at ten percent for the next twelve months. This agreement represents a truce that allows both sides to reconsider their positions and negotiate.

The culmination of this policy of détente was China's swift suspension of the tariffs that had only been imposed on October 9, 2025. This suggests that the meeting between Trump and Xi represented a genuine turning point. The rapid implementation of the agreement demonstrates that both sides are genuinely interested in de-escalation, at least for the time being.

What developments led to this situation and what tensions existed beforehand?

The current situation is the result of a gradual escalation that began as early as 2024. In 2024, China initially imposed selective export bans against the US. These measures were designed in response to American tariff increases on Chinese goods. The US aimed to protect its domestic semiconductor industry and slow China's technological catch-up.

In the spring of 2025, Beijing significantly escalated its actions. In addition to gallium, antimony, and germanium, China blocked exports of tungsten and seven rare earth elements. This was a massive escalation. With this action, China demonstrated its willingness to put pressure on the Western semiconductor industry by deliberately depriving it of critical raw materials.

This development caused extreme concern in Washington and other Western capitals. The prospect of the US being unable to maintain its chip production was a national security nightmare. This underscored the need for a negotiated solution.

What is China's global market position in these raw materials?

China's monopoly is truly impressive. The People's Republic controls approximately 80 percent of the world's rare earth metal production. For specialized metals like gallium, the Chinese share is even higher, sometimes exceeding 90 percent of global capacity. This makes China the absolute gatekeeper for these critical materials.

This monopoly did not arise by chance. For decades, China has strategically invested in the exploration, extraction, and processing of these raw materials. While Western countries have often outsourced mining and refining activities to China for cost reasons or due to environmental concerns, the People's Republic has systematically built up its capacities.

Western alternatives are marginal. Other producing countries exist, but without substantial exploration and development investments, they cannot quickly reach significant production volumes. Doubling non-Chinese capacity would take years and require substantial capital investment. This means that the US and its allies will remain technologically dependent on Chinese raw materials for the foreseeable future.

How does this dependency affect the strategic position of the USA?

The US's dependence on Chinese raw materials for semiconductor production is a significant strategic problem. The US cannot simply increase its chip production if China cuts off the supply of raw materials. This means that the US holds a weak hand in a trade war.

This also explains why the Trump administration and the previous Biden administration were willing to negotiate a tariff reduction. The long-term ability of the US to maintain its technology and defense industries depends on an uninterrupted semiconductor production. Without chips, there are no modern weapons, no telecommunications, and no computer systems.

The US has attempted to reduce this dependence through the CHIPS Act and other measures. The goal is to bring semiconductor production back to the country. However, building a completely self-sufficient semiconductor industry with its own raw material sources takes time and is expensive.

What does this supply chain dynamic mean for European countries?

European countries are even more dependent on Chinese raw materials than the US. While the US is at least trying to strengthen its semiconductor industry, many European countries have neglected their chip manufacturing for years. Germany once had a strong chip industry, but it has shrunk over decades. Belgium still has significant chip manufacturing capacity, but even this is insufficient to meet European demands.

The dependence on China for gallium, antimony, and germanium means that European technology companies are also vulnerable. A Chinese export ban would affect European firms just as much as American ones. This has led the EU to also work on diversification measures and try to strengthen its own semiconductor capacities.

What other raw materials and export restrictions did China lift at the same time?

In addition to lifting the bans on gallium, antimony, and germanium, China also eased further export restrictions over the same weekend. These restrictions affect certain rare earth metals, lithium battery materials, and superhard materials such as tungsten and certain alloys.

This broader lifting of the ban demonstrates that China is pursuing a comprehensive de-escalation strategy, not just a minimal concession. The lifting of the ban on lithium battery materials is particularly significant, as lithium is essential for the global energy transition. Electric vehicles, energy storage systems, and portable devices all rely on lithium. A Chinese blockade of lithium resources would significantly slow the global shift to renewable energy and electric mobility.

These extended suspensions also have the same time limit as the gallium, antimony and germanium regulations: until November 10, 2026.

How does China's strategy of resource restrictions function as a political tool?

China uses its monopoly on raw materials as leverage in trade negotiations and geopolitical conflicts. The strategy operates in several stages. First, China signals through rhetorical threats that it might be prepared to restrict exports. This creates concern in Western markets.

In the second phase, China does indeed introduce restrictions, initially selectively and with prior announcements to increase pressure. This forces Western governments and companies to negotiate. Uncertainty about the availability of critical raw materials leads to price volatility and economic disruption.

In the third phase, China can then offer negotiations and use the lifting of restrictions as a concession. The other side must then make concessions, whether in customs negotiations, on the recognition of Taiwan's status, or on other strategic issues.

This strategy is effective because it is based on genuine dependencies. Without Chinese raw materials, Western countries simply cannot maintain their technology industries. This makes China an indispensable partner, even if one dislikes it.

What are the potential effects of this measure on Western chip companies?

The lifting of export restrictions gives Western chip companies some breathing room. Companies like Intel, Qualcomm, and many others can once again rely on stable sources of raw materials. This allows them to plan their production and stabilize their supply chains.

However, this relief is only temporary. With the restrictions limited until November 2026, chip companies know they have an expiration date. This will likely lead to increased stockpiles of gallium, antimony, and germanium. Companies will buy and store these raw materials to protect themselves against a possible renewed blockade. This could lead to temporary price increases.

In the long term, chip companies will intensify their efforts to diversify raw material sources. They will invest in non-Chinese mining companies and fund research into alternative materials. This is a rational response to geopolitical risk.

What are the long-term implications of this development for the global semiconductor industry?

The current situation paints a picture of the fragility of the global semiconductor industry. This industry is critical to all modern technologies and military capabilities, but it is not resilient to raw material blockades from a single country.

This will lead to structural changes in the long term. First, Western countries will try to decentralize their semiconductor production and reduce their reliance on Chinese influence. Second, they will diversify their raw material sources. Third, they will invest in materials science to become less dependent on certain critical raw materials.

These adjustments take time. For the next five to ten years, the Western semiconductor industry will likely remain vulnerable to Chinese commodity blockades. This is a reality that Western strategists must address.

What are the political and economic implications of the contract being limited until November 2026?

The time limit is calculated and strategically intended. It gives Western companies and governments enough time to adapt, but not enough time to completely overcome Chinese dependence. During these 13 months, Western countries must decide how they want to shape their long-term raw materials strategy.

For China, the time limit means it retains control over these raw materials and can use them again as leverage at any time. If negotiations with the US do not lead to a lasting solution by November 2026, China can reinstate the restrictions. This is a key element of China's negotiating strategy.

The time limit also signals that the Trump-Xi meeting did not lead to a comprehensive solution to the trade conflict. It is a temporary truce, not a lasting peace. This is typical of modern trade conflicts, which unfold in cycles of escalation and de-escalation.

What might further rounds of negotiations look like, and what topics are likely to be discussed?

The next 13 months, until November 2026, will be crucial. Both sides will try to improve their position. For the US, this will mean further reducing tariffs and preserving investment in US industries. For China, it will mean maintaining the status quo in technology exports and accelerating its military catch-up process.

Negotiations on several issues will likely take place simultaneously. In addition to raw material exports, topics such as technology transfer, investments by Chinese companies in the US, the treatment of Uyghurs, and other human rights issues will be on the agenda. It is unlikely that all sides will reach an agreement quickly.

A likely scenario is a series of mini-agreements and mutual concessions. This could lead to extended ceasefires, but not to fundamental solutions to the underlying conflicts of interest.

Our global industry and economic expertise in business development, sales and marketing

Our global industry and business expertise in business development, sales and marketing - Image: Xpert.Digital

Industry focus: B2B, digitalization (from AI to XR), mechanical engineering, logistics, renewable energies and industry

More about it here:

A topic hub with insights and expertise:

- Knowledge platform on the global and regional economy, innovation and industry-specific trends

- Collection of analyses, impulses and background information from our focus areas

- A place for expertise and information on current developments in business and technology

- Topic hub for companies that want to learn about markets, digitalization and industry innovations

Strategic raw materials: How the EU wants to secure supply chains and autonomy

What are the risks of further escalation in this trade war?

Despite the current de-escalation, significant risks of escalation remain. First, a new geopolitical conflict, for example over Taiwan or in the South China Sea, could immediately lead to renewed resource blockades. Second, domestic political changes in the US or China could trigger new protectionist policies. Third, a technological breakthrough in China or the US could reignite the trade war.

The Taiwan issue is particularly critical. If military confrontations were to erupt between China and the US over Taiwan, China would immediately halt all raw material exports. This would trigger a crisis in the Western semiconductor industry. Under these circumstances, Western countries would have to quickly activate alternative strategies.

Another risk lies in domestic political changes. If Trump is not re-elected in 2026, or if the balance of power in China shifts, new administrations could revert to more aggressive trade policies. The current de-escalation could quickly collapse.

Suitable for:

- Antimony, a semi-metal – China's new super-weapon: This unknown metal is putting the USA in a tight spot.

How do other countries and regions position themselves in this conflict?

The European Union is observing the conflict with great concern. On the one hand, Europe does not want to be caught between the US and China. On the other hand, Europe is also dependent on Chinese raw materials. This leads to a diplomatically delicate situation for European countries.

Countries like Germany, Belgium, and the Netherlands have strong chip industries but lack independent sources of raw materials. This makes them vulnerable to Chinese resource blockades. In the long run, European countries will try to develop or diversify their own raw material sources.

Japan and South Korea, both major chip manufacturers, find themselves in similar situations. They are also dependent on Chinese raw materials, but are also close allies of the US. This complicates their positions. They must maintain their trade relations with China while simultaneously not wanting to abandon their alliance with the US.

Taiwan is in a particularly critical position. As the world's leading semiconductor manufacturer, Taiwan is entirely dependent on raw material imports. Whether Taiwan receives raw materials from China, elsewhere, or from the USA is a critical question for Taiwanese industry and the economy.

What is the historical significance of China's raw material monopoly in the global economy?

China's monopoly on rare earth metals and other critical raw materials is a relatively recent development in economic history. In the 1990s and early 2000s, raw material sources were still geographically diversified. But over the years, China has systematically built up its capacity.

This is partly the result of natural resources. China has large deposits of rare earth metals, gallium, germanium, and other critical raw materials within its borders. But it is also the result of targeted government policy and industrial strategy.

While Western countries outsourced or shut down their mining and refining industries, China invested heavily in these sectors. This was part of China's long-term strategy to build economic power and create Western dependence on Chinese raw materials. Now that China has achieved this monopoly, it can use it as a geopolitical tool.

This development represents a turning point in the global economy. For the first time in decades, non-Western countries have gained control over critical technological raw materials. This fundamentally alters the balance of power in the global economy and geopolitics.

What strategies could Western countries pursue to reduce their dependence?

There are several strategies that Western countries could pursue. The first strategy is the diversification of raw material sources. This means developing and supporting alternative producing countries. Countries like Australia, Canada, Brazil, and others have deposits of rare earth metals and other critical raw materials. With investment and technical assistance, these countries could expand their production.

The second strategy is recycling and material efficiency. Many critical raw materials are used in electronics, which are later disposed of. Improved recycling could allow Western countries to reduce their dependence on virgin ore. Developing more material-efficient technologies could also lower demand.

The third strategy is the creation of strategic stockpiles. If Western countries and companies stockpile critical raw materials, they can weather short-term blockades. This is an expensive strategy, but one that reduces risks.

The fourth strategy is research into alternative materials. If scientists and engineers develop alternatives to gallium, germanium, and antimony, this would reduce dependence. This is a long-term project that could take years, but it could offer a solution in the long run.

The fifth strategy is the decentralization of chip production. If Western countries build their own chip manufacturing capacities, they will need to import less from China. This is an expensive program, as the CHIPS Act in the US demonstrates, but it could reduce dependence in the long run.

What differences exist between the raw materials in terms of their criticality and their applications?

Although all three raw materials are critical, they differ in their functions and criticality. Gallium is probably the most critical of the three because it is used in high-frequency chips and LEDs, which are essential in many modern technologies. A shortage of gallium would severely impact the telecommunications and defense industries.

Germanium is less widely used, but critical in its application areas. Infrared sensors and fiber optic cables are important, but there are potentially more alternatives than with gallium. However, it is difficult to completely replace germanium without accepting performance losses.

Antimony may have the most diverse applications, but it is not absolutely essential in any single one. Alternative flame retardants exist, and alternative battery chemistries are being researched. This makes antimony somewhat less critical than gallium and germanium, but it remains an important raw material.

These differences mean that Western countries should tailor their diversification strategies to the criticality level of the raw material. For gallium, the focus should be on rapid alternatives and diversified sources. For antimony, long-term research projects in materials science could be prioritized.

How has resource geopolitics developed over the last few decades?

In the 1990s and 2000s, commodity geopolitics was less of a concern. Commodities were traded relatively freely, and most Western countries were not dependent on any single nation. This changed with China's rise as a global superpower and its focus on resource control.

With China's admission to the World Trade Organization in 2001, it was expected that China would open its markets and adhere to liberal trade practices. Instead, China has systematically expanded its influence over critical commodities and used them as leverage.

This is part of a larger pattern in which China uses traditional Western institutions and norms to strengthen its position without adhering to Western rules. China imports Western technology but stifles its own innovation from Western companies. China uses global trade rules to its advantage but does not allow foreign investment under the same conditions.

Current resource geopolitics is the result of this asymmetric development. Western countries must understand that they are in a new era in which resource dependence is a genuine geopolitical tool.

What could this repeal mean for the future of protectionism?

This repeal could be interpreted as a turning point in global protectionism. After years of increasing tariffs and trade conflicts, the repeal signals that it is possible to reach an agreement. This could be seen as the beginning of a decline in protectionism.

However, the current suspension is likely more of a tactical shift than a fundamental change. Both sides have recognized that another trade war would be economically damaging for both. This leads to a temporary de-escalation, but not to a new, open trade policy.

A more likely scenario is one in which protectionism persists in a modern form. Instead of direct tariffs, countries will probably use technical standards, safety regulations, and environmental protection measures to protect their markets. At the same time, countries like China and the US will continue to protect and subsidize their strategic industries.

The current lifting of trade restrictions is an example of this modern protectionism. China is making concessions, but only temporarily and only regarding raw materials. China continues to protect its own industries and markets. This is a new form of trade, distinct from the liberal free trade that prevailed in the 1990s and 2000s.

How should companies react to this situation?

For companies in the semiconductor and technology industries, the current situation is a wake-up call. They need to review their supply chains and develop diversification strategies. This could mean identifying alternative raw material sources, negotiating with non-Chinese mining companies, or investing in recycling technologies.

At the same time, companies have to deal with the uncertainty. The agreement's expiration date of November 2026 means that companies don't know whether the raw material blockades will return. This leads to strategic planning under uncertainty, which is difficult.

A crucial step is cooperation with governments. Companies should inform their governments about their dependence on raw materials and request support for diversification programs. Governments have the power to negotiate with mining companies and promote investment.

Companies should also invest in research and development. Developing new materials that don't require gallium, germanium, and antimony could be advantageous in the medium term. Companies that develop such technologies could gain a competitive edge.

What are the geopolitical implications of this development for the future?

The current situation paints a picture of a world dividing into several blocs. This is a return to a blockade mentality reminiscent of the Cold War. On one side, the US and its Western allies have their interests; on the other, China has its interests.

In this world, there is no longer a true global economy, but rather several regional economies with some interconnections. This is not ideal for economic efficiency, but it could be the political and military reality of the future.

This has implications for small and medium-sized countries. They must decide which bloc they want to belong to. Countries trying to remain neutral will come under increasing pressure to choose. This is a difficult position for many European and Asian countries.

In the long run, this could lead to a decentralization of the global economy. States will try to develop their own raw material sources and production capacities in order to be independent. This could ultimately result in a less efficient but more resilient global economy.

What might the outcome look like in November 2026?

There are several possible scenarios for November 2026. The most optimistic scenario is that China and the US can agree on a lasting solution acceptable to both sides. This could lead to a new era of cooperation, at least in economic matters. However, this is unlikely, given the deep-seated conflicts of interest.

A more likely scenario is a further extension. Both sides might realize they cannot reach a fundamental solution but are also unwilling to escalate further. Another twelve-month extension could be the result. This would maintain the status quo until 2027 or later.

The most pessimistic scenario is a return to commodity blockades. If there are political changes in the US or China, or if geopolitical conflicts erupt, China could reimpose the blockades. This would lead to a new crisis in the Western semiconductor industry.

A fourth, more likely scenario is a continuation of the current pattern of escalation and de-escalation. There could be several minor crises, but no major fundamental changes. This is typical of modern trade conflicts and would mean that uncertainty persists.

What lessons can be learned from this development?

The first lesson is that resource dependence is a real geopolitical risk. Countries and companies that rely on a single country for critical raw materials are vulnerable. This is an important point for all Western countries.

The second lesson is that while current globalization creates economic efficiency, it also creates strategic vulnerabilities. Building supply chains that depend on a single country is strategically risky. Countries and companies must learn to balance efficiency with resilience.

The third lesson is that Western countries should not completely outsource their own raw material and production capacities. A certain degree of self-sufficiency in critical raw materials and industries is necessary for national security. This is a traditional view of economics that has fallen out of favor in recent decades, but is likely to return.

The fourth lesson is that geopolitical conflicts cannot simply be resolved through negotiations; they are structural in nature. The Trump-Xi meeting was helpful for a temporary de-escalation, but it did not resolve the underlying conflicts of interest. This means that the conflict is likely to persist, even during periods of détente.

Your global marketing and business development partner

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development / Marketing / PR / Trade Fairs

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here: