China wasn't the only weak spot in Apple's holiday business.

When Apple lowered its revenue forecast for the holiday quarter earlier this month, the company's CEO attributed "the vast majority of our revenue decline and over 100 percent of our year-over-year global revenue decline" to weak sales across China. And while yesterday's results proved that mathematically correct—without the negative impact from China, Apple's revenue would have experienced the smallest growth—the world's second-largest economy wasn't the company's only geographical vulnerability.

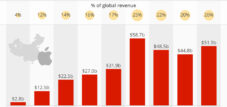

As the following chart shows, Apple also experienced revenue declines in Europe and Japan last quarter, primarily due to weak demand for new iPhones. A combination of high prices, lower carrier subsidies, and longer replacement cycles led to a 15 percent drop in global iPhone sales, offsetting the 19 percent growth in Apple's other products and services.

When Apple revised its revenue guidance for the holiday quarter downwards earlier this month, the company's CEO attributed “most of our revenue shortfall and over 100 percent of our year-over-year worldwide revenue decline” to lackluster sales across Greater China. And while yesterday's results proved that to be mathematically true – without the negative impact from China, Apple's revenue would have seen the slightest growth – the world's second largest economy was not the company's only weak spot, geographically speaking.

As the following chart shows, Apple also suffered sales declines in Europe and Japan in the past quarter, a fact that can mostly be traced back to weak demand for new iPhones. A combination of high prices, lower carrier subsidies and longer replacement cycles has led to a 15 percent drop in global iPhone sales, offsetting 19 percent growth from Apple's other products and services.

iPhone weakness overshadows Apple's balance sheet

Apple's financial results look good across almost all areas. Revenue from the iPad (+16.9 percent), Services (+19.1 percent), and Wearables, Home, and Accessories (+33.3 percent) product groups has grown by double digits. However, the iPhone business is faltering. Compared to the previous year, revenue from Apple's most important product has declined by around 15 percent. The Chinese, in particular, are currently not very enthusiastic about the iPhone, as a look at the regional sales distribution shows. Nevertheless, the company continues to post substantial profits: earnings for the period from October to December amounted to approximately 20 billion US dollars, matching the previous year's level.

Apple's balance sheet looks good in almost all areas. Sales of the product groups iPad (+16.9 percent), Services (+19.1 percent) and Wearables, Home and Accessories (+33.3 percent) grew at double-digit rates. However, the iPhone business is weak. Compared to the previous year, sales of Apple's most important product declined by around 15 percent. The Chinese in particular are not really enthusiastic about the iPhone at the moment, as a glance at the regional distribution of sales shows. Nevertheless, the company continues to write deep black figures: the profit for the period from October to December amounts to around 20 billion US dollars and is thus at the level of the previous year.