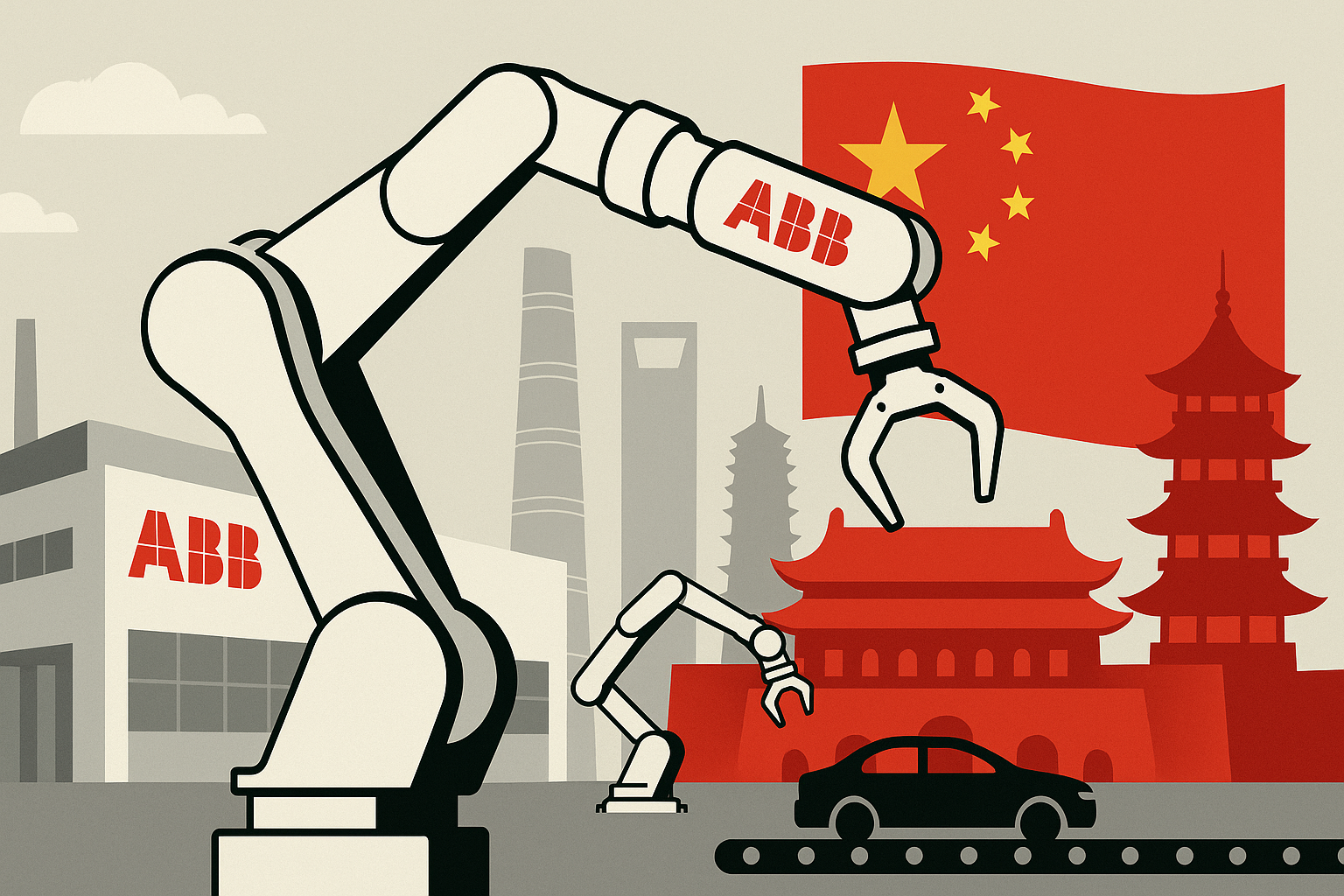

ABB is increasing robotics offensive in China: Swiss group plans to expansion in the world's largest industrial robot market

Strategic course: Fig is promoting market leadership in China's booming robotics industry

ABB, the Swiss technology group, is implementing a comprehensive strategy to strengthen its position in the Chinese robotics market and to open up new growth opportunities. This strategic initiative comes at a crucial time when the global robotics market is in a transformation phase and China is considered the world's largest buyer of industrial robots.

The current market situation in China

China dominates the global robotic market to an unprecedented extent. The state installed around 276,288 new industrial robots in 2023, which corresponds to around 51 percent of all global installations. This impressive market share underlines China's position as an undisputed world market leader in industrial robotics. With an operational inventory of almost 1.8 million industrial robots, China has the largest robot park worldwide.

The development of the Chinese robot density shows the rapid growth of automation in the country. China was able to increase its robot density of only 68 robots per 10,000 workers in 2019 to 470 units in 2023 and thus overtake Germany. This remarkable increase reflects the systematic endeavor of the Chinese government to increase productivity through automation and to counteract the impending shortage of skilled workers.

However, the Chinese robotics market also has challenges. After years of record growth, the 2023 market recorded a decrease of two percent in the new installations. This weakness is attributed to various factors, including the slower economic recovery after corona pandemic and sales problems of western automobile manufacturers in China. Despite this short -term weakness, experts expect a continuation of long -term growth, although possibly no longer with the two -digit growth rates of the past.

ABBS new robot families for the Chinese market

ABB reacts to the specific market conditions in China with the introduction of three new robot families that were specifically developed for the middle market segment. This strategic decision is based on the realization that the middle segment between 2021 and 2024 expanded with an average annual growth rate of 24 percent and further growth of around eight percent annually by 2028.

The three new robot families include different areas of application and target groups. The LITE+ model was specially designed for basic material handling and pick-and-place tasks. Its compact design and user -friendly operation make it easier for smaller companies to get started with automation. This model is initially available in China and Asia and is seamlessly complemented with other ABB robots to flexible end-to-end solutions.

The POWA represents a compact collaborative robot that combines speed with cooperation. With movement speeds of up to 5.8 meters per second, it is particularly suitable for fast pick-and-place, palletizing and machine control tasks. Easy commissioning through no-code programming and plug-and-play technology enables use within an hour, which makes it ideal for small and medium-sized companies.

The new generation of the IRB 1200 was introduced worldwide and is optimized for high-speed and precision tasks such as assembly, polishing and dosing. The approximately 20 percent lighter and more compact robot enables space -saving manufacturing cells and increases throughput and efficiency. All three robot types are integrated on the uniform control platform Omnicore, the KI-, Sensor, Cloud and EDGE computing systems.

Technological innovations and artificial intelligence

ABB increasingly relies on the integration of artificial intelligence to simplify robot programming. At the presentation of the new models in Shanghai, the group presented a revolutionary AI solution for language-controlled programming. This innovative technology enables the robot to visually perceive its surroundings, to process linguistic instructions in real time and to implement them directly into precise movements.

The development of voice -controlled robot programming is significant progress in automation technology. Traditionally, programming robots was too complicated for smaller customers and required specialized knowledge. This hurdle is drastically reduced by using artificial intelligence. Sami Atiya, head of the ABB robotic division, emphasizes: "With AI this will change drastically". For the new cobot, the remarkable property now applies that it can be unpacked within 60 minutes and made it ready for operation.

The technological innovation goes beyond simple voice control. The system combines generative and analytical AI methods that significantly shorten the learning process of robots. The collaborative robot Powa is controlled by the “Lake, Speak, DO” method, in which he captures its surroundings using a computer vision, processes linguistic commands and performs corresponding actions.

Local production and strategic positioning

A central aspect of ABBS China strategy is local production. Over 90 percent of the ABB robots for Chinese customers are now being produced on site. The state-of-the-art Mega factory opened in Shanghai in 2022 with an investment of $ 150 million and an area of $ 67,000 square meters.

This production facility embodies ABBS “Local-For-Local” strategy and strengthens the entire value chain in China. The factory uses the latest digital and automation technologies to produce the next generation robots. Instead of conventional solid assembly lines, flexible, modular manufacturing cells are used, which are digitally networked and operated by intelligent autonomous mobile robots.

The strategic importance of local production is also evident in the responsibility of market needs. Henry Han, Head of ABB Robotics in China, explains: "Our local production and development enable us to react quickly to market needs and make top technology available". This proximity to the customer and the ability to adapt quickly represent important competitive advantages.

Market position and competitive environment

ABB claims a strong position in the Chinese robotics market, especially in the upper segment, where the company is one of the two leading providers. China accounts for about 30 percent of ABBS overall robot business, which underlines the strategic importance of this market. In 2024, ABBS Robotik division generated sales of $ 2.3 billion, which corresponds to about seven percent of the group sales.

The competitive environment in China is increasingly shaped by local providers. Chinese robot manufacturers were able to increase their market share in the home market from 30 percent in 2020 to 47 percent in 2023. In certain industries such as the metal industry and mechanical engineering, Chinese providers even reach a market share of 85 percent. This development is a significant challenge for western manufacturers.

Despite the growing local competition, ABB continues to see good opportunities for western robot manufacturers. Sami Atiya emphasizes that Chinese customers also appreciate innovative and high -quality robots of western manufacturers, provided that they offer real added value. The competition from cheaper Chinese manufacturers is noticeable, but these companies would ultimately also have to make profits.

Target groups and areas of application

ABB's new robot offensive is aimed specifically at medium-sized companies and new industries that have so far been little automated. The middle market segment offers special growth opportunities, since smaller companies are increasingly looking for user -friendly and inexpensive automation solutions. The new robot families are ideal for use in growth -strong sectors such as electronics, consumer goods industry and general production industry.

The price range of the new robots is between 20,000 and over $ 100,000, depending on the equipment. This pricing makes the technology accessible to a wider customer base and also enables smaller companies to benefit from the advantages of automation.

The focus on the electronics industry, which has developed into the main buyer and growth driver for industrial robots in China since 2016, is particularly interesting. Almost two thirds of all industrial robots in the global electronics industry were installed in China alone in 2023. This concentration offers ABB considerable market opportunities.

🎯🎯🎯 Benefit from Xpert.Digital's extensive, five-fold expertise in a comprehensive service package | BD, R&D, XR, PR & Digital Visibility Optimization

Benefit from Xpert.Digital's extensive, fivefold expertise in a comprehensive service package | R&D, XR, PR & Digital Visibility Optimization - Image: Xpert.Digital

Xpert.Digital has in-depth knowledge of various industries. This allows us to develop tailor-made strategies that are tailored precisely to the requirements and challenges of your specific market segment. By continually analyzing market trends and following industry developments, we can act with foresight and offer innovative solutions. Through the combination of experience and knowledge, we generate added value and give our customers a decisive competitive advantage.

More about it here:

China robotics market: $ 20 billion awaited by 2032

Economic importance and future prospects

The Chinese robotics market has enormous economic importance for the global industry. With an estimated market volume of $ 6.31 billion in 2024 and expecting $ 20.33 billion by 2032, the considerable growth potential was shown. The average annual growth rate of 13.9 percent in the forecast period underlines the dynamics of this market.

The Chinese government actively supports this development through strategic images. China has appointed the robotics into a key industry in a five -year plan and set up a publicly funded venture capital fund for robotics, artificial intelligence and top innovations. Local governments and the private sector should spend the equivalent of around 128 billion euros over a term of twenty years.

ABB is confident about the long -term development of the Chinese market. Robotics boss Sami Atiya explains: "The Chinese market is healthy and will continue to grow". Even if the times of double -digit growth may be over, the need increases continuously. This assessment is based on structural factors such as the impending shortage of skilled workers and the continued endeavor to increase productivity in production.

Automation in response to the shortage of skilled workers

An important driver for robot question in China is the impending shortage of skilled workers. As in many developed economies, China is faced with the challenge of an aging population and a lack of qualified workers in production. Automation and robotics offer a strategic answer to these demographic challenges.

The importance of automation is also evident in global development. Germany is also struggling with a persistent shortage of skilled workers, with 82 percent of German companies currently having vacancies that they are difficult to occupy. In this context, AI-based automation solutions focus on relieving workers and closing productivity gaps.

Automation not only offers a solution for the shortage of skilled workers, but also opportunities to improve work quality. Robots can take on dangerous, monotonous or physically stressful tasks and thereby release human workers for more valuable activities. This development leads to a transformation of the world of work, in which people and machines are increasingly working together.

Technological trends and innovation

The robotics industry goes through a phase of intensive technological innovation. Artificial intelligence, machine learning and advanced sensor technology revolutionize the skills of industrial robots. AI-supported vision systems enable robots to recognize, understand and act autonomously.

A particularly important trend is the development of AI vision systems that enable robots to also work in unstructured and dynamic environments. These systems combine machine learning with computer vision to precisely identify and manipulate objects. Companies such as Micropsi Industries have developed with products such as Mirai software that enables robots to adapt in real time in position, shape, light and color.

The voice control of robots represents another significant innovation. Microsoft, for example, has expanded Chatgpt to intuitively control robot arms, drones and household assistants by language. This development makes robot technology accessible to a wider user base and reduces the need for specialized programming skills.

Global market dynamics and competition

The global industrial robot market is dominated by a few large manufacturers. After the Japanese Fanuc, ABB is the second largest manufacturer of industrial robots in intensive competition with companies such as Yaskawa, Kuka and Mitsubishi Electric. These “Big Four” of the robotics industry compete in both traditional markets and in new areas of application.

The rise of Chinese robot manufacturers is particularly remarkable. Companies like Qjar have started to suppress western competitors in important projects. For example, Qjar was able to win an important project from Alibaba against ABB, Fanuc, Yaskawa and Kuka, which demonstrates the growing competitiveness of Chinese providers.

The international expansion of Chinese robot manufacturers is gaining drive. These companies use their cost advantage and their experiences in the Chinese market to gain a foothold in other regions. For example, the Chinese automation group ESTUT is aiming for a market share of five to ten percent in Europe.

Sustainability and circular economy

Sustainability is an important aspect of modern robotics development. Industrial robots have a lifespan of up to thirty years, which opens up new opportunities for refurbish and upgrade. Manufacturers such as ABB, FANUC, KUKA and YASKAWA operate specialized repair centers in order to overtake or upgrade used devices in a resource -efficient manner.

This “Prepared-to-Repair” strategy not only contributes to cost savings, but also makes an important contribution to the circular economy. The extension of the lifespan of robot systems can be spared resources and the environmental impact can be reduced.

Energy efficiency also becomes an important distinguishing feature. Modern robots are increasingly being optimized to consume less energy and at the same time perform higher performance. This development is particularly relevant against the background of rising energy costs and tighter environmental regulations.

Collaborative robotics and cobots

A particularly dynamic area of robotics development is collaborative robotics. Cobots (collaborative robots) are designed to work safely with people without the necessary protective devices. This property makes them particularly attractive for smaller companies and new areas of application.

The market for collaborative robots is growing disproportionately. In the automotive industry, large manufacturers such as BMW, Mercedes Benz and Ford are increasingly using cobots for various manufacturing processes. The versatility and simple integration of cobots make you an attractive alternative to traditional industrial robots.

China has also developed into an important market in the cobot area. Chinese manufacturers such as Warsonco, Hualian, Anhui Jitri, Jaka and Chenxing offer a wide range of collaborative robots for various applications. These local providers compete with both the price and specialized functions with international manufacturers.

ABBS double strategy: Robotics split and China expansion before technology change

ABB's robot offensive in China takes place at a strategically important time. The company has announced that it will split off its robotics division by the second quarter of 2026 and to bring it to the stock exchange as an independent company. This decision underlines the strategic importance of the robotics business and the need to react flexibly to market changes.

The long -term perspectives for the Chinese robotics market remain positive despite short -term fluctuations. The structural drivers such as a shortage of skilled workers, increasing wage costs and the need for higher productivity will continue to drive the demand for automation solutions. ABBS strategy of opening up the middle market segment and at the same time promoting technological innovations is well positioned by the company for future growth.

The integration of artificial intelligence into robot systems will fundamentally change the industry. Language -controlled programming, autonomous adaptation to changed environmental conditions and self -learning systems will significantly expand the possible uses of robots. These developments make robot technology accessible to a wider customer base and open up new fields of application.

ABBS comprehensive China strategy, which combines local production, technological innovation and target group-specific product development, shows a well-thought-out approach to coping with the challenges in a rapidly changing market. The success of this initiative will significantly depend on how well the company finds the balance between global expertise and local adaptation, while at the same time it competes with growing Chinese competition.

We are there for you - advice - planning - implementation - project management

☑️ SME support in strategy, consulting, planning and implementation

☑️ Creation or realignment of the digital strategy and digitalization

☑️ Expansion and optimization of international sales processes

☑️ Global & Digital B2B trading platforms

☑️ Pioneer Business Development

I would be happy to serve as your personal advisor.

You can contact me by filling out the contact form below or simply call me on +49 89 89 674 804 (Munich) .

I'm looking forward to our joint project.

Xpert.Digital - Konrad Wolfenstein

Xpert.Digital is a hub for industry with a focus on digitalization, mechanical engineering, logistics/intralogistics and photovoltaics.

With our 360° business development solution, we support well-known companies from new business to after sales.

Market intelligence, smarketing, marketing automation, content development, PR, mail campaigns, personalized social media and lead nurturing are part of our digital tools.

You can find out more at: www.xpert.digital - www.xpert.solar - www.xpert.plus