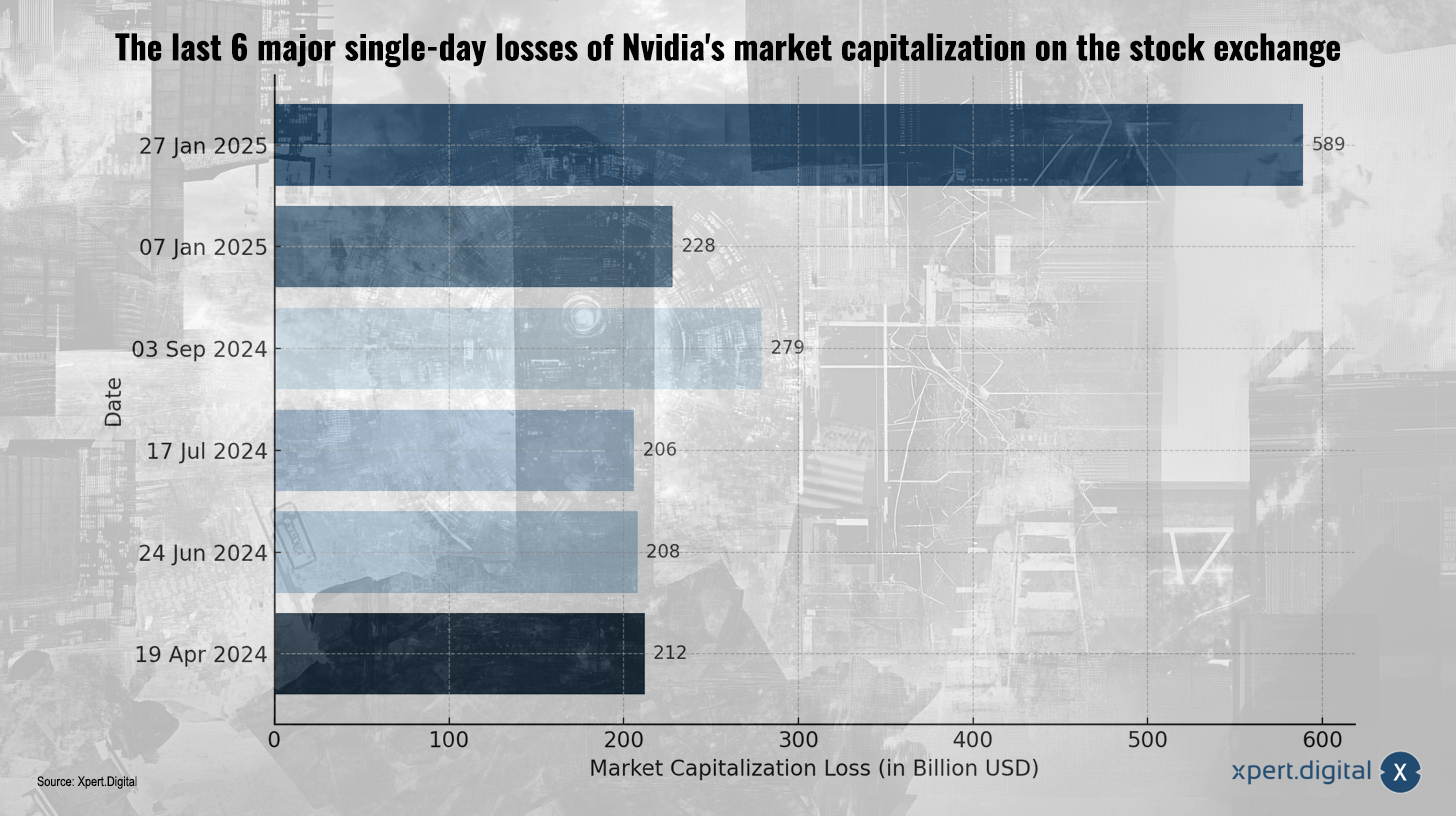

Nvidia's last 6 biggest daily losses in market capitalization on the stock exchange – Image: Xpert.Digital

New: $600 billion stock market loss in one day

DeepSeek from China is shaking up the financial world

The news from China reverberated through the financial world like a thunderclap: DeepSeek, a rising star in the field of artificial intelligence, had unveiled a new AI model that threatened the established market leader, Nvidia. The key to this model lies in its efficiency. It is said to require significantly less computing power, and therefore fewer of Nvidia's expensive graphics processing units (GPUs), than comparable models from its US competitors. This announcement triggered a veritable shockwave on the stock market.

Dramatic stock crash at Nvidia

Nvidia, the hitherto undisputed king of AI chips, experienced an unprecedented crash. The company's share price plummeted by around 17 percent, representing a loss of nearly $600 billion in market capitalization in a single day. This dramatic collapse is a clear signal that Nvidia's supposed dominance in AI hardware is no longer unassailable.

Suitable for:

Historical volatility at Nvidia

It's important to emphasize that this development didn't come out of nowhere. Nvidia has experienced turbulent times in the past. Last year alone, the company suffered five losses exceeding $200 billion in market capitalization. This illustrates how volatile and technologically driven the market is in which Nvidia operates. However, the stock market crash on January 27th, which wiped out almost $600 billion in market value, was on a different scale. It underscores the potential impact of innovation and how quickly an established position can be challenged.

The challenge posed by DeepSeek

Nvidia's success to date has been based on the assumption that its GPUs are essential for developing and running AI applications. The company held a de facto monopoly in this area and profited immensely from the global AI boom. This position allowed Nvidia to lead AI-related stock markets. However, the developments at DeepSeek show that this situation could fundamentally change. If the Chinese company has indeed developed an AI model that requires significantly less hardware, this could trigger a paradigm shift in the entire AI industry.

Impact on the technology industry

The repercussions of this stock market crash are far-reaching. It vividly demonstrates how quickly technological power can shift and how crucial continuous innovation is for staying ahead. For Nvidia, this is a stark wake-up call. The company must reassess its technological leadership and prepare for a new era in the AI hardware race. The loss of nearly $600 billion in market capitalization is not only a financial blow but also a signal to the entire technology industry that the rules of the game are being rewritten.

Dependence on key technologies

This incident also raises questions about the dependence on individual companies in key technologies. The fact that a single Chinese company could trigger such a shock in the financial world demonstrates the potential vulnerability of markets dominated by a few players. Diversification and the promotion of competition are therefore crucial to ensuring the stability and innovative strength of the technology sector.

Advances in efficient AI technology

Furthermore, this incident highlights the rapid development in the field of artificial intelligence. The efficiency of AI models is a key issue that is important not only for companies but also for society as a whole. Less energy-intensive and more resource-efficient AI models are a step towards more sustainable development. Research and development in this area will therefore become even more important in the future.

Competition for efficiency and success in the AI sector

The fall of Nvidia and the rise of DeepSeek demonstrate that competition in the AI sector is not only about the most advanced technology, but also about the highest efficiency. Companies must adapt their strategies to succeed in this constantly evolving landscape. It is a competition that will ultimately affect society as a whole and decisively shape the future of technology.

Historical context of losses at Nvidia

According to Bloomberg, seven of the ten largest one-day losses in Wall Street history involved Nvidia, although these were significantly smaller than the current decline. This underscores the volatility of Nvidia stock, particularly in the context of the AI boom and the associated high market valuations.

Dynamic standards in the technology sector

While the recent $600 billion loss is unprecedented in its magnitude, NVIDIA has experienced dramatic daily losses before. The frequency of such events reflects the dynamic nature of the technology sector and the high expectations placed on NVIDIA in the field of AI technology.

Suitable for: