Published on: October 20, 2024 / Update from: October 20, 2024 - Author: Konrad Wolfenstein

Revival of the German startup scene - upswing in financing - investments in German startups reach their highest level since 2022 - Image: Xpert.Digital

Upswing in uncertain times: German startups in focus

Strategies and perspectives: Future of the German startup landscape

The German startup landscape is experiencing a remarkable phase of development and transformation. In recent years, the framework conditions for young companies have changed significantly, bringing with it both challenges and new opportunities. After a phase of economic uncertainty, characterized by rising interest rates and global market turmoil, there are now signs of a cautious recovery, which is favored by various factors.

Increasing interest from international investors

A key driver of this positive development is the growing interest of international investors in German startups. Investors from the USA and Asia in particular are recognizing the potential of the German market and are increasingly investing in innovative companies. This increased commitment reflects the trust that international investors place in the quality and sustainability of German business ideas. They value the high level of technical expertise, the solid training of specialists and the innovative strength that characterizes many German startups.

Improved investment climate through interest rate cuts

The European Central Bank's monetary policy measures also have a positive impact on the investment climate. By lowering key interest rates, capital becomes more attractive for investment, resulting in more financial resources flowing into the market. This not only benefits established companies, but also particularly startups that rely on fresh capital to scale their business models and open up new markets.

Increase in financing rounds

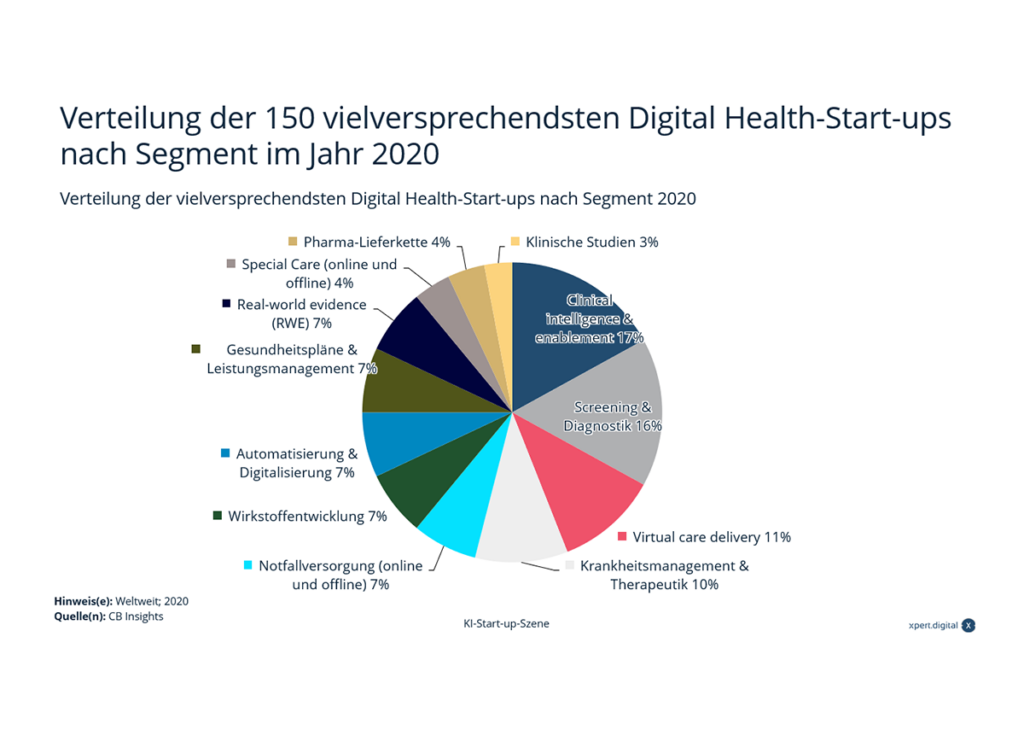

The number of financing rounds has increased recently, which is an indicator of increased investor confidence in the market. Young companies in the areas of health, energy and technology are particularly in focus. The healthcare sector records the largest share of deals, highlighting the growing importance of innovation in this area. Startups that deal with digital health solutions, biotechnology or medical devices are attracting significant investments.

Suitable for:

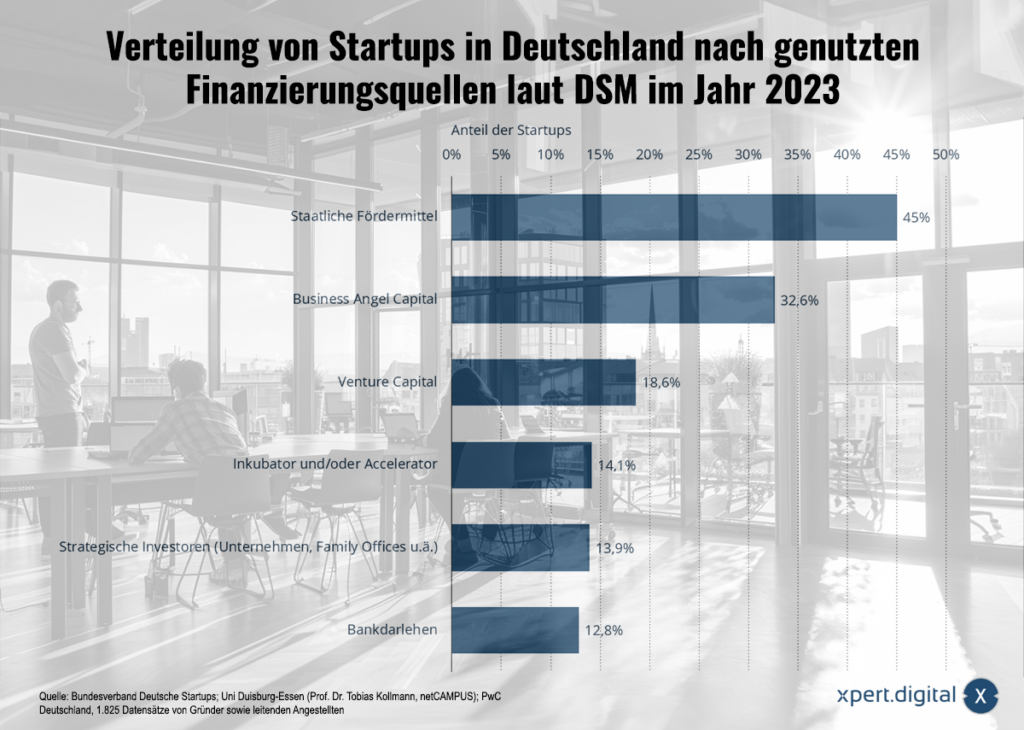

- Startups sources of financing 2023 – Financing for start-ups in Germany developed positively in 2024

Focus on sustainability and renewable energy

The area of renewable energies and sustainable technologies is becoming increasingly important. In view of the global climate crisis, investors are increasingly investing in companies that offer solutions for a sustainable future. German startups are often pioneers here and develop technologies that make both ecological and economic sense. This not only creates new business opportunities, but also contributes to the positive image of Germany as a business location.

Long-term challenges and perspectives

Despite the positive developments, Germany still faces the challenge of catching up in international comparison. The country lags behind leading nations such as the US and UK in venture capital investment. In 2023, the venture capital invested totaled six billion euros, which represents a decrease compared to the previous year. These figures make it clear that there is still a need for action to improve the framework conditions for startups and to make access to capital easier.

Regulatory framework and reduction in bureaucracy

An obstacle for many founders is the complex bureaucracy and the multitude of regulations. Simplifying start-up processes and creating a more business-friendly legal framework are crucial to increasing Germany's attractiveness as a location for innovative companies. Initiatives to digitize administrative processes and reduce bureaucratic hurdles can help accelerate this process.

Funding programs and government support

The federal government has launched various programs to support startups. This includes financial support, advice and networking opportunities. The High-Tech Start-up Fund, the Exist Start-up Grant and the Digital Hub Initiative are examples of successful measures that help to strengthen innovative strength and support founders in implementing their ideas.

Talent development and shortage of skilled workers

The success of startups depends largely on the availability of qualified specialists. The shortage of skilled workers, particularly in the areas of IT and engineering, represents a significant challenge. Educational initiatives, the promotion of MINT subjects and the attractiveness of the location for international talent are therefore of central importance. Skilled immigration programs and the integration of foreign experts can help alleviate this bottleneck.

Innovation culture and entrepreneurship

An open innovation culture and the promotion of entrepreneurship are essential for the development of the startup scene. Educational institutions, businesses and public institutions are increasingly working together to create an environment that promotes creativity and entrepreneurship. Incubators, accelerators and coworking spaces offer founders the opportunity to exchange ideas, build networks and learn from experienced mentors.

Success stories as inspiration

Successful startups such as BioNTech, Flixbus and Celonis serve as inspiration for new founders and show the potential that lies in the German startup landscape. They have managed to establish themselves internationally and make significant contributions in their respective industries. Such success stories help to arouse the interest of investors and strengthen trust in Germany as a location.

Technological trends and innovations

Technological developments such as artificial intelligence, blockchain and the Internet of Things offer immense opportunities for startups. German companies are leaders in many of these areas and are driving innovations that can revolutionize entire industries. Supporting these technologies through targeted investment and research is crucial to maintaining competitiveness.

Sustainability as a growth driver

Sustainability is not only an ethical imperative, but also an economic factor. Startups that pursue sustainable business models are meeting growing demand from consumers and investors. GreenTech and CleanTech are areas in which German startups are particularly active and where there is significant growth potential.

Internationalization and global markets

Opening up international markets is an important step towards growth for many startups. Support for internationalization, be it through export promotion, international networks or partnerships, can help ensure the success of German startups on a global level.

Collaboration between startups and established companies

Cooperations between young companies and established corporations offer advantages for both sides. Startups benefit from resources, expertise and market access, while large companies can benefit from the agility and innovative power of startups. Such synergies can accelerate innovation and increase competitiveness.

Recent developments are encouraging

The German startup scene is at a crucial point. The recent positive developments are encouraging, but continued efforts are required to fully exploit the existing potential. The combination of international investor commitment, improved investment climate and focused support from politics and business creates a promising basis.

With a strategic focus on innovation, sustainability and international networking, Germany can further expand its position as a leading location for startups. Creating an environment that encourages and supports founders is just as important as breaking down barriers and promoting talent.

The coming years will show to what extent it is possible to exploit these opportunities and sustainably strengthen the German startup landscape. The conditions are in place, and with collective efforts, Germany can become an even more important player on the global innovation stage.

- Many potential customers only know the problems but not the cause. Why, despite AI, there are market opportunities here, especially for German start-ups and SMEs - also internationally - Image: Xpert.Digital

- Over 1.8 billion euros for German startups - Top 10 sectors in Germany for risk investments 2018 - Image: Xpert.Digital

- Startups worldwide – PDF download

- Startups sources of financing 2023 - Financing for start-ups in Germany developed positively in 2024 - Image: Xpert.Digital

- The important role of start-ups in the economy - drivers of innovation, job engine and indicator of economic growth - Image: Xpert.Digital

- Distribution of the 150 most promising AI and digital health start-ups by segment – Image: Xpert.Digital

Financial injection in the third quarter: German startups on course for growth

Investment boom 2024: wave of success for Aleph Alpha, Helsing, DeepL and Raisin

In the third quarter of 2024, the German startup landscape experienced a notable increase in investments, allowing several companies to expand their business models and strengthen their market positions. In this dynamic environment, four startups in particular stood out: Aleph Alpha, Helsing, DeepL and Raisin. These companies benefited not only from financial resources, but also from increased interest in their innovative technologies and services.

Aleph Alpha: Pioneer in Artificial Intelligence

Aleph Alpha has established itself as a leading company in the field of artificial intelligence. The company received significant funding that will allow it to further expand its research and technology offerings. Aleph Alpha is known for developing advanced AI technologies that can find applications in various industries. These technologies include, but are not limited to, natural language processing, machine learning and automated decision making.

The investments in Aleph Alpha reflect investors' growing confidence in the company's ability to deliver innovative solutions that have applications in both industry and everyday life. Aleph Alpha's AI technologies could, for example, be used in the healthcare industry to improve diagnostic procedures or in the automotive industry to develop autonomous vehicles. The broad applicability of its technologies makes Aleph Alpha an attractive partner for companies from various sectors.

Suitable for:

Helsing: Protecting democratic societies through technology

Helsing is a defense technology startup focused on developing advanced software solutions. These solutions are designed to protect democratic societies and respond to ever-changing global security dynamics. The financing received indicates strong growth prospects and enables Helsing to further develop its technologies and enter new markets.

The company relies on artificial intelligence and machine learning to detect and ward off threats at an early stage. In a world where cyberattacks and digital threats are becoming increasingly common, Helsing offers solutions that can help governments and organizations ensure their security. The investments in Helsing underline the importance of technological innovations in the security sector and investors' confidence in the company's ability to provide effective solutions.

DeepL: Revolutionizing language translation

DeepL has established itself as a leader in AI-powered language translation services. The funding received highlights DeepL's growth potential in the area of AI speech processing. In an increasingly globalized world, the ability to communicate efficiently across language barriers is becoming increasingly important. DeepL's technologies enable companies and individuals to communicate seamlessly in different languages, opening up new markets.

DeepL's translation services are characterized by their high accuracy and natural language processing. This makes them a preferred choice for companies operating internationally or looking to expand their reach. The investments will enable DeepL to further develop its technologies and introduce new features that meet the needs of its customers.

Raisin: Innovation in the digital financial sector

Raisin is a fintech company that offers innovative savings and investment solutions. The funding received highlights the growth potential in the digital finance sector, particularly as consumers look for more flexible and diversified financial options. Raisin allows consumers to access a wide range of savings and investment products from across Europe, often with better conditions than traditional banks.

The company aims to democratize access to financial products and give consumers more control over their finances. Through partnerships with banks and financial institutions, Raisin offers its customers a wide range of products to suit their individual needs. The investments will help Raisin further expand its platform and enter new markets.

A promising outlook for German startups

The increased investments in the third quarter of 2024 not only provided German startups with financial resources, but also strengthened confidence in their innovative strength. Aleph Alpha, Helsing, DeepL and Raisin are examples of companies that have benefited significantly through their innovative approaches and support from international investors. These startups help position Germany as a leading location for technological innovation.

Overall, there is a promising outlook for German startups. The combination of technological innovation and strategic investments creates a solid foundation for further growth and success on a global scale. As the global economy evolves and new challenges emerge, these startups are well positioned to make a positive contribution to society with their solutions.

Suitable for: