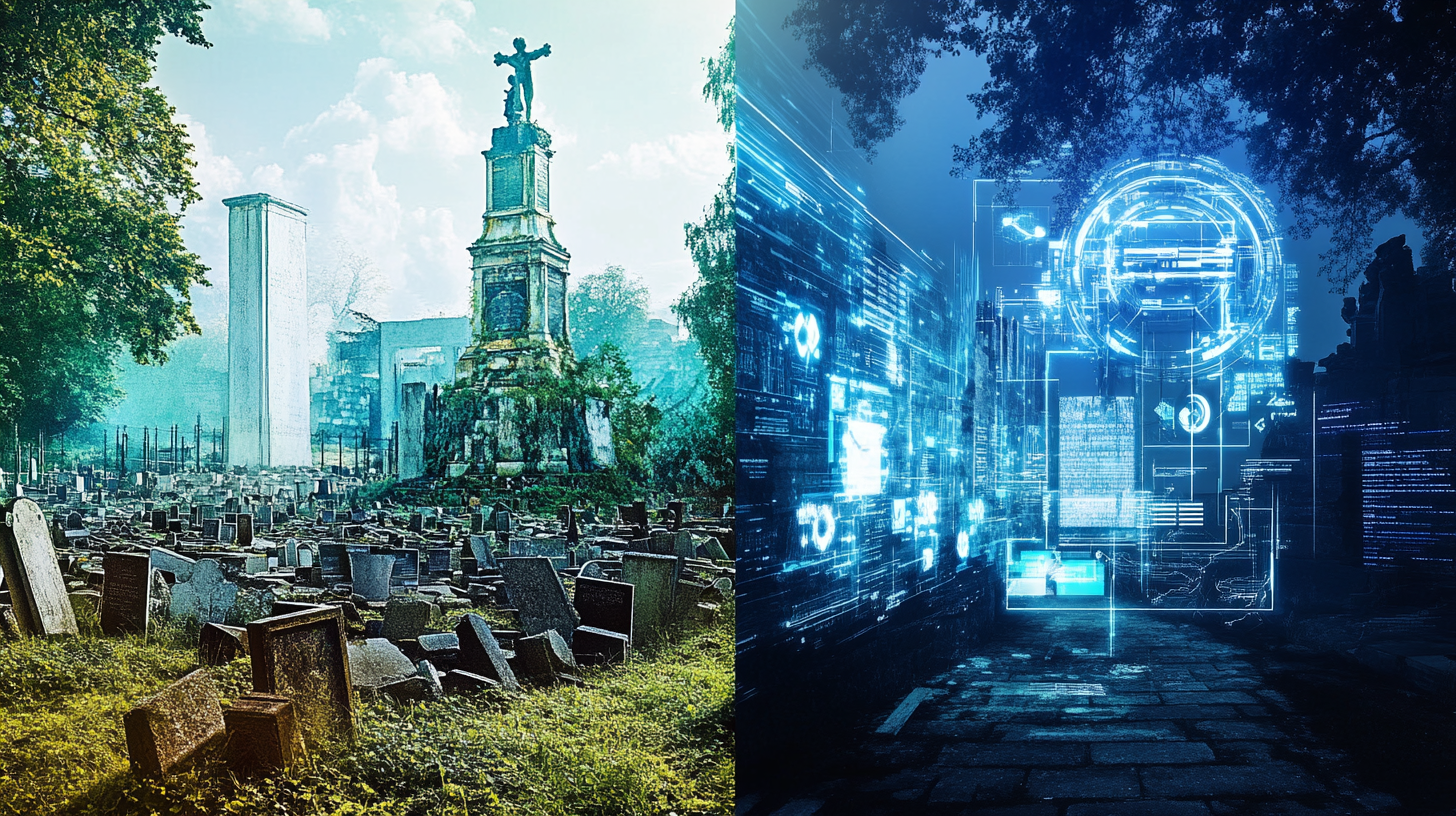

Start-up cemetery or innovation laboratory? So it is really about the German ITK market-picture: Xpert.digital

Reasons in the German tech scene: why it is so difficult (and what has to change)

Hype or craft? What the German ITK industry now needs to survive internationally

The German Market for Information and Telecommunications Technology (ITK) is booming. The industry has record sales, rising investments and a growing number of jobs. But at the same time, the foundation figures drop to a historical low. This paradox between strong industry growth and stagnating startup culture raises many questions.

Suitable for:

Growth and labor market development in the ITK industry

The ITK sector is one of the main pillars of the German economy and continues its growth course despite global uncertainties.

- Development of sales: In 2024, the industry generated sales of 222.6 billion euros, an increase of 3.3 % compared to the previous year. For 2025, growth is forecast from 4.6 % to 232.8 billion euros.

- Employment boom: The ITK industry continues to create new jobs. By 2025, 20,000 new jobs are expected to be created, so that a total of 1.371 million people will work in this area - more than in the automotive industry.

These numbers underline the increasing importance of the industry, especially in the course of digitization and automation, which transforms many industry.

Founding low despite the flourishing ITK economy

Despite the positive economic development, the industry has a dramatic decline in start -ups:

- Historical decline: In 2023 only 6,100 new ITK companies were founded (IT services: 5,950, hardware: 150). This is the lowest level since 2002.

- Compared to other industries: The founding rate of the ITK industry is 6.5 %, which is based on industries such as mechanical engineering (2.1 %) or trade (4.7 %), but still indicates a structural problem.

This development suggests that startups are increasingly confronted with hurdles that make their market entries difficult.

Causes of the stagnating founding process

Market dominance of established companies

Large ITK groups dominate the market through scale effects and targeted investments in future technologies:

- Technology investments: Established companies invest massively in artificial intelligence (KI) (+43 %growth), cloud services (+17 %) and software development (+9.8 %). Startups often cannot afford this capital loyalty.

- Stable investment policy: 59 % of ITK companies keep their investments stable, 17 % increase them in strategic growth fields.

- Network effects and market access: The existing infrastructure and customer base give large providers a significant competitive advantage.

Economic and regulatory challenges

- Capital access: While the industry is growing as a whole, smaller companies often hardly benefit from this upswing. Risk capital is more difficult, especially due to political uncertainties such as data protection regulations or increasing energy costs.

- Bureaucratic hurdles: High compliance costs and regulatory requirements scare many founders. In the area of AI, especially in the area of AI, there are strict regulations that can inhibit innovations.

Global competitive dynamics

- International growth rates: Germany with ITK growth of 4.6 %is behind the USA (+7.3 %) and India (+8 %). There, cheaper regulatory framework and funding programs create additional incentives for new start -ups.

- Depending on talents and capital: Due to the better financing and scaling options, many German startups move abroad.

Influence of technological developments on the founding process

Technological innovations can work as a catalyst and barrier for start -ups.

Market entry barriers through high-tech trends

- Capital -intensive future technologies:

- AI and machine learning require high investments in computing power and data.

- International tech groups control 75 % of the global AI market.

- Infrastructural dependencies:

- Large companies benefit from high-performance calculation centers such as DE-CIX Frankfurt.

- Startups have to switch to expensive cloud solutions.

- AI-driven market maturity:

- 45 % of ITK startups see AI as an innovation driver.

- Standardized solutions dominate the market, which shrinks niches for startups.

Positive impulses through digital innovations

- New foundation tools: Platforms such as ITONICS help to generate innovation ideas with AI-supported technologieradars.

- Cross-sector digitization: The ITK industry is driving the digitization of other sectors and thus indirectly creates opportunities for startups.

- Niche markets as an opportunity: new areas such as Edge Computing or 5G satellite networks can be profitable for young companies.

Possible strategies to promote new start -ups

In order to stop the start -up decline, targeted measures are required:

- Improvement of the financing conditions:

- Expansion of state funding programs for deep tech startups.

- Simplification of guarantee programs for innovative company start -ups.

- Reduction of regulatory hurdles:

- Simplified approval process for tech startups.

- Flexibilization of data protection requirements with no innovation obstacles.

- Strengthening the founding infrastructure:

- Building technology parks and incubators with specialized infrastructure.

- Promotion of networking options between startups and established companies.

- Promotion of high-tech training:

- More practice-oriented courses for artificial intelligence, cybersecurity and cloud technologies.

- Cooperations between universities and industry for early support for start -up spirit.

Innovative strength in danger: Why Germany has to act

The German ITK sector remains a growth driver, but the declines in new start-ups could endanger long-term innovative strength and competitiveness. A targeted funding policy, relieved financing conditions and an innovation -friendly regulatory framework are crucial in order to establish more entrepreneurship in the industry again. Germany has the chance to strengthen its position as an ITK commercial location-but only if it is specifically invested in the correct areas.

Suitable for:

We are there for you - advice - planning - implementation - project management

☑️ Our business language is English or German

☑️ NEW: Correspondence in your national language!

I would be happy to serve you and my team as a personal advisor.

You can contact me by filling out the contact form or simply call me on +49 89 89 674 804 (Munich) . My email address is: wolfenstein ∂ xpert.digital

I'm looking forward to our joint project.