Platforms determine the economy

- Number of currently existing digital platforms (B2B, B2C): over 500

- Annual growth rates: 20+ percent

- Value of the 60 most valuable platforms: $7 trillion

- Value of all platform companies $8.5 billion

- 7 largest B2C platforms are worth more than all stocks in the Euro Stoxx 50

- Amazon is the second trillion-dollar company after Apple

- Top 10 platforms increased almost 20% per year; Top 10 of the DAX only around 10%

Advantages

What Amazon, Alibaba, Airbnb, Tencent, Uber, booking.com, Facebook, Spotify and Co. are ahead of the conventional economy

Efficiency

- Hardly any investments in production capacities, buildings or movable goods are necessary, therefore a lot less tied-up capital

- With every transaction, commission-based income flows to the platform operator

Scalability

- Whether 1,000 or 1,000,000 customers – the digital platform can be quickly scaled if successful

- Marginal costs of new customers are close to zero, production costs are negligible

versatility

- Platforms can be adapted and the offering can be easily expanded if necessary (e.g. Airbnb no longer only offers overnight stays, but also activities)

- Required for this: developers, software and server capacities - much quicker and cheaper to implement than building a factory or developing a new car

Examples

Mobility: Car rental companies such as Herz, Avis or Europcar have to keep hundreds of thousands of cars available worldwide. The result is billions in tied-up capital for the vehicles.

Agents like Uber or Lyft do not have their own vehicle fleets, but they benefit from every trip arranged in the form of commissions.

Consequence: Uber market value >70 billion US dollars, Europcar <3 billion US dollars

Hotel: Chains like Marriott and Hilton have millions of rooms worldwide, whereas Airbnb's platform providers do not manage a single hotel. Airbnb's market value is higher than Hilton's

Europe is lagging behind developments

- Share of US companies (based on goodwill) 67% of the platform world

- Asia 30% (China is catching up; most new platform models are being developed here, especially in the B2B segment)

- Europe: shockingly meager 3%

Digital platforms in Germany “uncharted territory” (Bitkom study from January 2018 of 505 companies with more than 20 employees):

54% of respondents have never heard of the term “digital platform”.

Possible platform models

- Focus on shared use of resources, capacities and know-how – for companies from industries with overlap

- Focus on cooperation platform in which the products and services of the participants complement each other (horizontal or vertical cooperation)

- Focus on digital data and technologies – partners release their data (e.g. from production, purchasing or logistics) for sharing and analysis

Companies can choose depending on their know-how and market power

- Own platform model (for innovations and first movers)

- Platform with other partners (if greater market power and importance is expected with partners)

- Existing platforms for cooperation or as an additional sales channel

Applications in logistics

- Establishment of shipping platforms – interface to shipping service providers to process transports

- Everyone is waiting for “THE NEXT BING THING”, or a business model for parcel delivery comparable to Uber

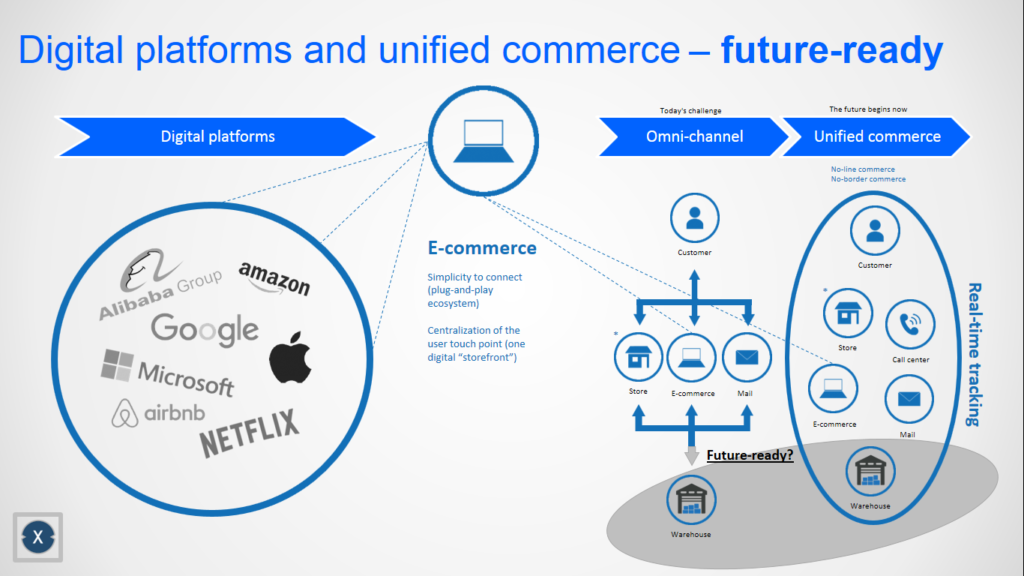

- Boundaries between industries such as retail – whether e-commerce, omnichannel or unified commerce – and logistics are increasingly disappearing

- Collaborative platform models of a kind booking.com for logistics services: In addition to a comprehensive offer, overview and transparency, the customer can find answers to the reliability of the respective provider in the form of reviews.